Qualified Income Miller Trust Form

What is the Qualified Income Miller Trust

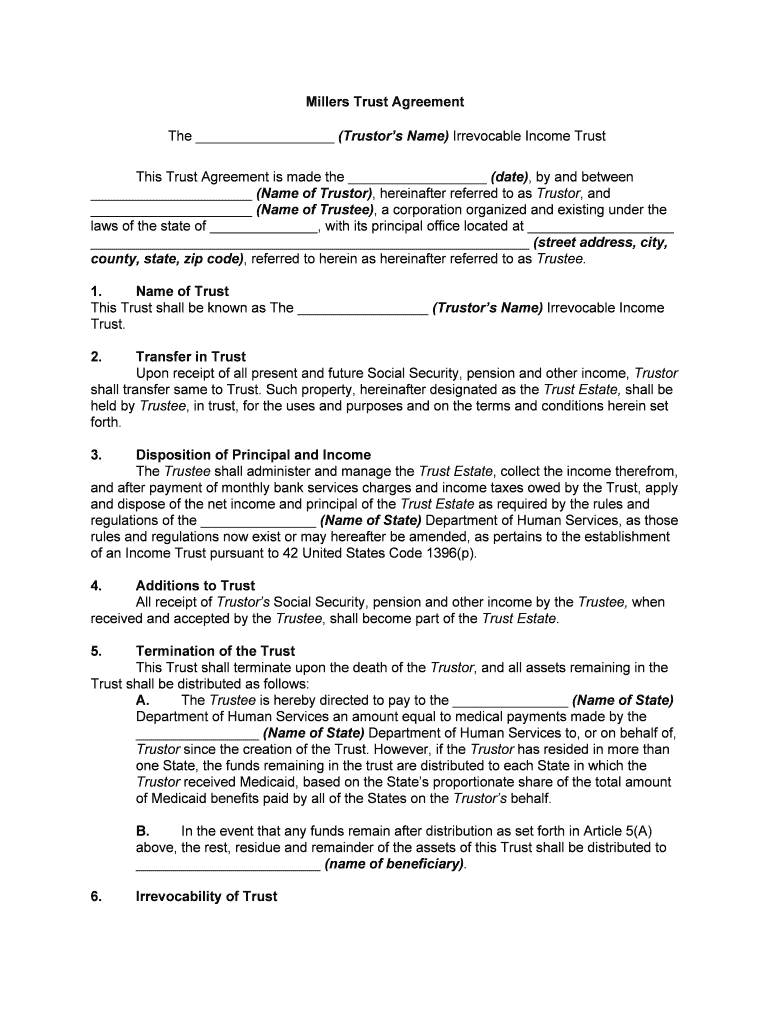

The Qualified Income Miller Trust is a specialized financial tool designed to help individuals qualify for Medicaid benefits while managing their income. This trust allows individuals whose income exceeds the Medicaid eligibility threshold to set aside excess income in a trust, thereby reducing their countable income for Medicaid purposes. The funds in the trust can only be used for specific expenses, such as medical care and related costs, ensuring that beneficiaries can access necessary services without jeopardizing their eligibility for essential benefits.

How to use the Qualified Income Miller Trust

Using a Qualified Income Miller Trust involves several steps to ensure compliance with Medicaid regulations. First, individuals must establish the trust by working with a qualified attorney or financial advisor. Once the trust is created, the individual deposits their excess income into the trust account. The trustee, who is often the individual or a designated representative, manages the funds. It is crucial to maintain accurate records of all transactions and ensure that withdrawals are made only for allowable expenses, such as medical bills, to preserve the trust's integrity and the individual's Medicaid eligibility.

Steps to complete the Qualified Income Miller Trust

Completing a Qualified Income Miller Trust entails a series of important steps:

- Consult a professional: Engage with a legal or financial expert familiar with Medicaid and trust laws.

- Create the trust: Draft the trust document, specifying the terms and conditions, including the trustee's powers and responsibilities.

- Open a trust account: Set up a separate bank account for the trust to hold the excess income.

- Deposit income: Transfer the excess income into the trust account on a regular basis.

- Document expenses: Keep detailed records of all expenditures from the trust to ensure compliance with Medicaid requirements.

Legal use of the Qualified Income Miller Trust

The legal framework surrounding the Qualified Income Miller Trust is designed to ensure that it serves its intended purpose without violating Medicaid regulations. The trust must be irrevocable, meaning that once funds are placed into it, they cannot be withdrawn for personal use. Additionally, the trust must comply with state-specific laws regarding Medicaid eligibility and income limits. It is essential for individuals to adhere strictly to these legal requirements to avoid penalties and maintain their eligibility for Medicaid benefits.

Eligibility Criteria

To qualify for a Qualified Income Miller Trust, individuals must meet specific criteria. Primarily, they must have income that exceeds the Medicaid income limit set by their state. This limit varies by state and is adjusted annually. Additionally, the individual must be applying for Medicaid benefits for long-term care services. It is important to note that not all income types are counted towards this limit, so individuals should consult with a professional to understand their unique situation and ensure compliance with eligibility requirements.

Required Documents

Establishing a Qualified Income Miller Trust requires several key documents. These typically include:

- Trust agreement: The legal document that outlines the terms and conditions of the trust.

- Bank statements: Documentation of the income being deposited into the trust account.

- Medicaid application: The official application for Medicaid benefits, which may require additional supporting documentation.

- Proof of income: Verification of the individual’s income sources and amounts to determine eligibility.

Quick guide on how to complete qualified income miller trust

Effortlessly Prepare Qualified Income Miller Trust on Any Device

Managing documents online has gained immense popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, enabling you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Qualified Income Miller Trust on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign Qualified Income Miller Trust with Ease

- Locate Qualified Income Miller Trust and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant portions of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method for submitting your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or mislaid files, tedious form searches, or the need to print new document copies for any errors. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Qualified Income Miller Trust ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the qualified income miller trust

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Qualified Income Miller Trust?

A Qualified Income Miller Trust is a specialized trust designed to help individuals qualify for Medicaid benefits while ensuring that their income stays within required limits. This trust allows the individual to allocate excess income, enabling eligibility for essential healthcare services.

-

How does a Qualified Income Miller Trust benefit Medicaid applicants?

The main benefit of a Qualified Income Miller Trust for Medicaid applicants is that it enables them to keep a higher income level while still qualifying for Medicaid services. By funneling excess income into the trust, individuals can manage their resources more effectively without losing access to vital benefits.

-

What are the costs associated with setting up a Qualified Income Miller Trust?

The costs for setting up a Qualified Income Miller Trust can vary based on state regulations and the complexity of the trust structure. Typically, legal fees, administrative fees, and potential ongoing management costs should be anticipated, but these expenses are often outweighed by the benefits of qualifying for Medicaid.

-

Can a Qualified Income Miller Trust be integrated with other financial planning tools?

Yes, a Qualified Income Miller Trust can certainly be integrated with other financial planning tools and strategies. By working with a financial advisor, individuals can ensure the trust complements their overall financial goals while maximizing asset protection and Medicaid eligibility.

-

What are the eligibility criteria for establishing a Qualified Income Miller Trust?

Eligibility criteria for establishing a Qualified Income Miller Trust typically include being unable to qualify for Medicaid due to excess income. Each state may have specific rules regarding the trust setup, so it’s essential to consult with a legal expert to ensure compliance and proper establishment.

-

How does a Qualified Income Miller Trust affect inheritance planning?

A Qualified Income Miller Trust can have implications for inheritance planning, as assets within the trust may not be passed down in traditional ways. It is crucial to work with an estate planning attorney to effectively navigate how the trust interacts with your overall inheritance strategy.

-

What are the common misconceptions about Qualified Income Miller Trusts?

Common misconceptions about Qualified Income Miller Trusts include the belief that they are only for wealthy individuals or that they complicate financial management. In reality, these trusts are essential tools for many people who need assistance accessing Medicaid without signNowly impacting their financial stability.

Get more for Qualified Income Miller Trust

- The remaining balance of is returned to you with this letter form

- Has the right to the amount wrongfully withheld plus costs attorneys fees and possible punitive form

- If you do not return the amount of to me immediately i will sue you for that amount form

- To sub lease the premises to the persons identified below form

- All about subletting tenant resource center form

- Assignments and subleases the basicsinsights and events form

- I would ask that you reconsider as there cannot possibly be any harm in sub leasing the form

- The 10 types of notices for every landlord landlordology form

Find out other Qualified Income Miller Trust

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document