Save PW 2 Form Print Wisconsin Nonresident Partner, Member, Shareholder, or Beneficiary Withholding Exemption Affidavit Clear No

Understanding the Save PW-2 Form

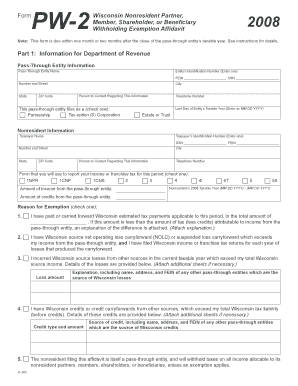

The Save PW-2 Form is a crucial document for nonresident partners, members, shareholders, or beneficiaries in Wisconsin seeking a withholding exemption. This affidavit allows eligible individuals to claim exemption from Wisconsin state income tax withholding on income received from pass-through entities. The form must be submitted within one to two months after the end of the pass-through entity's taxable year, ensuring timely compliance with state regulations.

Steps to Complete the Save PW-2 Form

Completing the Save PW-2 Form involves several key steps. First, gather necessary information, including your name, address, and taxpayer identification number. Next, provide details about the pass-through entity, such as its name and federal employer identification number (EIN). Carefully read the instructions on the form to ensure all required fields are filled accurately. Finally, sign and date the affidavit to validate your claim for exemption.

Filing Deadlines for the Save PW-2 Form

It is essential to adhere to the filing deadlines for the Save PW-2 Form. The form must be submitted within one month or two months following the close of the pass-through entity's taxable year. Missing this deadline may result in withholding taxes being deducted from your income, which could lead to unnecessary financial burdens.

Eligibility Criteria for the Save PW-2 Form

To qualify for the withholding exemption using the Save PW-2 Form, individuals must meet specific eligibility criteria. Generally, this includes being a nonresident partner, member, shareholder, or beneficiary of a pass-through entity that is subject to Wisconsin income tax. Additionally, the individual must not have any Wisconsin source income that would otherwise be subject to withholding.

Legal Use of the Save PW-2 Form

The Save PW-2 Form serves a legal purpose in Wisconsin tax law, allowing nonresident individuals to formally declare their exemption from state income tax withholding. Proper use of this form ensures compliance with state regulations and protects individuals from unnecessary tax liabilities. It is advisable to consult a tax professional if there are uncertainties regarding eligibility or the completion of the form.

Obtaining the Save PW-2 Form

The Save PW-2 Form can be obtained through the Wisconsin Department of Revenue's official website or by contacting their office directly. It is available in both digital and paper formats, allowing for flexibility in how individuals choose to complete and submit the form. Ensure you have the most current version of the form to avoid any issues during the filing process.

Quick guide on how to complete save pw 2 form print wisconsin nonresident partner member shareholder or beneficiary withholding exemption affidavit clear note

Prepare [SKS] effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly and efficiently. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and press the Done button to save your changes.

- Select how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Save PW 2 Form Print Wisconsin Nonresident Partner, Member, Shareholder, Or Beneficiary Withholding Exemption Affidavit Clear No

Create this form in 5 minutes!

How to create an eSignature for the save pw 2 form print wisconsin nonresident partner member shareholder or beneficiary withholding exemption affidavit clear note

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Save PW 2 Form Print Wisconsin Nonresident Partner, Member, Shareholder, Or Beneficiary Withholding Exemption Affidavit?

The Save PW 2 Form Print Wisconsin Nonresident Partner, Member, Shareholder, Or Beneficiary Withholding Exemption Affidavit is a tax document that allows nonresident partners, members, shareholders, or beneficiaries to claim withholding exemption for taxes in Wisconsin. This form is crucial for ensuring compliance with state tax laws and must be submitted within the specified time frame.

-

How do I complete the Save PW 2 Form Print Wisconsin Nonresident Partner, Member, Shareholder, Or Beneficiary Withholding Exemption Affidavit?

To complete the Save PW 2 Form Print Wisconsin Nonresident Partner, Member, Shareholder, Or Beneficiary Withholding Exemption Affidavit, provide all required information, including your entity details and personal identification. Ensure that you review the instructions closely and submit the form accurately in compliance with the regulations to avoid complications.

-

What are the consequences of not submitting the Save PW 2 Form Print Wisconsin Nonresident Partner, Member, Shareholder, Or Beneficiary Withholding Exemption Affidavit on time?

Failing to submit the Save PW 2 Form Print Wisconsin Nonresident Partner, Member, Shareholder, Or Beneficiary Withholding Exemption Affidavit on time can lead to penalties and increased tax liabilities. This form must be submitted within one month or two months after the closure of the pass-through entity's taxable year to ensure proper tax treatment.

-

Can I electronically sign the Save PW 2 Form Print Wisconsin Nonresident Partner, Member, Shareholder, Or Beneficiary Withholding Exemption Affidavit?

Yes, you can electronically sign the Save PW 2 Form Print Wisconsin Nonresident Partner, Member, Shareholder, Or Beneficiary Withholding Exemption Affidavit using airSlate SignNow. Our platform provides a simple and secure way to eSign documents, making it easy to complete your tax filings without physical paperwork.

-

What pricing options are available for using airSlate SignNow to handle the Save PW 2 Form Print?

airSlate SignNow offers a variety of pricing plans suited for different business needs, allowing you to efficiently manage documents like the Save PW 2 Form Print Wisconsin Nonresident Partner, Member, Shareholder, Or Beneficiary Withholding Exemption Affidavit. Our plans are cost-effective, providing robust features that cater to individual users and larger teams alike.

-

What features does airSlate SignNow offer for handling tax forms like the Save PW 2 Form Print?

airSlate SignNow includes several features to streamline the handling of tax forms, such as customizable templates, automatic reminders, secure cloud storage, and integration with other business tools. These features enhance your workflow, especially for managing the Save PW 2 Form Print Wisconsin Nonresident Partner, Member, Shareholder, Or Beneficiary Withholding Exemption Affidavit.

-

How can I ensure compliance with Wisconsin tax laws when using the Save PW 2 Form Print?

To ensure compliance with Wisconsin tax laws when using the Save PW 2 Form Print Wisconsin Nonresident Partner, Member, Shareholder, Or Beneficiary Withholding Exemption Affidavit, make sure to follow the guidelines provided by the state and consult with a tax professional if necessary. Regularly review any updates to tax regulations to stay informed.

Get more for Save PW 2 Form Print Wisconsin Nonresident Partner, Member, Shareholder, Or Beneficiary Withholding Exemption Affidavit Clear No

- No download needed and no install needed word form

- Organic management plan for nasaa certified producers form

- Section 18 4 color answer key form

- Construction loan commitment letter form

- Damage assessment form building contents

- World religions worksheet pdf answers form

- Customer service charter template word form

- Sop pharmacy example form

Find out other Save PW 2 Form Print Wisconsin Nonresident Partner, Member, Shareholder, Or Beneficiary Withholding Exemption Affidavit Clear No

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF