Policy Loan Withdrawal Request KSKJ Life Form

What is the Policy Loan Withdrawal Request KSKJ Life

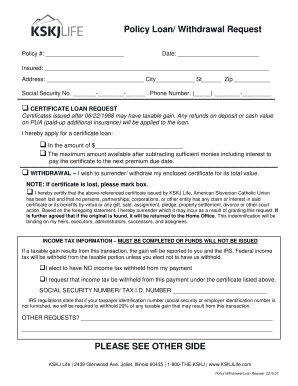

The Policy Loan Withdrawal Request KSKJ Life is a formal document that policyholders use to request a loan against the cash value of their life insurance policy. This type of loan allows individuals to access funds without needing to undergo a credit check or provide collateral, as the loan is secured by the policy's cash value. The amount available for withdrawal is typically determined by the policy's accumulated cash value and any outstanding loans or withdrawals previously made.

How to use the Policy Loan Withdrawal Request KSKJ Life

To use the Policy Loan Withdrawal Request KSKJ Life, policyholders must complete the form accurately, providing necessary personal information and details about the policy. This includes the policy number, the amount requested, and the reason for the loan, if required. Once filled out, the form must be submitted to KSKJ Life according to the specified submission methods, which may include online submission, mailing, or in-person delivery.

Steps to complete the Policy Loan Withdrawal Request KSKJ Life

Completing the Policy Loan Withdrawal Request KSKJ Life involves several key steps:

- Gather necessary information, including your policy number and personal identification.

- Fill out the form, ensuring all required fields are completed accurately.

- Specify the amount you wish to withdraw from your policy's cash value.

- Review the form for any errors or omissions.

- Submit the completed form through your chosen method: online, by mail, or in person.

Required Documents

When submitting the Policy Loan Withdrawal Request KSKJ Life, policyholders may need to provide certain documents to verify their identity and policy details. Commonly required documents include:

- A copy of a government-issued identification, such as a driver's license or passport.

- Proof of address, which may include a utility bill or bank statement.

- Any additional documentation requested by KSKJ Life to process the loan request.

Eligibility Criteria

To be eligible for a loan through the Policy Loan Withdrawal Request KSKJ Life, policyholders must meet specific criteria, including:

- Having an active life insurance policy with a cash value.

- Ensuring that the requested loan amount does not exceed the available cash value.

- Being in good standing with the policy, meaning no lapses in premium payments.

Form Submission Methods

The Policy Loan Withdrawal Request KSKJ Life can be submitted through various methods, allowing for flexibility based on the policyholder's preference:

- Online: Submit the form through the KSKJ Life online portal, if available.

- By Mail: Send the completed form to the designated KSKJ Life address.

- In Person: Deliver the form directly to a KSKJ Life office or authorized representative.

Quick guide on how to complete policy loan withdrawal request kskj life

Effortlessly prepare Policy Loan Withdrawal Request KSKJ Life on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to acquire the necessary template and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and eSign your documents quickly without delays. Manage Policy Loan Withdrawal Request KSKJ Life on any gadget with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest way to edit and eSign Policy Loan Withdrawal Request KSKJ Life with ease

- Locate Policy Loan Withdrawal Request KSKJ Life and then click Obtain Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent parts of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal authority as a traditional wet ink signature.

- Verify the details and then click the Finish button to save your changes.

- Select how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Policy Loan Withdrawal Request KSKJ Life and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the policy loan withdrawal request kskj life

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Policy Loan Withdrawal Request KSKJ Life?

A Policy Loan Withdrawal Request KSKJ Life allows policyholders to borrow against the cash value of their life insurance policy. This request can be processed easily through the airSlate SignNow platform, ensuring a seamless experience. Policyholders can use these funds for various needs while still maintaining their policy.

-

How do I submit a Policy Loan Withdrawal Request KSKJ Life?

To submit a Policy Loan Withdrawal Request KSKJ Life, simply access the required forms on the airSlate SignNow platform. Fill in the necessary information, eSign the document, and submit it for processing. Our platform streamlines the submission process, ensuring timely handling of your request.

-

Are there any fees associated with the Policy Loan Withdrawal Request KSKJ Life?

Fees related to the Policy Loan Withdrawal Request KSKJ Life may vary depending on your specific policy terms. It's essential to review your insurance policy or consult with your KSKJ Life representative for detailed information on any applicable charges. Using airSlate SignNow allows you to easily access your policy documents for review.

-

What are the benefits of using airSlate SignNow for my Policy Loan Withdrawal Request KSKJ Life?

Using airSlate SignNow for your Policy Loan Withdrawal Request KSKJ Life provides a user-friendly and efficient way to handle your documents. The platform offers secure eSigning capabilities, ensuring your information remains protected. Additionally, you can track the status of your request in real-time for added peace of mind.

-

How quickly can I expect to receive funds after submitting my Policy Loan Withdrawal Request KSKJ Life?

The time it takes to receive funds after submitting your Policy Loan Withdrawal Request KSKJ Life can vary based on internal processing times. However, airSlate SignNow helps expedite your request by providing a clear and organized submission process. You’ll be notified of the status and timeline once your request is received.

-

Can I make multiple Policy Loan Withdrawal Requests KSKJ Life?

Yes, you can make multiple Policy Loan Withdrawal Requests KSKJ Life as long as they stay within the limits set by your insurance policy. It’s essential to monitor your policy's cash value and loan limits. airSlate SignNow keeps all your requests and documents organized for easy reference.

-

Is the Policy Loan Withdrawal Request KSKJ Life process safe and secure?

Absolutely, the Policy Loan Withdrawal Request KSKJ Life process through airSlate SignNow is designed with security in mind. Our platform employs advanced encryption and data protection measures to safeguard your personal and financial information. You can confidently manage your policy loan requests knowing your data is secure.

Get more for Policy Loan Withdrawal Request KSKJ Life

- Famlaw 113 contra costa superior court form

- Power of attorney maryland taxes form

- Wg 021 confidential supplement to application for earnings form

- Wg 022 earnings holdiing order for taxes wage garnishment wg 022 982512 form

- 151 state of michigan form

- Employer and tax information texas secretary of state

- Taxpayer identification numbers tininternal revenue irs form

- Offer in compromise ohio attorney general form

Find out other Policy Loan Withdrawal Request KSKJ Life

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself

- eSign West Virginia Rental lease agreement template Safe

- How To eSign California Residential lease agreement form

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now