Rv Credit Application Form

What is the RV Credit Application

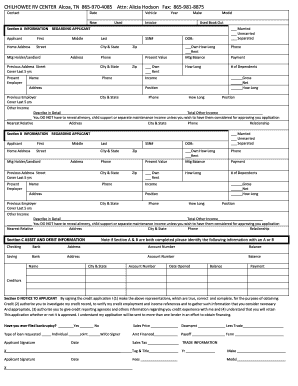

The RV credit application is a financial document used by individuals seeking to finance the purchase of a recreational vehicle (RV). This application collects essential information about the applicant's financial status, including income, credit history, and employment details. Lenders utilize this information to assess the applicant's creditworthiness and determine the terms of the loan, such as interest rates and repayment periods. Understanding the RV credit application is crucial for anyone looking to secure financing for their RV purchase.

Key Elements of the RV Credit Application

Several key elements are typically included in an RV credit application. These elements help lenders evaluate the applicant's financial situation:

- Personal Information: Name, address, date of birth, and Social Security number.

- Employment Details: Current employer, job title, length of employment, and monthly income.

- Financial Information: Monthly expenses, existing debts, and assets.

- Loan Details: Desired loan amount, purpose of the loan, and preferred repayment terms.

Providing accurate and complete information in these sections can significantly impact the approval process and loan terms.

Steps to Complete the RV Credit Application

Completing the RV credit application involves several straightforward steps:

- Gather Necessary Documents: Collect financial documents, including pay stubs, tax returns, and bank statements.

- Fill Out the Application: Provide all requested personal and financial information accurately.

- Review Your Application: Double-check for any errors or omissions that could affect your approval.

- Submit the Application: Send the completed application to the lender either online or via mail, depending on their submission methods.

Following these steps can streamline the application process and enhance the likelihood of approval.

Eligibility Criteria

Eligibility for an RV credit application varies by lender, but common criteria include:

- Credit Score: Most lenders require a minimum credit score, often around six hundred to qualify.

- Income Level: Applicants must demonstrate sufficient income to cover loan payments.

- Debt-to-Income Ratio: Lenders typically prefer a ratio below a certain percentage, often around forty-three percent.

- Employment Stability: A consistent employment history can positively influence the application.

Understanding these criteria can help applicants prepare their financial profiles for a successful application.

How to Obtain the RV Credit Application

The RV credit application can typically be obtained from various sources:

- Lender Websites: Many financial institutions provide downloadable applications directly on their websites.

- Dealerships: RV dealerships often have applications available for customers looking to finance their purchases.

- Financial Advisors: Consulting with a financial advisor can also guide you in obtaining and completing the application.

Accessing the application from these sources ensures that you are using the most current version required by lenders.

Form Submission Methods

Submitting the RV credit application can be done through various methods, depending on the lender's preferences:

- Online Submission: Many lenders offer a secure online portal for submitting applications electronically.

- Mail: Applicants can print the completed application and send it via postal service.

- In-Person: Some lenders allow applicants to submit their applications at branch locations.

Choosing the right submission method can enhance the speed and efficiency of the application process.

Quick guide on how to complete rv credit application

Complete Rv Credit Application effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the right form and safely store it online. airSlate SignNow equips you with all the necessary tools to produce, modify, and eSign your documents swiftly without delays. Manage Rv Credit Application on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Rv Credit Application with ease

- Find Rv Credit Application and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Rv Credit Application and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rv credit application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an RV credit application?

An RV credit application is a formal request to obtain financing for purchasing a recreational vehicle. It typically requires personal and financial information to evaluate the applicant's creditworthiness. Using airSlate SignNow, you can seamlessly fill out and eSign your RV credit application online.

-

How does airSlate SignNow streamline the RV credit application process?

airSlate SignNow simplifies the RV credit application process by providing an easy-to-use platform for document management and electronic signatures. Users can easily fill out their applications, gather necessary documents, and securely eSign everything in one place. This eliminates the hassle of paper forms and speeds up the approval process.

-

Is airSlate SignNow secure for submitting my RV credit application?

Yes, airSlate SignNow prioritizes security by using advanced encryption and authentication measures. When submitting your RV credit application, you can trust that your personal and financial information is protected. Our compliance with industry standards ensures that your data remains confidential.

-

What features are included with airSlate SignNow for RV credit applications?

With airSlate SignNow, you get features like customizable templates, automated workflows, and real-time tracking of your RV credit application. These tools help simplify the application process, reduce errors, and ensure timely submissions. You can also easily collaborate with others involved in the credit approval process.

-

Can I integrate airSlate SignNow with my current CRM for RV credit applications?

Absolutely! airSlate SignNow offers integrations with popular CRM systems, allowing you to streamline your RV credit application management. This integration helps maintain consistent data flow and enhances your business's operational efficiency. You can easily manage all customer interactions from one platform.

-

What are the pricing options for using airSlate SignNow for RV credit applications?

airSlate SignNow provides competitive pricing plans tailored to fit various business needs. Whether you're a small dealership or a large enterprise, there’s a plan for efficiently managing RV credit applications. You can also try a free trial to explore the features before committing to a subscription.

-

How can airSlate SignNow benefit my dealership's RV credit application process?

By using airSlate SignNow, your dealership can improve the efficiency of your RV credit application process. The platform reduces processing times, minimizes paperwork errors, and enhances customer experience through quick eSigning. Overall, this leads to faster approvals and happier customers.

Get more for Rv Credit Application

- Application for judgment and dismissal re interrogatories in a form

- Motion to continue and refix form

- Defendant through undersigned counsel moves that the form

- In the above captioned case be continued from the date on which it is set 20 at form

- Defendant through undersigned counsel moves that the in form

- Defendant through undersigned counsel moves that the sentencing in the form

- Defendant through undersigned counsel moves that the trial in the abovecaptioned case be continued from the date on which it is form

- State of louisiana v mario t willis 2018 louisiana form

Find out other Rv Credit Application

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast