Ir6104 Form

Understanding the IR6104 Form

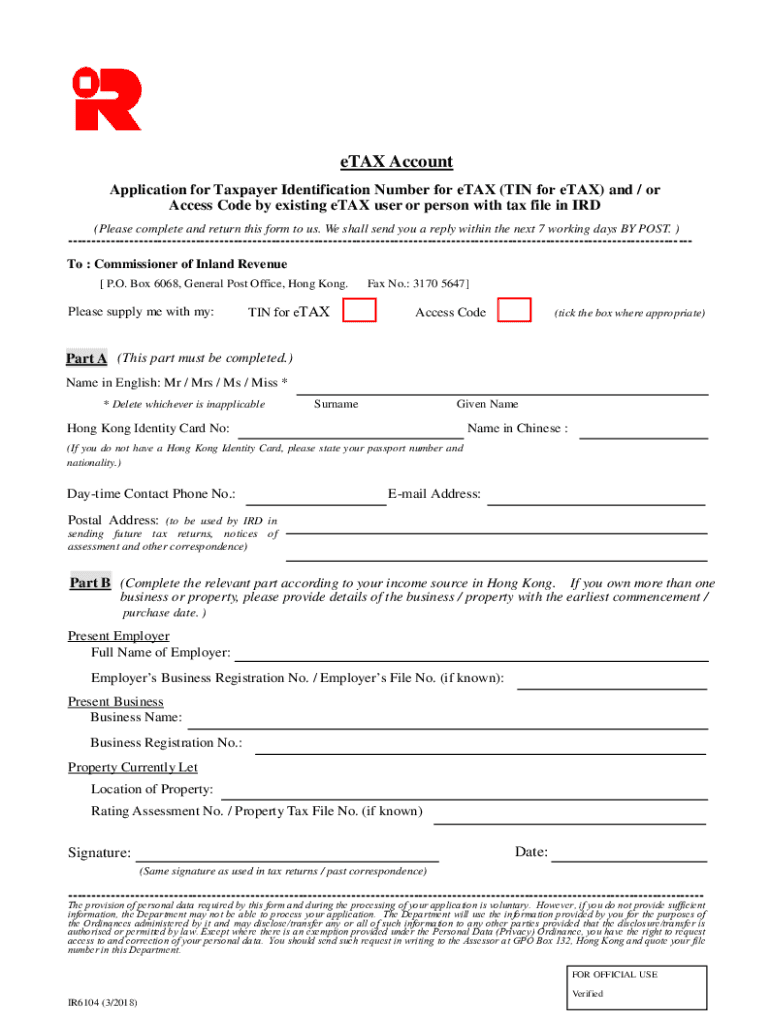

The IR6104 form is a crucial document used primarily for tax purposes in the United States. It is typically employed by individuals and businesses to report specific financial information to the Internal Revenue Service (IRS). Understanding the purpose and requirements of the IR6104 is essential for ensuring compliance with federal tax regulations. This form helps in accurately reporting income, deductions, and other relevant financial data, which can impact tax liabilities.

How to Complete the IR6104 Form

Filling out the IR6104 form requires careful attention to detail. Begin by gathering all necessary financial documents, including income statements, previous tax returns, and any relevant receipts. Each section of the form must be completed accurately, ensuring that all figures are correct and reflect your financial situation. It is advisable to follow the instructions provided with the form closely, as they outline the specific requirements for each field. Double-check your entries for accuracy before submission to avoid potential issues with the IRS.

Obtaining the IR6104 Form

The IR6104 form can be obtained directly from the IRS website or through authorized tax preparation services. It is essential to ensure that you are using the most current version of the form, as outdated forms may not be accepted. Additionally, many tax software programs include the IR6104 form, allowing for easy access and completion as part of the tax filing process.

Key Components of the IR6104 Form

The IR6104 form consists of several key sections that must be completed. These include personal identification information, income reporting, deductions, and credits. Each section is designed to capture specific financial details, which are critical for accurate tax reporting. Understanding these components is vital for effective completion of the form and ensuring compliance with IRS requirements.

Legal Considerations for Using the IR6104

Using the IR6104 form legally requires adherence to IRS guidelines and regulations. It is important to ensure that all information provided is truthful and accurate, as submitting false information can lead to penalties or legal repercussions. Familiarizing yourself with the legal implications of filing the IR6104 can help mitigate risks and ensure a smooth filing process.

Filing Deadlines for the IR6104 Form

Timely submission of the IR6104 form is crucial to avoid penalties. The IRS typically sets specific deadlines for filing, which may vary depending on the type of filer (individual or business). It is important to stay informed about these deadlines and plan accordingly to ensure that the form is submitted on time. Missing the deadline can result in late fees and complications with your tax return.

Quick guide on how to complete ir6104 612483248

Complete Ir6104 smoothly on any device

Online document management has become favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without any hold-ups. Manage Ir6104 on any platform with airSlate SignNow Android or iOS applications and streamline any document-centric task today.

The simplest way to edit and eSign Ir6104 effortlessly

- Obtain Ir6104 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that task.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require reprinting document copies. airSlate SignNow addresses all your document management needs with just a few clicks from the device of your choice. Edit and eSign Ir6104 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ir6104 612483248

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ir6104 and how does it relate to airSlate SignNow?

The term ir6104 refers to a specific function or feature within airSlate SignNow that facilitates document eSigning. Users can leverage ir6104 to streamline their signing processes efficiently, ensuring legal compliance and convenience.

-

How much does airSlate SignNow cost, particularly with the ir6104 feature?

Pricing for airSlate SignNow varies based on usage and features, including the ir6104 functionality. Generally, the platform is designed to be cost-effective, making it accessible for businesses of all sizes looking to enhance their eSignature capabilities.

-

What are the key features of airSlate SignNow that include ir6104?

airSlate SignNow offers a variety of features alongside ir6104, such as document templates, workflow automation, and collaboration tools. These capabilities make it easier for teams to manage documents and make the signing process quicker and more efficient.

-

How can the ir6104 feature benefit my business?

The ir6104 feature within airSlate SignNow can signNowly improve your business’s efficiency by allowing fast and secure eSigning of documents. This leads to reduced turnaround times and ensures that critical agreements are executed swiftly.

-

Can I integrate airSlate SignNow with other applications while using the ir6104 feature?

Yes, airSlate SignNow supports a variety of integrations with popular applications, which aligns seamlessly with the ir6104 feature. This makes it easier for businesses to incorporate eSigning into their existing workflows without disruption.

-

Is airSlate SignNow secure when using the ir6104 feature?

Absolutely, airSlate SignNow ensures high security standards for all transactions, including those involving the ir6104 feature. The platform utilizes encryption protocols and follows compliance regulations to protect your data during the signing process.

-

What types of documents can I send and sign using ir6104?

With the ir6104 functionality, you can send and sign various document types, such as contracts, agreements, and forms. airSlate SignNow supports file formats like PDF, Word, and more, enhancing versatility for your signing needs.

Get more for Ir6104

- C16 notice to case management form 3 2015 butlercountyohio

- Cabo certification form

- Xofigo insurance benefit verification request form il pparx

- Cookcounty clerk of court form

- Bonus form

- Arizona for your protection arizona law requires the us life form

- City of lapeer special event application ci lapeer mi form

- Annex d bctesg form

Find out other Ir6104

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe