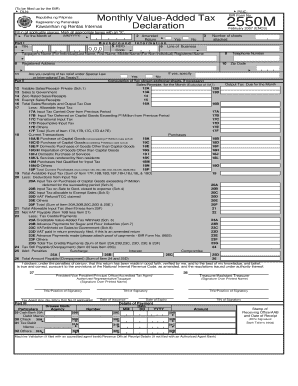

Monthly Value Added Tax 2550M Form

What is the Monthly Value Added Tax 2550M

The Monthly Value Added Tax 2550M is a tax form used by businesses to report and pay value-added tax (VAT) on a monthly basis. This form is essential for companies that are registered for VAT and need to comply with tax regulations. It provides a structured way to document sales, purchases, and the VAT collected and paid during the month. Understanding this form is crucial for maintaining compliance with federal and state tax laws.

How to use the Monthly Value Added Tax 2550M

Using the Monthly Value Added Tax 2550M involves several key steps. First, businesses must gather all relevant financial data for the month, including sales invoices and purchase receipts. Next, they need to calculate the total VAT collected from sales and the total VAT paid on purchases. This information is then entered into the appropriate sections of the form. Finally, the completed form must be submitted to the relevant tax authority, either electronically or by mail, depending on the jurisdiction.

Steps to complete the Monthly Value Added Tax 2550M

Completing the Monthly Value Added Tax 2550M requires careful attention to detail. Here are the steps to follow:

- Gather all sales and purchase records for the month.

- Calculate the total VAT collected on sales.

- Calculate the total VAT paid on purchases.

- Fill out the form with the calculated figures.

- Review the form for accuracy.

- Submit the form by the due date.

Legal use of the Monthly Value Added Tax 2550M

The Monthly Value Added Tax 2550M must be used in accordance with federal and state tax laws. Businesses are legally required to file this form if they are registered for VAT. Failure to submit the form on time or providing inaccurate information can lead to penalties and interest charges. It is important for businesses to stay informed about their legal obligations regarding VAT reporting to avoid non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Monthly Value Added Tax 2550M can vary based on state regulations. Generally, businesses must submit this form by the end of the month following the reporting period. For instance, the VAT for January would typically be due by the end of February. It is essential for businesses to keep track of these deadlines to ensure timely submissions and avoid penalties.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Monthly Value Added Tax 2550M can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits by tax authorities. Businesses should prioritize accurate and timely filing to mitigate these risks. Understanding the consequences of non-compliance can help motivate timely submissions and adherence to tax regulations.

Quick guide on how to complete monthly value added tax 2550m

Effortlessly Prepare Monthly Value Added Tax 2550M on Any Device

Digital document management has gained popularity among both companies and individuals. It presents an ideal eco-friendly solution to conventional printed and signed documents, allowing you to obtain the correct form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, adjust, and electronically sign your documents quickly and without delays. Manage Monthly Value Added Tax 2550M on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to Modify and Electronically Sign Monthly Value Added Tax 2550M with Ease

- Locate Monthly Value Added Tax 2550M and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure confidential details with tools that airSlate SignNow supplies specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form: via email, SMS, or an invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Monthly Value Added Tax 2550M to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the monthly value added tax 2550m

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Monthly Value Added Tax 2550M?

The Monthly Value Added Tax 2550M is a tax form that businesses must file to report their Value Added Tax obligations in Thailand. This form is essential to ensure compliance with local tax regulations and to avoid penalties. Understanding the Monthly Value Added Tax 2550M can help you better manage your finances and streamline your reporting processes.

-

How can airSlate SignNow help with the Monthly Value Added Tax 2550M?

airSlate SignNow can simplify the process of preparing and submitting the Monthly Value Added Tax 2550M. With its user-friendly eSignature and document management features, you can easily create, send, and sign the necessary documents needed for VAT submissions. This reduces the time spent on paperwork and increases overall efficiency.

-

Is airSlate SignNow cost-effective for small businesses dealing with the Monthly Value Added Tax 2550M?

Yes, airSlate SignNow offers cost-effective solutions ideal for small businesses managing the Monthly Value Added Tax 2550M. By streamlining document workflows and reducing reliance on physical paperwork, small businesses can save both time and money. Our pricing plans are designed to accommodate various business needs without breaking the bank.

-

What features of airSlate SignNow are relevant to processing the Monthly Value Added Tax 2550M?

Key features of airSlate SignNow that aid in processing the Monthly Value Added Tax 2550M include document templates, automated workflows, and secure eSignature capabilities. These features ensure that your tax documents are prepared and signed accurately and efficiently. Moreover, the platform provides a secure environment for managing sensitive tax information.

-

Can I integrate airSlate SignNow with accounting software for the Monthly Value Added Tax 2550M?

Absolutely! airSlate SignNow can be integrated with various accounting software solutions to facilitate easier management of the Monthly Value Added Tax 2550M. This integration helps in automating data transfer and ensures that all necessary tax documentation is readily available for filing. Thus, you can streamline your overall accounting practices.

-

What are the benefits of using airSlate SignNow for submitting the Monthly Value Added Tax 2550M?

Using airSlate SignNow for submitting the Monthly Value Added Tax 2550M offers several benefits, such as enhanced efficiency, reduced errors, and faster processing times. The platform’s intuitive design allows users to quickly navigate through document workflows and manage signatures with ease. This means you can focus more on your business rather than being bogged down by paperwork.

-

Is there customer support available for queries related to the Monthly Value Added Tax 2550M?

Yes, airSlate SignNow provides robust customer support to assist with any queries related to the Monthly Value Added Tax 2550M. Whether you need help with document templates, eSignatures, or understanding tax compliance, our support team is available to guide you. This ensures that you are never left without assistance when dealing with important tax matters.

Get more for Monthly Value Added Tax 2550M

- Nonresident real estate withholding form

- New york state e file signature authorization for tax year 2020 for forms it 201 it 201 x it 203 it 203 x it 214 and nyc 210

- Sc1120s scgov form

- Sc1065 k 1 form

- It 2664 department of taxation and finance form

- Wformstestdevelopmentsc990t3315sc990t331502xft

- Due by the 15th day of the fourth month following the close of the taxable year form

- Statutory required 6 month filing window for cagov form

Find out other Monthly Value Added Tax 2550M

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document