DELAWARE Non Resident Individual Income Tax Return Form

Understanding the Delaware Non-Resident Individual Income Tax Return

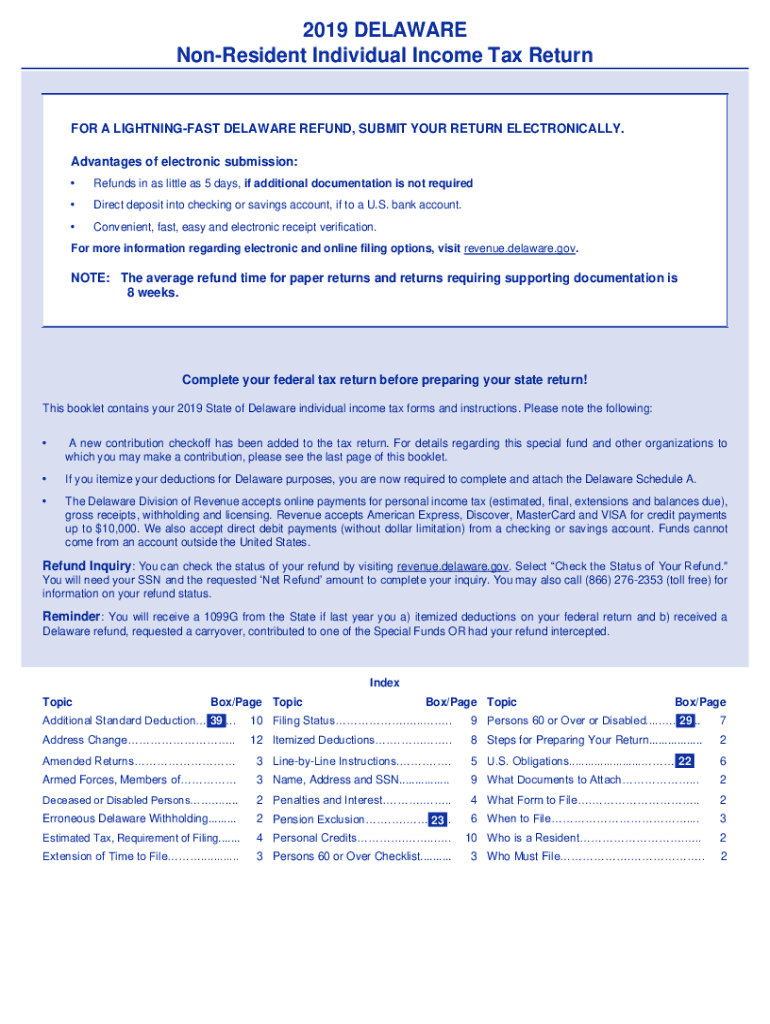

The Delaware Non-Resident Individual Income Tax Return, commonly referred to as the Delaware Form 200-02, is a tax document specifically designed for individuals who earn income in Delaware but do not reside in the state. This form allows non-residents to report their Delaware-sourced income and calculate their tax liability accordingly. It is essential for ensuring compliance with state tax laws and for accurately assessing the amount owed to the state based on income earned within its borders.

Steps to Complete the Delaware Non-Resident Individual Income Tax Return

Filling out the Delaware Form 200-02 involves several key steps. First, gather all necessary documentation, including W-2s, 1099s, and any other income statements that reflect earnings sourced from Delaware. Next, carefully follow the instructions provided on the form, ensuring that all sections are completed accurately. Pay close attention to the calculation of taxable income, as this will determine your overall tax liability. After completing the form, review it for any errors before submission.

Required Documents for Filing

To successfully file the Delaware Non-Resident Individual Income Tax Return, you will need specific documents. These typically include:

- W-2 forms from Delaware employers

- 1099 forms for any freelance or contract work done in Delaware

- Records of other income earned in the state

- Previous tax returns, if applicable

Having these documents on hand will facilitate a smoother filing process and help ensure that you report all income accurately.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the Delaware Form 200-02. Typically, the return must be filed by April 30 of the year following the tax year in question. If you miss this deadline, you may incur penalties and interest on any unpaid taxes. It is advisable to check for any updates or changes to deadlines each tax year to remain compliant.

Form Submission Methods

The Delaware Non-Resident Individual Income Tax Return can be submitted in various ways. You have the option to file online through the Delaware Division of Revenue's website, which is a convenient and efficient method. Alternatively, you can mail your completed form to the appropriate address provided in the instructions. In-person submissions are also possible at designated state offices. Each method has its own processing times, so choose the one that best suits your needs.

Penalties for Non-Compliance

Failure to file the Delaware Form 200-02 or to pay any taxes owed can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action. It is essential to file accurately and on time to avoid these repercussions. Understanding the importance of compliance can help ensure that you meet your tax obligations responsibly.

Quick guide on how to complete delaware non resident individual income tax return

Prepare DELAWARE Non Resident Individual Income Tax Return effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your files promptly without delays. Manage DELAWARE Non Resident Individual Income Tax Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The optimal way to modify and eSign DELAWARE Non Resident Individual Income Tax Return with ease

- Find DELAWARE Non Resident Individual Income Tax Return and click on Get Form to commence.

- Utilize the resources we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal significance as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign DELAWARE Non Resident Individual Income Tax Return and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the delaware non resident individual income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Delaware Form 200 02?

The Delaware Form 200 02 is a tax reporting form used by businesses operating in the state of Delaware. It is essential for ensuring compliance with state tax regulations. By submitting this form, businesses can accurately report their tax obligations and maintain good standing in Delaware.

-

How can airSlate SignNow help with the Delaware Form 200 02?

airSlate SignNow offers an efficient platform to electronically sign and send the Delaware Form 200 02, streamlining the submission process. This ensures that businesses can complete their tax filings swiftly and securely. With our user-friendly interface, handling these forms becomes hassle-free.

-

Is there a cost associated with using airSlate SignNow for the Delaware Form 200 02?

Yes, airSlate SignNow operates on a subscription-based pricing model, offering various plans suitable for businesses of all sizes. The cost is competitive, considering the features provided, such as unlimited signing, document storage, and integration capabilities, which simplify the management of the Delaware Form 200 02.

-

What features does airSlate SignNow offer for managing the Delaware Form 200 02?

airSlate SignNow offers a variety of features to enhance the management of the Delaware Form 200 02, including customizable templates and document workflows. Users can leverage advanced security measures to ensure the safety of their sensitive information. Additionally, real-time tracking allows businesses to monitor the status of their submissions.

-

Are there any integrations available for the Delaware Form 200 02 with airSlate SignNow?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, making it easier to manage the Delaware Form 200 02 within your existing workflow. Whether it’s CRMs, cloud storage services, or accounting software, these integrations enhance productivity and ensure consistent document handling.

-

What are the benefits of using airSlate SignNow for tax forms like the Delaware Form 200 02?

Using airSlate SignNow for tax forms like the Delaware Form 200 02 provides numerous benefits, such as enhanced efficiency and reduced turnaround times. The platform's easy-to-use design facilitates quick document signing and submission, helping ensure compliance while freeing up valuable time for businesses. Additionally, the secure environment safeguards sensitive tax information.

-

Can I access the Delaware Form 200 02 using mobile devices?

Yes, airSlate SignNow is fully optimized for mobile use, allowing users to access and manage the Delaware Form 200 02 on smartphones and tablets. This mobility supports on-the-go document signing and submission, making it easier than ever to handle important tax forms from anywhere.

Get more for DELAWARE Non Resident Individual Income Tax Return

- Indemnity waiver and release of liability form

- Working draftscript when talking with parentguardian regarding threat to student form

- Muni seniors form

- Professional services agreement 9 19 form

- Writing an impressive extension request letter with form

- Temporary food event application contra costa health services form

- Candidate for membership application form

- Waxing intake form 441180960

Find out other DELAWARE Non Resident Individual Income Tax Return

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney

- How Do I Electronic signature South Carolina Unlimited Power of Attorney

- How Can I Electronic signature Alaska Limited Power of Attorney

- How To Electronic signature Massachusetts Retainer Agreement Template

- Electronic signature California Limited Power of Attorney Now

- Electronic signature Colorado Limited Power of Attorney Now

- Electronic signature Georgia Limited Power of Attorney Simple

- Electronic signature Nevada Retainer Agreement Template Myself

- Electronic signature Alabama Limited Partnership Agreement Online

- Can I Electronic signature Wisconsin Retainer Agreement Template

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy