Form 11 C Rev January Internal Revenue Service

What is the Form 11 C Rev January Internal Revenue Service

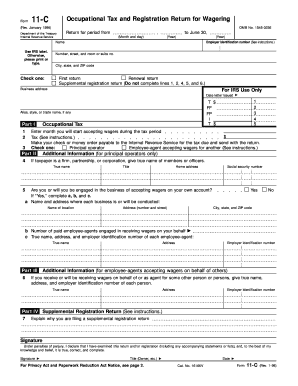

The Form 11 C Rev January is a crucial document issued by the Internal Revenue Service (IRS) for businesses that operate gaming activities. This form is primarily used to report and pay the annual occupational tax on certain types of gaming operations. It is essential for compliance with federal tax regulations, ensuring that businesses involved in gaming activities meet their tax obligations. The form provides the IRS with necessary information about the nature of the gaming operations and the revenue generated from these activities.

How to use the Form 11 C Rev January Internal Revenue Service

Using the Form 11 C Rev January requires careful attention to detail to ensure accurate reporting. Businesses must complete the form with specific information regarding their gaming activities, including the type of games offered and the total revenue earned. Once filled out, the form must be submitted to the IRS along with the appropriate payment for the occupational tax. It is advisable to keep a copy of the completed form for your records, as it serves as proof of compliance with federal tax requirements.

Steps to complete the Form 11 C Rev January Internal Revenue Service

Completing the Form 11 C Rev January involves several key steps:

- Gather necessary information about your gaming operations, including revenue figures and types of games.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total occupational tax owed based on your reported revenue.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS, along with the payment for the tax due.

Legal use of the Form 11 C Rev January Internal Revenue Service

The legal use of the Form 11 C Rev January is mandated by federal law for businesses engaged in gaming activities. Failure to file this form or pay the associated tax can result in penalties and legal repercussions. It is vital for businesses to understand their obligations under the law and to use the form correctly to avoid non-compliance issues. Consulting with a tax professional can provide additional guidance on the legal aspects of using this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 11 C Rev January are critical to ensure compliance with IRS regulations. Typically, the form must be filed annually, and the due date is set for the last day of the month following the end of the tax year. It is important for businesses to mark their calendars and prepare the necessary documentation ahead of time to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 11 C Rev January can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission through the IRS e-file system, which is efficient and allows for immediate confirmation.

- Mailing the completed form to the appropriate IRS address, ensuring it is postmarked by the due date.

- In-person submission at designated IRS offices, which may be beneficial for those needing immediate assistance or clarification.

Quick guide on how to complete form 11 c rev january internal revenue service

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to Modify and eSign [SKS] with Ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant parts of the documents or obscure sensitive information with the tools airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Review the details carefully and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any chosen device. Edit and eSign [SKS] while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 11 C Rev January Internal Revenue Service

Create this form in 5 minutes!

How to create an eSignature for the form 11 c rev january internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 11 C Rev January Internal Revenue Service?

Form 11 C Rev January Internal Revenue Service is a federal form used for reporting information regarding the occupational tax on operators of certain businesses involving wagering. This form is essential for compliance with IRS regulations and must be submitted annually. Understanding how to accurately fill out this form is crucial for those in specific industries.

-

How can airSlate SignNow assist with Form 11 C Rev January Internal Revenue Service?

airSlate SignNow offers a streamlined process for signing and submitting Form 11 C Rev January Internal Revenue Service. With our intuitive eSigning platform, users can easily manage their documents, ensuring compliance and accuracy. Our solution simplifies the paperwork involved and enhances workflow efficiency.

-

What features does airSlate SignNow provide for handling Form 11 C Rev January Internal Revenue Service?

airSlate SignNow provides several features beneficial for handling Form 11 C Rev January Internal Revenue Service, including customizable templates, automated reminders, and secure storage. These features help users ensure that they never miss a deadline and can quickly access their important documents anytime. Additionally, real-time tracking gives users peace of mind during the submission process.

-

Is there a cost associated with using airSlate SignNow for Form 11 C Rev January Internal Revenue Service?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Pricing tiers cater to various needs, ensuring everyone can find the right plan to suit their budget while accessing features to manage Form 11 C Rev January Internal Revenue Service effectively. The investment often leads to signNow savings in time and resources.

-

Can I integrate airSlate SignNow with other tools for processing Form 11 C Rev January Internal Revenue Service?

Absolutely! airSlate SignNow seamlessly integrates with various business tools and platforms, enhancing your ability to process Form 11 C Rev January Internal Revenue Service efficiently. Whether you use CRM software, cloud storage, or communication tools, our integrations enable streamlined document management across your existing workflows.

-

What are the benefits of using airSlate SignNow for Form 11 C Rev January Internal Revenue Service?

Using airSlate SignNow for Form 11 C Rev January Internal Revenue Service provides numerous benefits, including improved compliance, time savings, and better document security. Our platform ensures that documents are signed securely and are properly stored, reducing the risk of errors. Additionally, the ease of use means that businesses can focus more on their core operations rather than paperwork.

-

How secure is airSlate SignNow when processing Form 11 C Rev January Internal Revenue Service?

Security is a top priority for airSlate SignNow. When processing Form 11 C Rev January Internal Revenue Service, our platform employs advanced security measures, including encryption and secure storage, to protect sensitive information. Users can trust that their documents are safe and that they comply with all relevant legal standards.

Get more for Form 11 C Rev January Internal Revenue Service

- Tc 94 178 docx transportation ky form

- Tenant authorization form assignment of samlarc

- P45 part 1a pbas webpayrolltraining co form

- Application for medical marijuana dispensaries county of kern co kern ca form

- Genkouyoushi paper printable form

- Notice to defend form in pennsylvania

- Payoff gm financial form

- 2560 pm bwm0015c form

Find out other Form 11 C Rev January Internal Revenue Service

- How To Sign South Dakota Education PDF

- How Can I Sign South Dakota Education Word

- How Do I Sign South Dakota Education PDF

- Can I Sign South Dakota Education Word

- Help Me With Sign South Dakota Education PDF

- How Do I Sign South Dakota Education PDF

- Help Me With Sign South Dakota Education PDF

- How To Sign South Dakota Education Word

- Help Me With Sign South Dakota Education Word

- How Do I Sign South Dakota Education Word

- How Can I Sign South Dakota Education Word

- How Can I Sign South Dakota Education PDF

- How Can I Sign South Dakota Education PDF

- Can I Sign South Dakota Education Word

- Can I Sign South Dakota Education PDF

- Can I Sign South Dakota Education PDF

- How Do I Sign South Dakota Education Word

- How To Sign South Dakota Education Word

- Help Me With Sign South Dakota Education Word

- How Can I Sign South Dakota Education Word