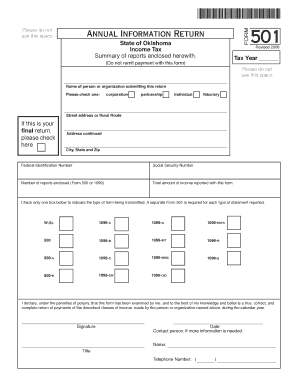

Annual Information Return State of Oklahoma Income Tax Summary of Reports Enclosed Herewith Tax Ok

What is the Annual Information Return State Of Oklahoma Income Tax Summary Of Reports Enclosed Herewith Tax Ok

The Annual Information Return State Of Oklahoma Income Tax Summary Of Reports Enclosed Herewith Tax Ok is a crucial document for taxpayers in Oklahoma. It serves to summarize various income tax-related reports submitted to the state. This form is essential for ensuring compliance with state tax regulations and provides a consolidated view of income and deductions reported during the tax year. Understanding the purpose of this return helps taxpayers maintain accurate records and fulfill their tax obligations effectively.

How to use the Annual Information Return State Of Oklahoma Income Tax Summary Of Reports Enclosed Herewith Tax Ok

This form is utilized by individuals and businesses to report their income tax information to the state of Oklahoma. Users should gather all relevant financial documents, including W-2s, 1099s, and other income statements. After compiling the necessary information, the form can be filled out either digitally or on paper. It is important to ensure that all data is accurate and complete before submission to avoid potential penalties or delays in processing.

Steps to complete the Annual Information Return State Of Oklahoma Income Tax Summary Of Reports Enclosed Herewith Tax Ok

Completing the Annual Information Return involves several key steps:

- Gather all necessary income documentation, such as W-2 forms and 1099 statements.

- Fill out the form with accurate income figures, deductions, and credits.

- Review the completed form for any errors or omissions.

- Submit the form either electronically or by mail, ensuring it is sent to the correct address.

- Keep a copy of the submitted form and all supporting documents for your records.

Legal use of the Annual Information Return State Of Oklahoma Income Tax Summary Of Reports Enclosed Herewith Tax Ok

This form is legally required for individuals and entities that meet specific income thresholds in Oklahoma. Filing this return accurately ensures compliance with state tax laws and helps avoid legal repercussions, such as fines or audits. Taxpayers should be aware of their obligations and the legal implications of failing to file or misreporting information.

Filing Deadlines / Important Dates

Timely submission of the Annual Information Return is critical. The deadline for filing this return typically aligns with the federal tax deadline, which is usually April 15. However, taxpayers should verify specific dates for the current tax year, as they can vary. Late submissions may incur penalties, so it is advisable to stay informed about these important dates.

Required Documents

To complete the Annual Information Return, taxpayers must gather several key documents, including:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources.

- Documentation for deductions, such as receipts for business expenses.

Having these documents ready will streamline the process and help ensure accuracy in reporting.

Quick guide on how to complete annual information return state of oklahoma income tax summary of reports enclosed herewith tax ok

Complete [SKS] seamlessly on any device

Web-based document management has become popular among companies and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to get started.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you would prefer to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Annual Information Return State Of Oklahoma Income Tax Summary Of Reports Enclosed Herewith Tax Ok

Create this form in 5 minutes!

How to create an eSignature for the annual information return state of oklahoma income tax summary of reports enclosed herewith tax ok

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Annual Information Return State Of Oklahoma Income Tax Summary Of Reports Enclosed Herewith Tax Ok?

The Annual Information Return State Of Oklahoma Income Tax Summary Of Reports Enclosed Herewith Tax Ok is a crucial document that businesses in Oklahoma must file to summarize their income tax information. This return includes essential details that help the state assess the income tax obligations of a business. Accurately preparing and submitting this return is vital for compliance and avoiding fines.

-

How can airSlate SignNow assist with the Annual Information Return State Of Oklahoma Income Tax Summary Of Reports Enclosed Herewith Tax Ok?

airSlate SignNow streamlines the process of preparing, signing, and submitting the Annual Information Return State Of Oklahoma Income Tax Summary Of Reports Enclosed Herewith Tax Ok. With our user-friendly features, businesses can easily collect signatures and ensure all necessary documents are attached. This ensures smooth compliance with Oklahoma tax requirements.

-

What pricing plans does airSlate SignNow offer for handling tax documents?

airSlate SignNow provides flexible pricing plans suitable for various business sizes, allowing you to choose one that best fits your needs for managing documents like the Annual Information Return State Of Oklahoma Income Tax Summary Of Reports Enclosed Herewith Tax Ok. Our plans are designed to be cost-effective while providing complete access to essential features, ensuring value for your investment.

-

What features does airSlate SignNow offer for eSigning tax documents?

With airSlate SignNow, you get robust eSigning features specifically designed for documents like the Annual Information Return State Of Oklahoma Income Tax Summary Of Reports Enclosed Herewith Tax Ok. You can request signatures, track document status, and store signed documents securely, all from one convenient platform. This enhances your workflow efficiency and reduces paperwork.

-

Can I integrate airSlate SignNow with other software for tax documentation?

Yes, airSlate SignNow offers seamless integrations with popular tools and platforms that assist with tax documentation. This includes accounting software and CRMs that can complement your management of the Annual Information Return State Of Oklahoma Income Tax Summary Of Reports Enclosed Herewith Tax Ok. Integrations help centralize your operations and improve overall productivity.

-

What are the benefits of using airSlate SignNow for filing tax returns?

Using airSlate SignNow to handle your Annual Information Return State Of Oklahoma Income Tax Summary Of Reports Enclosed Herewith Tax Ok offers numerous benefits. It simplifies the preparation and signing process, reduces the risk of errors, and ensures that documents are filed on time. This helps protect your business from penalties and streamlines your tax compliance.

-

Is my data secure when using airSlate SignNow for tax documents?

Absolutely, data security is a top priority for airSlate SignNow. We utilize advanced encryption methods and robust security protocols to protect your information while handling sensitive documents like the Annual Information Return State Of Oklahoma Income Tax Summary Of Reports Enclosed Herewith Tax Ok. You can trust that your data is safe and secure.

Get more for Annual Information Return State Of Oklahoma Income Tax Summary Of Reports Enclosed Herewith Tax Ok

Find out other Annual Information Return State Of Oklahoma Income Tax Summary Of Reports Enclosed Herewith Tax Ok

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF