INVENTORY of TAXABLE PROPERTY DUE on or BEFORE Form

What is the NH 28 Form?

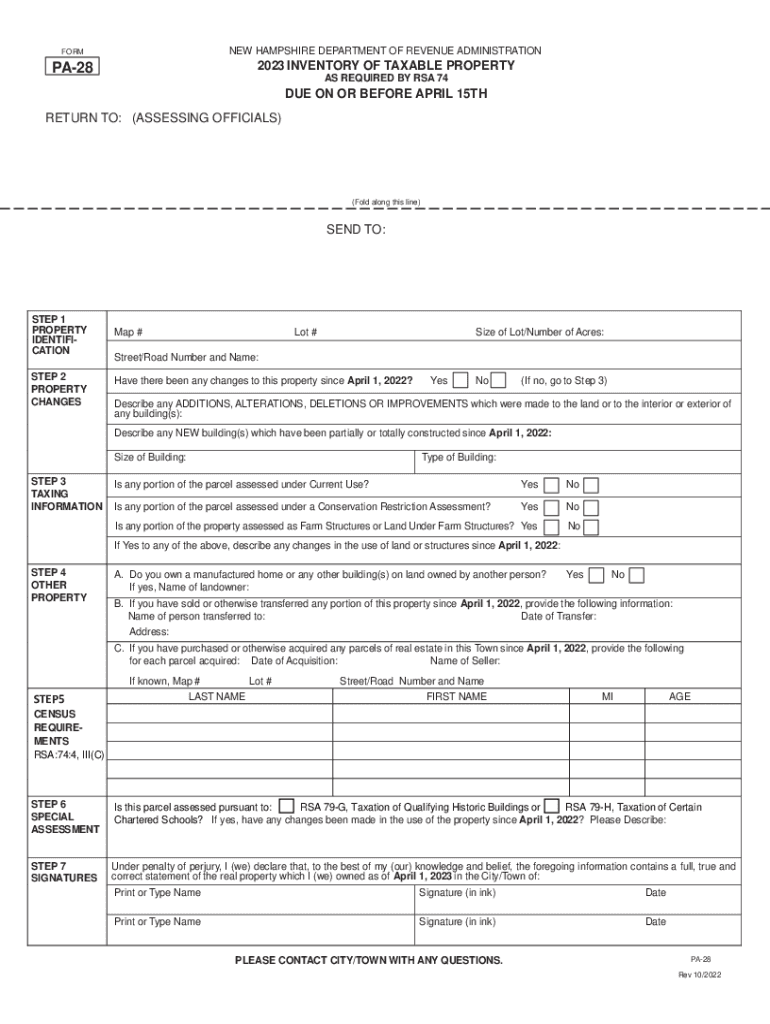

The NH 28 form, also known as the Inventory of Taxable Property, is a document required by the New Hampshire Department of Revenue Administration. This form is essential for property owners to report their taxable property, including real estate and personal property, to ensure compliance with state tax regulations. The NH 28 form helps local assessors determine the fair market value of properties for tax assessment purposes.

How to Use the NH 28 Form

Using the NH 28 form involves accurately reporting all taxable property owned as of April 1st each year. Property owners must fill out the form with details about their property, including its location, type, and assessed value. This information is crucial for local authorities to calculate property taxes. Once completed, the form must be submitted to the appropriate local assessing office by the designated deadline.

Steps to Complete the NH 28 Form

Completing the NH 28 form requires several key steps:

- Gather all necessary information about your taxable properties, including addresses and descriptions.

- Determine the assessed value of each property, which may require consulting local property records.

- Fill out the NH 28 form accurately, ensuring all information is complete and correct.

- Review the form for any errors or omissions before submission.

- Submit the completed form to your local assessing office by the specified deadline.

Legal Use of the NH 28 Form

The NH 28 form is legally required under New Hampshire tax law. Failure to submit this form can result in penalties, including fines or increased assessments. Property owners must understand their obligations under state law to avoid potential legal issues. The form serves as a declaration of ownership and value, which is crucial for maintaining accurate tax records.

Filing Deadlines / Important Dates

Property owners must file the NH 28 form by April 15th each year. It is important to be aware of this deadline to avoid late penalties. Additionally, any changes in property ownership or value throughout the year should be reported promptly to ensure accurate assessments and compliance with tax regulations.

Who Issues the NH 28 Form

The NH 28 form is issued by the New Hampshire Department of Revenue Administration. This department oversees property tax assessments and ensures that property owners comply with state tax laws. Property owners can obtain the form from their local assessing office or download it from the department's official website.

Quick guide on how to complete inventory of taxable property due on or before

Prepare INVENTORY OF TAXABLE PROPERTY DUE ON OR BEFORE effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed forms, allowing you to access the correct document and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage INVENTORY OF TAXABLE PROPERTY DUE ON OR BEFORE on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign INVENTORY OF TAXABLE PROPERTY DUE ON OR BEFORE with ease

- Find INVENTORY OF TAXABLE PROPERTY DUE ON OR BEFORE and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for those purposes.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information, then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Revise and electronically sign INVENTORY OF TAXABLE PROPERTY DUE ON OR BEFORE to ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the inventory of taxable property due on or before

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NH 28 form used for?

The NH 28 form is a legal document primarily used in New Hampshire for various administrative processes. It often serves as a critical tool for entities needing to file specific requests or notices with state agencies. Understanding the purpose of the NH 28 form is essential for businesses to ensure compliance.

-

How can airSlate SignNow help with the NH 28 form?

airSlate SignNow provides an efficient platform to electronically sign and send the NH 28 form. With our user-friendly interface, businesses can easily prepare and manage their documents without the hassle of paper. This not only speeds up the process but also enhances accuracy and compliance.

-

What are the pricing options for using airSlate SignNow for the NH 28 form?

airSlate SignNow offers a variety of pricing plans that cater to different business needs. You can choose from a monthly or annual subscription, which unlocks features that streamline the handling of forms like the NH 28 form. Explore our pricing page for detailed information on plans suited for your organization.

-

Is electronic signing of the NH 28 form legally valid?

Yes, electronic signing of the NH 28 form is legally valid under the E-Sign Act and UETA. airSlate SignNow ensures that all electronic signatures comply with legal standards, offering peace of mind when sending important documents. This means you can confidently manage your NH 28 form through our platform.

-

What features does airSlate SignNow include for managing the NH 28 form?

airSlate SignNow equips users with features like customizable templates, secure storage, and real-time notifications to manage the NH 28 form effectively. Our platform also supports integrations with other tools to streamline your workflow. These features signNowly enhance productivity and document management.

-

Can airSlate SignNow integrate with other software for the NH 28 form?

Absolutely, airSlate SignNow offers seamless integrations with various third-party applications designed to optimize the workflow involving the NH 28 form. This includes popular software like Google Drive, Salesforce, and more, allowing users to create a cohesive digital ecosystem for their document management.

-

What are the benefits of using airSlate SignNow for the NH 28 form?

Using airSlate SignNow for the NH 28 form brings a range of benefits, including faster processing times, reduced paperwork, and improved compliance. The platform's intuitive design and accessibility make it easy for businesses to manage their documents efficiently. Overall, it simplifies the workflow surrounding the NH 28 form.

Get more for INVENTORY OF TAXABLE PROPERTY DUE ON OR BEFORE

- Tennessee being of sound and disposing mind and memory do hereby make publish and declare this to form

- I do hereby make oath that i am a licensed attorney andor the custodian of form

- Before me of the state and county mentioned personally appeared form

- Before me of the state and county aforementioned personally form

- Assumed corporate form

- Assumed name form

- Of assumed form

- Application for change or form

Find out other INVENTORY OF TAXABLE PROPERTY DUE ON OR BEFORE

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer