4589, MICHIGAN Business Tax Film Credit Assignment Michigan Form

What is the 4589, MICHIGAN Business Tax Film Credit Assignment Michigan

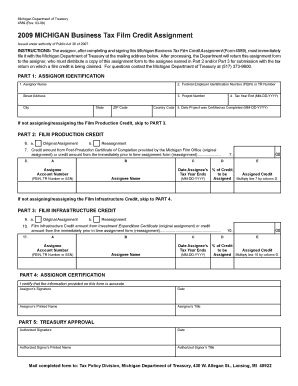

The 4589, MICHIGAN Business Tax Film Credit Assignment is a specific form used by businesses in Michigan that are involved in film production. This form allows businesses to assign their tax credits earned from film production activities to other entities. The purpose of this assignment is to facilitate the transfer of credits, enabling businesses to benefit from tax incentives related to the film industry. Understanding this form is essential for businesses looking to maximize their tax benefits while complying with state regulations.

Key elements of the 4589, MICHIGAN Business Tax Film Credit Assignment Michigan

The key elements of the 4589 form include the identification of the assignor and assignee, the amount of tax credits being assigned, and the specific film project associated with the credits. Additionally, the form requires details about the production company, including its legal name and address. It is crucial that all information is accurate and complete to ensure the validity of the assignment and to avoid any potential issues with the Michigan Department of Treasury.

Steps to complete the 4589, MICHIGAN Business Tax Film Credit Assignment Michigan

Completing the 4589 form involves several important steps:

- Gather necessary information about the assignor and assignee, including legal names and addresses.

- Document the specific amount of tax credits being assigned and the related film project.

- Ensure that all required signatures are obtained from both parties involved in the assignment.

- Review the completed form for accuracy and completeness before submission.

- Submit the form to the appropriate state department as specified in the instructions.

How to obtain the 4589, MICHIGAN Business Tax Film Credit Assignment Michigan

The 4589 form can typically be obtained from the Michigan Department of Treasury's official website or through direct contact with their office. It is important to ensure that you are using the most current version of the form, as updates may occur. Additionally, businesses may consult with tax professionals or legal advisors who specialize in Michigan tax law to assist in obtaining and completing the form correctly.

Eligibility Criteria for the 4589, MICHIGAN Business Tax Film Credit Assignment Michigan

To be eligible to use the 4589 form, businesses must have participated in qualifying film production activities within Michigan. This includes meeting specific criteria set forth by the state, such as the minimum amount spent on production and the type of production being undertaken. Additionally, both the assignor and assignee must be registered and in good standing with the Michigan Department of Treasury to ensure compliance with state tax laws.

Form Submission Methods for the 4589, MICHIGAN Business Tax Film Credit Assignment Michigan

The completed 4589 form can be submitted to the Michigan Department of Treasury through various methods. Businesses may choose to submit the form electronically, if available, or send it via mail. In-person submissions may also be an option, depending on the department's guidelines. It is advisable to check the latest submission methods on the official state website to ensure compliance with current procedures.

Quick guide on how to complete 4589 michigan business tax film credit assignment michigan

Effortlessly Prepare [SKS] on Any Device

Online document management has gained traction among businesses and individuals alike. It serves as a perfect eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, edit, and electronically sign your documents swiftly without any delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4589 michigan business tax film credit assignment michigan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 4589, MICHIGAN Business Tax Film Credit Assignment Michigan?

The 4589, MICHIGAN Business Tax Film Credit Assignment Michigan is a program that allows qualified businesses to assign their film tax credits to other entities. This process can maximize financial benefits and broaden funding options for film projects in Michigan. Understanding this assignment can be crucial for businesses looking to manage tax obligations effectively.

-

How does airSlate SignNow facilitate the 4589, MICHIGAN Business Tax Film Credit Assignment Michigan?

airSlate SignNow provides an efficient platform for businesses to digitally sign documents related to the 4589, MICHIGAN Business Tax Film Credit Assignment Michigan. With user-friendly features, users can easily organize, sign, and store their important documents securely. This streamlines the assignment process, ensuring timely and compliant submissions.

-

What are the costs associated with using airSlate SignNow for the 4589, MICHIGAN Business Tax Film Credit Assignment Michigan?

airSlate SignNow offers a cost-effective solution for managing the 4589, MICHIGAN Business Tax Film Credit Assignment Michigan, with plans starting at a competitive rate. Depending on your business size and needs, you can choose from various pricing tiers that include features ideal for tax document management. This affordability ensures that businesses of any size can efficiently handle their assignments.

-

What features does airSlate SignNow offer for managing film tax credits?

Key features of airSlate SignNow for the 4589, MICHIGAN Business Tax Film Credit Assignment Michigan include intuitive document creation, secure electronic signatures, and efficient online workflows. These capabilities help businesses automate their tasks while ensuring compliance with state requirements. Moreover, the platform's user-friendly interface makes the process accessible to all users.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax management software to enhance the handling of the 4589, MICHIGAN Business Tax Film Credit Assignment Michigan. This integration allows for streamlined processes and centralized data management. Connecting your systems can signNowly improve efficiency and reduce the risk of errors during assignments.

-

What are the benefits of using airSlate SignNow for the 4589, MICHIGAN Business Tax Film Credit Assignment Michigan?

Utilizing airSlate SignNow for the 4589, MICHIGAN Business Tax Film Credit Assignment Michigan offers numerous benefits including time savings, improved accuracy, and enhanced security. The platform eliminates the hassle of paper signatures and promotes a faster turnaround for document processing. Additionally, businesses can track their assignment statuses in real-time, ensuring transparency.

-

Is airSlate SignNow compliant with Michigan regulations for business tax credits?

Absolutely! airSlate SignNow is designed to comply with all relevant Michigan regulations concerning the 4589, MICHIGAN Business Tax Film Credit Assignment Michigan. The platform incorporates necessary features and safeguards to ensure your transactions are legally valid. You can trust that your document management process adheres to state guidelines.

Get more for 4589, MICHIGAN Business Tax Film Credit Assignment Michigan

- School payment voucher form

- American independence afo prescription form

- Westpac introducer forms

- Bc 1040 booklet city of battle creek michigan battlecreekmi 100108294 form

- Form sa1 parent authorization for student travel 3

- Inovnet form

- California cpa education requirements worksheet form

- Macromolecule worksheet form

Find out other 4589, MICHIGAN Business Tax Film Credit Assignment Michigan

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast