UNITED STATES TAX COURT May 8, PRESS U S Tax Court Ustaxcourt Form

Understanding the UNITED STATES TAX COURT

The United States Tax Court is a specialized court that handles disputes between taxpayers and the Internal Revenue Service (IRS). Established by Congress, it provides a forum for taxpayers to challenge IRS decisions without having to pay the disputed tax first. This court is crucial for ensuring that taxpayers have a fair opportunity to contest tax liabilities and seek justice in tax-related matters.

How to Utilize the UNITED STATES TAX COURT

To engage with the United States Tax Court, taxpayers must file a petition. This petition typically arises from a notice of deficiency issued by the IRS. Taxpayers can represent themselves or choose to hire an attorney. It is essential to understand the specific procedures and rules of the court, including deadlines for filing petitions and the types of cases the court can hear.

Steps to Complete the Petition Process

Filing a petition with the United States Tax Court involves several key steps:

- Obtain the notice of deficiency from the IRS.

- Prepare the petition, ensuring it includes all required information.

- File the petition with the court within the specified timeframe, typically within ninety days of receiving the IRS notice.

- Serve a copy of the petition to the IRS.

- Await a response from the court and prepare for any hearings or additional requirements.

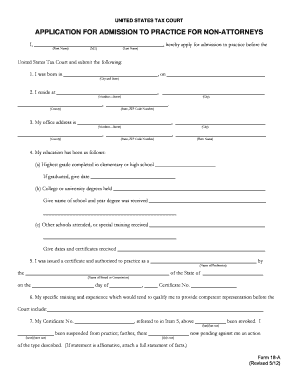

Key Elements of the Petition

The petition submitted to the United States Tax Court must include several critical components:

- Your name and address, as well as the IRS's name and address.

- A clear statement of the facts and issues being contested.

- The legal basis for your claims.

- A request for relief, explaining what you seek from the court.

Required Documents for Filing

When filing a petition with the United States Tax Court, certain documents are necessary to support your case:

- The notice of deficiency from the IRS.

- Any relevant tax returns or financial statements.

- Documentation supporting your claims or disputes.

Filing Deadlines and Important Dates

Timeliness is crucial in tax court proceedings. The general deadline for filing a petition is ninety days from the date of the IRS notice of deficiency. It is important to keep track of any additional deadlines related to court hearings or responses from the IRS to ensure compliance with court rules.

Eligibility Criteria for Tax Court Cases

To bring a case before the United States Tax Court, taxpayers must meet specific eligibility criteria. Generally, the court hears cases involving disputes over income tax, estate tax, and gift tax. Taxpayers must have received a notice of deficiency or other determinations from the IRS that they wish to contest.

Quick guide on how to complete united states tax court may 8 press u s tax court ustaxcourt

Prepare [SKS] effortlessly on any device

Online document management has gained popularity among organizations and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, since you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign [SKS] with minimal effort

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to UNITED STATES TAX COURT May 8, PRESS U S Tax Court Ustaxcourt

Create this form in 5 minutes!

How to create an eSignature for the united states tax court may 8 press u s tax court ustaxcourt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the UNITED STATES TAX COURT May 8, PRESS U S Tax Court Ustaxcourt?

The UNITED STATES TAX COURT May 8, PRESS U S Tax Court Ustaxcourt refers to a specific court ruling or announcement made by the U.S. Tax Court. This court handles disputes between taxpayers and the Internal Revenue Service (IRS). Understanding these rulings can be crucial for tax planning and compliance.

-

How can airSlate SignNow help with documents related to the U S Tax Court?

airSlate SignNow offers a comprehensive platform for eSigning documents related to the U S Tax Court efficiently. By utilizing our solution, businesses can easily prepare and send important legal documents for electronic signatures, ensuring compliance with court requirements and timelines that may be influenced by rulings like the UNITED STATES TAX COURT May 8, PRESS U S Tax Court Ustaxcourt.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow provides multiple pricing tiers designed to meet a variety of business needs and budgets. From basic plans to advanced features suitable for larger organizations, our pricing ensures that users can manage document signing efficiently, especially for important filings such as those associated with the UNITED STATES TAX COURT May 8, PRESS U S Tax Court Ustaxcourt.

-

What are the main features of airSlate SignNow?

Key features of airSlate SignNow include intuitive document creation, robust eSigning capabilities, and automated workflow management. These functionalities make it easier for businesses to handle documents relevant to legal matters like the UNITED STATES TAX COURT May 8, PRESS U S Tax Court Ustaxcourt, streamlining the process and enhancing productivity.

-

What benefits does airSlate SignNow provide for businesses?

Using airSlate SignNow can signNowly reduce the time and resources spent on document processing. Our platform enhances operational efficiency, ensures compliance with legal standards, especially in cases like the UNITED STATES TAX COURT May 8, PRESS U S Tax Court Ustaxcourt, and provides a secure environment for document management.

-

Can airSlate SignNow integrate with other software solutions?

Yes, airSlate SignNow seamlessly integrates with numerous software applications, enhancing its usability across various business environments. Integrations with CRM, cloud storage, and workflow tools allow users to manage documents related to cases like the UNITED STATES TAX COURT May 8, PRESS U S Tax Court Ustaxcourt in a cohesive manner.

-

Is airSlate SignNow suitable for small businesses and startups?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an excellent choice for small businesses and startups. It enables them to handle essential documents, such as those related to the UNITED STATES TAX COURT May 8, PRESS U S Tax Court Ustaxcourt, without incurring high operational costs.

Get more for UNITED STATES TAX COURT May 8, PRESS U S Tax Court Ustaxcourt

Find out other UNITED STATES TAX COURT May 8, PRESS U S Tax Court Ustaxcourt

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer