Form it 203 X Amended Nonresident and Part Year Resident Income Tax Return Tax Year

Understanding the IT 203 X Amended Nonresident and Part-Year Resident Income Tax Return

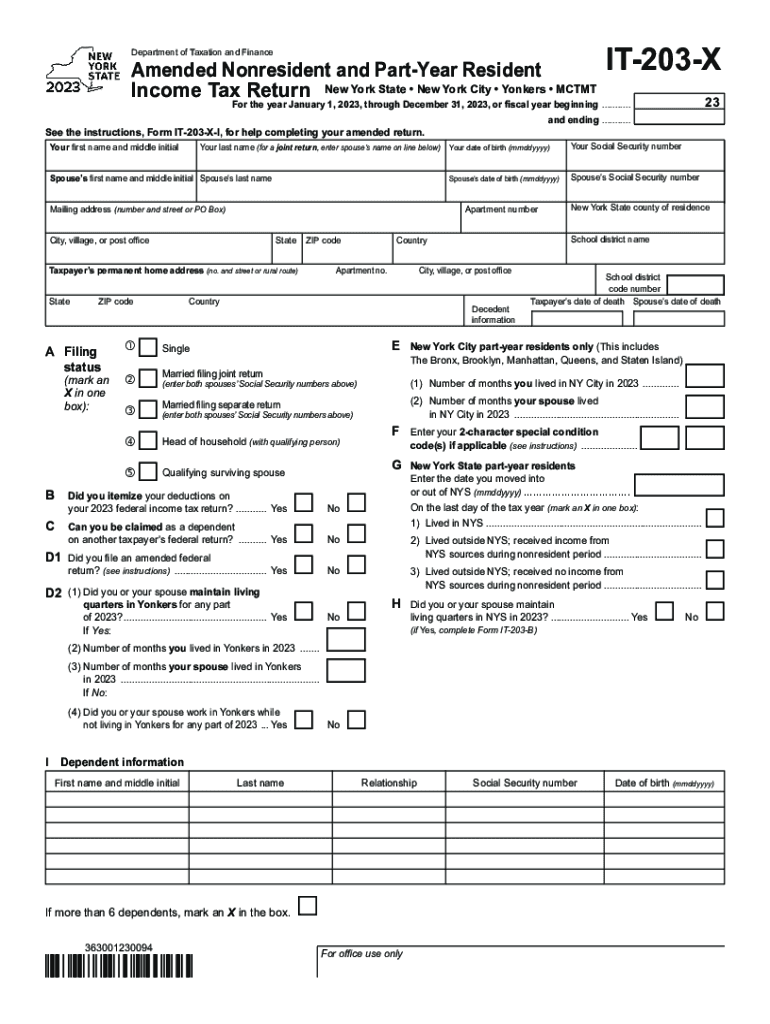

The IT 203 X is a crucial tax form for nonresidents and part-year residents of New York who need to amend their income tax returns. This form allows individuals to correct errors or make changes to previously filed IT 203 forms. It is specifically designed for those who may have initially submitted incorrect information or who need to report additional income or deductions that were not included in their original return.

Steps to Complete the IT 203 X Form

Completing the IT 203 X form involves several key steps. First, gather all relevant financial documents, including your original IT 203 form and any additional information that supports your amendments. Next, clearly indicate the changes you are making, ensuring that you provide accurate figures and explanations for each amendment. It is important to fill out the form carefully, as errors can lead to processing delays or complications with your tax obligations. Once completed, review the form thoroughly before submission.

Obtaining the IT 203 X Form

The IT 203 X form can be easily obtained through the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing taxpayers to print and fill it out manually. Additionally, the form may be accessible through various tax software programs that support New York state tax filings, providing a convenient option for those who prefer digital completion.

Filing Deadlines for the IT 203 X Form

Filing deadlines for the IT 203 X form are critical to avoid penalties. Typically, the amended return must be filed within three years from the original due date of the return or within two years from the date the tax was paid, whichever is later. It is advisable to check the New York State Department of Taxation and Finance for specific dates and any changes that may occur annually.

Key Elements of the IT 203 X Form

The IT 203 X form includes several key elements that must be accurately filled out. These include personal identification information, details about the original return, and specific sections where taxpayers can outline the changes being made. Additionally, the form requires a clear explanation for each amendment, ensuring that the tax authorities understand the reasons behind the corrections.

Legal Use of the IT 203 X Form

The IT 203 X form is legally recognized for amending tax returns in New York State. Taxpayers must ensure that they are eligible to use this form and that their amendments comply with state tax laws. Proper use of the form can help prevent legal issues related to tax compliance and ensure that individuals fulfill their tax obligations accurately.

Quick guide on how to complete form it 203 x amended nonresident and part year resident income tax return tax year

Complete Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without any hold-ups. Manage Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year on any device using airSlate SignNow’s Android or iOS applications and enhance any document-based process today.

How to modify and eSign Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year effortlessly

- Obtain Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select crucial sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 203 x amended nonresident and part year resident income tax return tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for the 2023 NY IT 203 X tax form?

airSlate SignNow provides a range of features specifically designed to streamline the signing process for the 2023 NY IT 203 X tax form. Users can easily upload, sign, and send documents securely, ensuring compliance with state regulations. Additionally, the platform offers automated workflows to reduce paperwork and enhance efficiency.

-

How much does airSlate SignNow cost for the 2023 NY IT 203 X users?

The pricing for airSlate SignNow is competitive and tailored to suit businesses looking to manage the 2023 NY IT 203 X tax form efficiently. We offer various subscription plans that vary based on the number of users and advanced features needed. Prospective customers can explore our pricing page for detailed information and special promotions.

-

Can I integrate other applications with airSlate SignNow for the 2023 NY IT 203 X?

Yes, airSlate SignNow supports integrations with various applications that can help streamline your workflow for the 2023 NY IT 203 X tax form. Whether you're using CRM systems or document management platforms, our tool can be integrated to facilitate smoother operations. Check our integrations page for a full list of supported applications.

-

Is airSlate SignNow secure for handling sensitive tax information like the 2023 NY IT 203 X?

Absolutely! airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive information such as the 2023 NY IT 203 X. We utilize advanced encryption protocols and comply with industry regulations to protect your data. Users can trust that their documents are securely handled throughout the signing process.

-

What are the benefits of using airSlate SignNow for the 2023 NY IT 203 X?

Utilizing airSlate SignNow for the 2023 NY IT 203 X provides numerous benefits, including enhanced efficiency, cost savings, and improved document management. Our platform simplifies the entire signing process, allowing you to focus on your business operations. Customers can expect faster turnaround times and increased productivity.

-

Can airSlate SignNow help with compliance for the 2023 NY IT 203 X?

Yes, airSlate SignNow is designed to assist users in maintaining compliance with the requirements for the 2023 NY IT 203 X. Our platform provides audit trails and ensures that all necessary signatures are obtained, which is critical for tax documents. With integrated compliance features, users can confidently prepare their filings.

-

How easy is it to use airSlate SignNow for signing the 2023 NY IT 203 X?

airSlate SignNow is known for its user-friendly interface, making it incredibly easy for users to sign the 2023 NY IT 203 X. The step-by-step process guides you through uploading and signing documents seamlessly. Most users can get started within minutes, regardless of their tech-savviness.

Get more for Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year

- Application for additional sets of dealer plates in transit plates form

- Bca 10 30r form

- Taps combat military financial fraud illinois secretary of state form

- Illinois sec331 1 form

- Lp fax transmittal request form for certificates of

- Llc 5 5 s form

- Affidavit for remittance agent license affidavit for remittance agent license form

- Upa illinois 2014 2019 form

Find out other Form IT 203 X Amended Nonresident And Part Year Resident Income Tax Return Tax Year

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement