Canada Profit Loss Statement Form

Key elements of the profit and loss statement

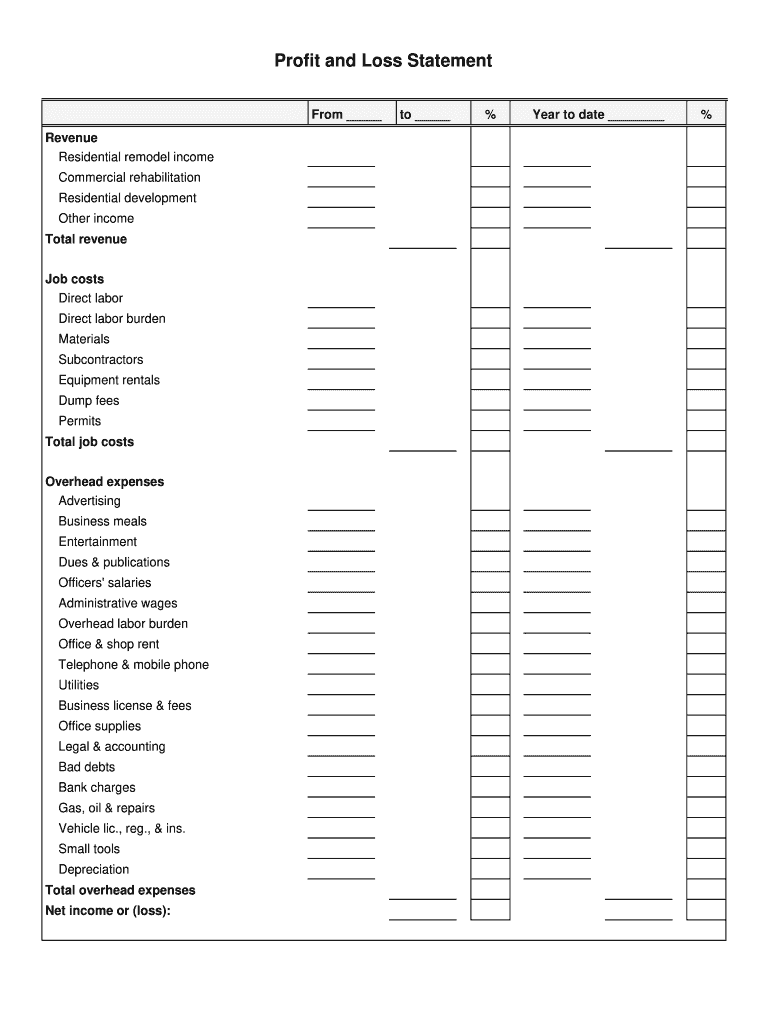

A profit and loss statement, often referred to as a P&L sheet, is essential for understanding a business's financial performance. The key elements typically include:

- Revenue: This is the total income generated from sales before any expenses are deducted.

- Cost of Goods Sold (COGS): This includes all direct costs associated with the production of goods sold by the business.

- Gross Profit: Calculated by subtracting COGS from revenue, this figure indicates the profitability of core business operations.

- Operating Expenses: These are the costs required to run the business that are not directly tied to production, such as rent, utilities, and salaries.

- Net Profit: This is the final profit after all expenses, including taxes and interest, have been deducted from gross profit.

Steps to complete the profit and loss statement

Completing a profit and loss statement involves several straightforward steps that ensure accuracy and clarity:

- Gather all financial records, including sales invoices, receipts, and expense reports.

- Calculate total revenue for the reporting period.

- Determine the cost of goods sold by adding all direct costs associated with production.

- Subtract COGS from total revenue to find gross profit.

- List all operating expenses and sum them up.

- Subtract total operating expenses from gross profit to determine net profit.

Examples of using the profit and loss statement

Profit and loss statements serve various purposes across different business scenarios. Here are some examples of their application:

- A trucking company may use a profit and loss statement to assess profitability by comparing revenue from freight services against operational costs.

- Construction firms often utilize a P&L sheet to evaluate project-specific profitability, helping in budgeting and forecasting.

- Small businesses can leverage these statements to attract investors by demonstrating financial viability and growth potential.

IRS Guidelines

Understanding IRS guidelines is crucial for accurate reporting. The IRS requires businesses to maintain accurate records of income and expenses, which should align with the figures presented in the profit and loss statement. Specific guidelines include:

- Businesses must report all income received during the tax year.

- Expenses must be ordinary and necessary for the business to qualify for deductions.

- Maintaining supporting documentation for all reported figures is essential for compliance and audit purposes.

Required Documents

To complete a profit and loss statement accurately, certain documents are necessary. These include:

- Sales invoices and receipts to verify revenue.

- Bank statements to cross-check income and expenses.

- Expense receipts for all operating costs, including utilities, salaries, and materials.

Digital vs. Paper Version

When preparing a profit and loss statement, businesses can choose between digital and paper formats. Each has its advantages:

- Digital Version: Offers ease of editing, automatic calculations, and integration with accounting software.

- Paper Version: Provides a tangible record that some may prefer for physical filing or presentations.

Quick guide on how to complete canada profit loss statement

Effortlessly Manage Canada Profit Loss Statement on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely preserve it online. airSlate SignNow equips you with all the essentials needed to generate, edit, and eSign your documents swiftly without any delays. Handle Canada Profit Loss Statement on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

Effortlessly Edit and eSign Canada Profit Loss Statement

- Obtain Canada Profit Loss Statement and click Get Form to begin.

- Utilize the offerings we provide to fill out your form.

- Emphasize relevant parts of the documents or conceal sensitive information using tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow addresses all your document management requirements with just a few clicks from the device of your choice. Modify and eSign Canada Profit Loss Statement and ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the canada profit loss statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a forms profit loss statement?

A forms profit loss statement is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period. This statement helps businesses evaluate their financial performance and make informed decisions. airSlate SignNow facilitates the creation and signing of these forms seamlessly.

-

How can airSlate SignNow help with forms profit loss statement management?

AirSlate SignNow provides an easy-to-use platform for businesses to create, send, and eSign forms profit loss statement documents quickly. The streamlined process ensures accuracy and efficiency, allowing management to focus on more strategic tasks rather than paperwork. With our solution, tracking and managing these statements becomes hassle-free.

-

Is there a cost to use airSlate SignNow for forms profit loss statement?

AirSlate SignNow offers flexible pricing plans, making it affordable for businesses of all sizes to manage forms profit loss statements. Our cost-effective solution includes robust features that justify the investment. We also provide a free trial, allowing you to experience the benefits before committing.

-

What features does airSlate SignNow offer for forms profit loss statement?

AirSlate SignNow includes features like document templates, collaborative editing, eSignature capabilities, and cloud storage for forms profit loss statement. These features ensure that your statements can be created, signed, and stored efficiently in one secure location. Additionally, our platform is highly intuitive, requiring minimal training.

-

Can I integrate airSlate SignNow with other tools for forms profit loss statement?

Yes, airSlate SignNow can integrate with various accounting and business applications to optimize your forms profit loss statement handling. Whether you use QuickBooks, Salesforce, or other tools, our platform allows for seamless data transfer and document management. Integrating these tools enhances workflow and reduces redundancy.

-

What benefits do businesses gain from using airSlate SignNow for forms profit loss statement?

By utilizing airSlate SignNow for forms profit loss statement, businesses experience increased efficiency, improved accuracy, and enhanced compliance. The ability to sign documents electronically accelerates the approval process and reduces turnaround times. Furthermore, our secure platform ensures that sensitive financial data remains protected.

-

How does airSlate SignNow ensure the security of my forms profit loss statement?

AirSlate SignNow employs industry-leading security protocols to safeguard your forms profit loss statement and other documents. Our platform uses encryption, two-factor authentication, and compliance with data protection regulations to ensure your information is secure. You can trust that your financial statements are handled with the highest level of security.

Get more for Canada Profit Loss Statement

- Notice in accordance with law and the terms of our lease agreement form

- This letter is to provide you with legal notice that you have given me insufficient notice of the change you have form

- It has come to my attention that you have unauthorized inhabitants living in your leased form

- Template letters tenant resource and advisory centre form

- This letter is to provide you with legal notice of the fact that there is insufficient heat in my form

- With limited warranties form

- Horses purchased the seller hereby agrees to sell and the buyer hereby agrees form

- Fourteen 14 days after service of this notice upon you you must pay in full to landlord the form

Find out other Canada Profit Loss Statement

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile