Transportation Reimbursement Form

What is the Transportation Reimbursement

The transportation reimbursement is a financial compensation offered by employers to cover costs incurred by employees while traveling for work-related purposes. This can include expenses related to public transportation, mileage for personal vehicles, parking fees, and tolls. The reimbursement is designed to alleviate the financial burden on employees who are required to travel as part of their job duties.

How to Use the Transportation Reimbursement

To effectively use the transportation reimbursement, employees should first understand their employer's policy regarding eligible expenses. Typically, this involves keeping detailed records of travel-related costs, including receipts and mileage logs. Employees may need to complete a reimbursement form, providing necessary documentation to support their claims. Submitting the form accurately and on time is crucial to ensure prompt reimbursement.

Steps to Complete the Transportation Reimbursement

Completing the transportation reimbursement process involves several key steps:

- Review your employer's transportation reimbursement policy for eligibility and guidelines.

- Track all travel-related expenses, including receipts for public transportation and mileage for personal vehicle use.

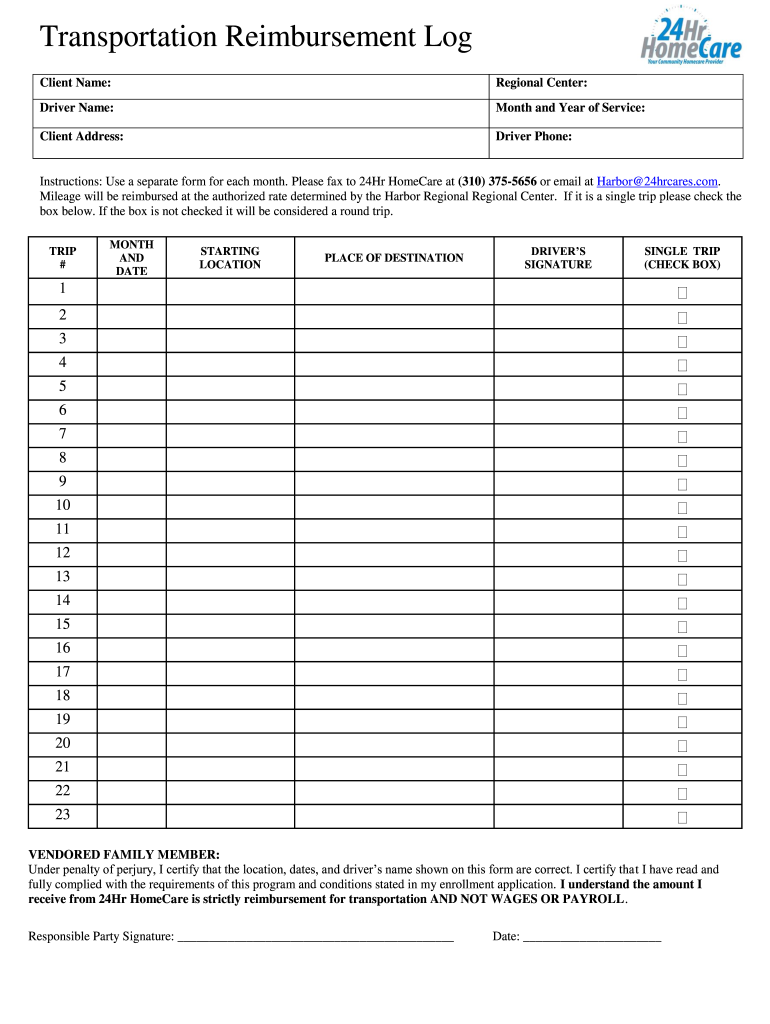

- Fill out the transportation reimbursement form, ensuring all required information is provided.

- Attach supporting documentation, such as receipts and mileage logs, to your reimbursement form.

- Submit the completed form and documentation to the appropriate department, typically human resources or finance.

Required Documents

When submitting a transportation reimbursement request, certain documents are typically required to validate the claim. These may include:

- Receipts for public transportation fares, parking fees, and tolls.

- Mileage logs detailing the dates, destinations, and distances traveled.

- The completed transportation reimbursement form.

Legal Use of the Transportation Reimbursement

The legal use of transportation reimbursement is governed by both federal and state laws, which outline the tax implications and requirements for employers. Employers must ensure that reimbursement policies comply with the Internal Revenue Service (IRS) guidelines to avoid potential tax liabilities. Employees should also be aware of their rights regarding reimbursement claims and any applicable labor laws that protect their interests.

IRS Guidelines

The IRS provides specific guidelines regarding transportation reimbursements, particularly concerning tax treatment. Generally, reimbursements for business-related travel are not considered taxable income, provided they meet certain criteria. Employers must adhere to the accountable plan structure, which requires employees to substantiate expenses and return any excess reimbursements. Understanding these guidelines helps both employers and employees navigate the reimbursement process effectively.

Quick guide on how to complete transportation reimbursement

Prepare Transportation Reimbursement effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Transportation Reimbursement on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The easiest way to edit and eSign Transportation Reimbursement seamlessly

- Obtain Transportation Reimbursement and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight essential sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you prefer. Modify and eSign Transportation Reimbursement and assure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the transportation reimbursement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is transportation reimbursement?

Transportation reimbursement refers to the process of compensating employees for travel expenses incurred while conducting business-related activities. With airSlate SignNow, businesses can efficiently manage and streamline their transportation reimbursement processes, ensuring fast and accurate payments.

-

How does airSlate SignNow facilitate transportation reimbursement?

airSlate SignNow simplifies transportation reimbursement by allowing businesses to electronically sign and manage reimbursement documents in one secure platform. This reduces the time spent on paperwork and increases efficiency for both employees and finance teams.

-

What are the benefits of using airSlate SignNow for transportation reimbursement?

Using airSlate SignNow for transportation reimbursement offers several benefits, including faster processing times, secure document storage, and improved accuracy with automated workflows. It helps ensure that reimbursements are processed promptly and efficiently.

-

Is airSlate SignNow cost-effective for managing transportation reimbursement?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing transportation reimbursement. With flexible pricing plans, businesses of all sizes can take advantage of its features without breaking the bank.

-

Can I integrate airSlate SignNow with other systems for transportation reimbursement?

Absolutely! airSlate SignNow offers integration capabilities with various accounting and HR systems. This ensures seamless data flow for transportation reimbursement and makes it easier to manage expenses across platforms.

-

How secure is the transportation reimbursement process with airSlate SignNow?

Security is a top priority with airSlate SignNow. The platform employs advanced encryption and secure protocols to protect sensitive information related to transportation reimbursement, ensuring that your data remains safe.

-

Can airSlate SignNow help track transportation reimbursement requests?

Yes, airSlate SignNow includes features that enable businesses to track and manage transportation reimbursement requests in real-time. This visibility ensures that all requests are accountable and that employees receive timely updates on their reimbursements.

Get more for Transportation Reimbursement

Find out other Transportation Reimbursement

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors