8283 Noncash Charitable Contributions Form Rev

What is the 8283 Noncash Charitable Contributions Form Rev

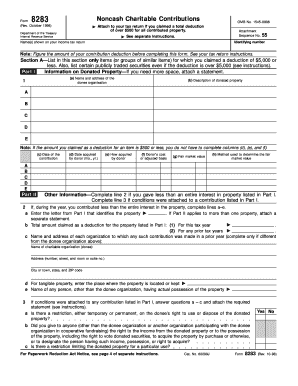

The 8283 Noncash Charitable Contributions Form Rev is a tax form used by individuals and businesses in the United States to report noncash charitable contributions. This form is essential for taxpayers who donate items such as clothing, vehicles, or real estate to qualified charitable organizations. By completing this form, donors can substantiate their contributions for tax deduction purposes, ensuring compliance with IRS regulations.

How to use the 8283 Noncash Charitable Contributions Form Rev

Using the 8283 form involves several steps. First, gather all necessary documentation related to the noncash contributions, including receipts and appraisals if required. Next, fill out the form accurately, detailing the items donated and their fair market value. Ensure that all information aligns with the records maintained by the charitable organization. After completing the form, keep a copy for your records and submit it with your tax return to the IRS.

Steps to complete the 8283 Noncash Charitable Contributions Form Rev

Completing the 8283 form requires attention to detail. Follow these steps:

- Identify the items donated and their respective values.

- Determine if an appraisal is necessary, especially for high-value items.

- Fill out Part A for donations under $500 and Part B for donations exceeding that amount.

- Provide the name and address of the charitable organization.

- Sign and date the form, ensuring all information is accurate.

Key elements of the 8283 Noncash Charitable Contributions Form Rev

The form consists of several key sections, including:

- Donor Information: Personal details of the donor.

- Charitable Organization: Name and address of the receiving charity.

- Item Description: Detailed list of donated items, including their fair market value.

- Appraisals: Required for items valued over $5,000.

IRS Guidelines

The IRS provides specific guidelines for completing the 8283 form. Donors must ensure that the contributions are made to qualified organizations and that the values assigned to the donated items reflect their fair market value at the time of donation. Additionally, the IRS requires proper documentation, including receipts and, when necessary, appraisals to support the claimed deductions. Familiarizing oneself with these guidelines helps prevent issues during tax filing.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the 8283 form. Typically, the form must be submitted along with your annual tax return by April 15 of the following year. If you file for an extension, ensure that the form is included in your extended return. Staying informed about these dates helps maintain compliance and maximizes potential tax benefits.

Quick guide on how to complete 8283 noncash charitable contributions form rev

Complete 8283 Noncash Charitable Contributions Form Rev seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Handle 8283 Noncash Charitable Contributions Form Rev on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and electronically sign 8283 Noncash Charitable Contributions Form Rev effortlessly

- Obtain 8283 Noncash Charitable Contributions Form Rev and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds exactly the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you prefer to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign 8283 Noncash Charitable Contributions Form Rev and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8283 noncash charitable contributions form rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8283 Noncash Charitable Contributions Form Rev.?

The 8283 Noncash Charitable Contributions Form Rev. is a tax form used to report noncash donations made to charitable organizations. This form ensures that donors can claim tax deductions for items donated, such as clothing, vehicles, and other property. Completing this form accurately is crucial to comply with IRS regulations.

-

How can airSlate SignNow help with the 8283 Noncash Charitable Contributions Form Rev.?

airSlate SignNow streamlines the process of completing the 8283 Noncash Charitable Contributions Form Rev. by enabling users to digitally fill out, sign, and send the document securely. This not only saves time but also reduces the risk of errors in filing. Our easy-to-use platform helps you manage your charitable contributions efficiently.

-

Is there a cost associated with using airSlate SignNow for the 8283 Noncash Charitable Contributions Form Rev.?

Yes, airSlate SignNow offers various pricing plans tailored to different needs, starting from affordable options for individuals to comprehensive solutions for businesses. While using our platform to process the 8283 Noncash Charitable Contributions Form Rev., you also gain access to additional features that enhance your document management experience.

-

What features does airSlate SignNow offer for the 8283 Noncash Charitable Contributions Form Rev.?

With airSlate SignNow, you get features such as electronic signatures, customizable templates, and automated workflows specifically designed for the 8283 Noncash Charitable Contributions Form Rev. This simplifies the entire process from start to finish, ensuring ease of use and compliance with IRS requirements.

-

Are there any integrations available with airSlate SignNow for managing the 8283 Noncash Charitable Contributions Form Rev.?

Yes, airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Dropbox, and various CRM systems. These integrations allow you to manage the 8283 Noncash Charitable Contributions Form Rev. and all related documents in one convenient location, enhancing your productivity.

-

What benefits does airSlate SignNow provide for non-profit organizations using the 8283 Noncash Charitable Contributions Form Rev.?

Non-profit organizations benefit signNowly from airSlate SignNow as it offers efficient document handling when dealing with the 8283 Noncash Charitable Contributions Form Rev. The platform increases transparency, improves donor communication, and helps ensure compliance with necessary regulations.

-

How secure is the airSlate SignNow platform for the 8283 Noncash Charitable Contributions Form Rev.?

airSlate SignNow prioritizes security and ensures that all documents, including the 8283 Noncash Charitable Contributions Form Rev., are protected through advanced encryption and compliance with industry-standard security protocols. Your information is kept confidential and secure while using our services.

Get more for 8283 Noncash Charitable Contributions Form Rev

- Condition inspection report rtb 27 form

- Inz 1165 investor investor 2 category expression of interest form

- John franklin memorial fellowship awards 2018 application form john franklin memorial fellowship

- Fillable online admissions calbar ca consent form

- Selr form

- Salve form

- Form r 390 ampquotannual report of appointment of school bus

- Oregon plan to manage special events download fillable pdf form

Find out other 8283 Noncash Charitable Contributions Form Rev

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure