Schedule Icr Form

What is the Schedule ICR Form

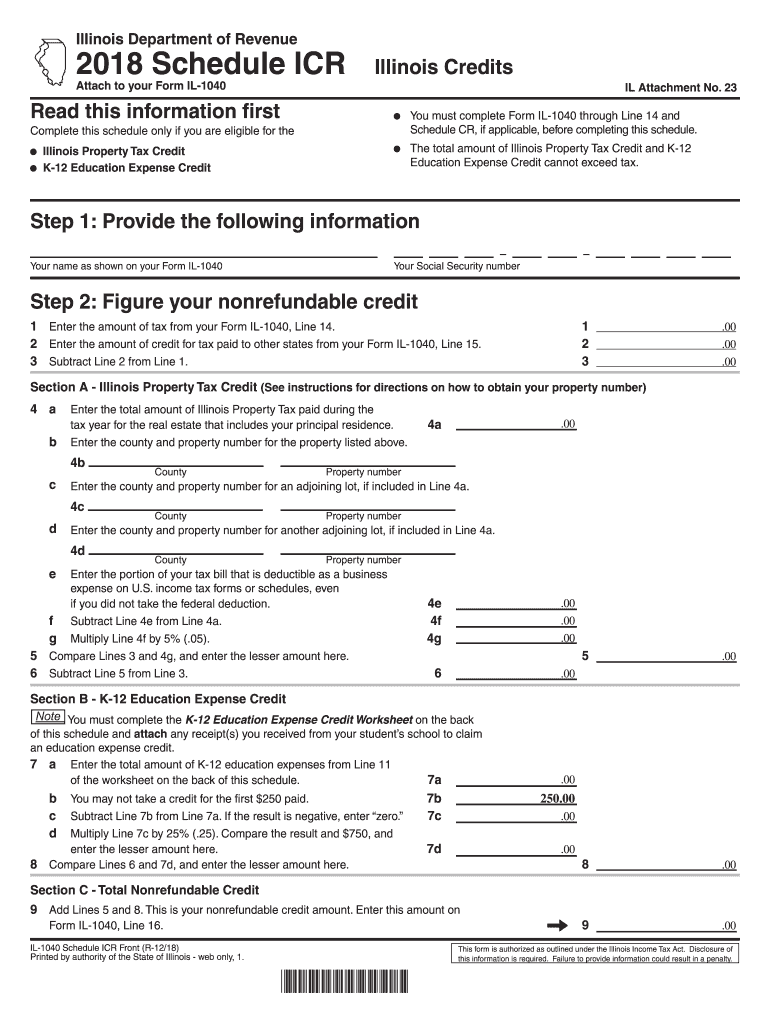

The Illinois Tax Return Schedule ICR is a specific form used by taxpayers in Illinois to claim a credit for income tax paid to other states. This form is essential for individuals who have earned income in multiple states and want to avoid double taxation. By completing the Schedule ICR, taxpayers can ensure that they receive appropriate credits for taxes already paid, which can significantly reduce their overall tax liability.

How to use the Schedule ICR Form

To effectively use the Schedule ICR form, taxpayers must first gather all relevant documentation, including income statements and tax returns from other states where income was earned. The form requires detailed information about the income earned in other states and the corresponding taxes paid. Once the necessary information is collected, taxpayers can fill out the form by following the provided instructions, ensuring that all entries are accurate to facilitate proper processing by the Illinois Department of Revenue.

Steps to complete the Schedule ICR Form

Completing the Schedule ICR form involves several key steps:

- Gather all necessary documents, including W-2s and 1099s from both Illinois and other states.

- Fill out the taxpayer's personal information at the top of the form, including name, address, and Social Security number.

- Report income earned in other states and the taxes paid on that income in the designated sections of the form.

- Calculate the credit amount based on the instructions provided, ensuring all calculations are accurate.

- Review the completed form for any errors or omissions before submitting it.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Schedule ICR form. Typically, the form is due on the same date as the Illinois income tax return, which is usually April 15. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to file the form on time to avoid penalties and ensure that any credits are applied to the tax return promptly.

Required Documents

When completing the Schedule ICR form, taxpayers must provide several key documents to support their claims. These documents typically include:

- W-2 forms from all employers, detailing income earned.

- 1099 forms for any additional income sources.

- Tax returns from other states where income was earned.

- Proof of taxes paid to other states, such as receipts or tax payment confirmations.

Penalties for Non-Compliance

Failing to properly complete and submit the Schedule ICR form can result in significant penalties. Taxpayers may face fines for late filing, as well as interest on any unpaid taxes. Additionally, incorrect information can lead to audits or further scrutiny from the Illinois Department of Revenue, potentially resulting in additional taxes owed. It is essential to ensure that the form is completed accurately and submitted on time to avoid these consequences.

Quick guide on how to complete schedule icr form 452254130

Accomplish Schedule Icr Form effortlessly on any gadget

Web-based document management has surged in popularity among businesses and individuals. It offers a superb eco-friendly alternative to conventional printed and signed documents, as you can easily find the right template and securely save it online. airSlate SignNow supplies all the resources you need to create, alter, and electronically sign your documents swiftly without any holdups. Manage Schedule Icr Form on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest method to modify and electronically sign Schedule Icr Form without hassle

- Obtain Schedule Icr Form and then click Get Form to begin.

- Leverage the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Form your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced papers, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Schedule Icr Form to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule icr form 452254130

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL tax return schedule ICR?

The IL tax return schedule ICR is an important form that individuals in Illinois need to complete when filing their income tax returns. It provides a comprehensive summary of income and deductions, ensuring that taxpayers accurately report their financial status to the state. Understanding and accurately filling out the schedule ICR can greatly impact your tax liability.

-

How can airSlate SignNow help with the IL tax return schedule ICR?

airSlate SignNow streamlines the process of completing the IL tax return schedule ICR by allowing users to easily fill out, sign, and send their tax documents electronically. Our platform offers templates that are specifically designed for tax forms, ensuring compliance and saving time. This means you can focus more on your financial planning rather than paperwork.

-

Is airSlate SignNow affordable for individuals filing IL tax return schedule ICR?

Yes, airSlate SignNow offers competitive pricing plans that cater to both individual and business users. Our cost-effective solution allows users to manage their eSigning needs without breaking the bank. The convenience and security of electronic signatures make it a smart investment for handling the IL tax return schedule ICR.

-

What features does airSlate SignNow offer for managing the IL tax return schedule ICR?

Some notable features of airSlate SignNow include intuitive document editing, customizable templates, secure eSigning, and real-time tracking. These features ensure that the completion of your IL tax return schedule ICR is efficient and organized. Our platform also allows users to store documents securely for future reference.

-

Can I integrate airSlate SignNow with other applications for my IL tax return schedule ICR?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Salesforce, and Zapier. This means you can easily manage your documents and data when preparing your IL tax return schedule ICR within the tools you already use. Integration enhances productivity and reduces the chances of errors.

-

What benefits do I gain from using airSlate SignNow for my IL tax return schedule ICR?

Using airSlate SignNow for your IL tax return schedule ICR allows you to eliminate manual processes and increase your efficiency. You can save time on document management, ensure compliance with regulations, and improve the accuracy of your submissions. The secure eSigning feature also enhances the credibility of your tax returns.

-

Is it secure to use airSlate SignNow for the IL tax return schedule ICR?

Yes, security is our top priority at airSlate SignNow. We utilize the best encryption and security measures to protect your sensitive information while you prepare and submit the IL tax return schedule ICR. You can eSign your documents with peace of mind knowing that your data is safe with us.

Get more for Schedule Icr Form

- Partner agency referral tips form

- North carolina dietetic association ncdamemberclicksnet ncda memberclicks form

- Sampson county concealed carry permit form

- Dma 5167pdf county analysis non compliance with processing thresholds or thresholds for denials withdrawals inquires form

- North carolina assumed form

- North carolina lighting incentive application form

- North carolina board of pharmacy ncbop homepage form

- Ardrey kell late arrival form

Find out other Schedule Icr Form

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now