Form IL 990 T Illinois Department of Revenue Tax Illinois

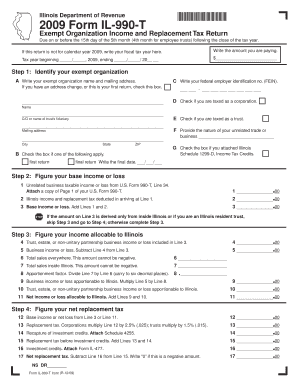

What is the Form IL-990-T?

The Form IL-990-T is a tax form used by the Illinois Department of Revenue for reporting unrelated business income by tax-exempt organizations. This form is essential for organizations such as charities, educational institutions, and other non-profits that generate income from activities not directly related to their exempt purpose. The form helps ensure compliance with state tax regulations and allows the state to assess taxes on income generated through these unrelated activities.

How to Use the Form IL-990-T

Using the Form IL-990-T involves several steps to accurately report unrelated business income. Organizations must first gather all relevant financial information, including income generated from unrelated business activities and any associated expenses. The form requires detailed reporting of both income and deductions to determine the taxable amount. Once completed, the form must be filed with the Illinois Department of Revenue by the specified deadline to avoid penalties.

Steps to Complete the Form IL-990-T

Completing the Form IL-990-T involves a systematic approach:

- Gather financial records related to unrelated business income.

- Complete the identification section with the organization's details.

- Report all unrelated business income in the appropriate sections.

- Deduct allowable expenses related to the income reported.

- Calculate the total taxable income and any taxes owed.

- Review the form for accuracy before submission.

Filing Deadlines and Important Dates

It is crucial for organizations to be aware of the filing deadlines for Form IL-990-T to ensure compliance. The form is typically due on the 15th day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this means the form is due by May 15. Extensions may be available, but they must be requested in advance to avoid penalties.

Required Documents for Form IL-990-T

When preparing to file Form IL-990-T, organizations should have several documents ready:

- Financial statements detailing unrelated business income.

- Receipts and records of expenses related to the income.

- Previous tax returns, if applicable.

- Any correspondence from the Illinois Department of Revenue.

Penalties for Non-Compliance

Failing to file Form IL-990-T or submitting it late can result in significant penalties. The Illinois Department of Revenue may impose fines based on the amount of tax owed and the duration of the delay. Additionally, organizations may lose their tax-exempt status if they repeatedly fail to comply with filing requirements. It is essential to adhere to all deadlines and requirements to maintain compliance and avoid financial repercussions.

Quick guide on how to complete form il 990 t illinois department of revenue tax illinois

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a flawless eco-friendly substitute for traditional printed and signed files, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form IL 990 T Illinois Department Of Revenue Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the form il 990 t illinois department of revenue tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IL 990 T for the Illinois Department of Revenue?

Form IL 990 T is a tax form required by the Illinois Department of Revenue for certain organizations to report unrelated business income. Businesses operating in Illinois must complete this form to ensure compliance with state tax regulations. By utilizing airSlate SignNow, you can streamline the process of signing and submitting Form IL 990 T efficiently.

-

How can airSlate SignNow help with Form IL 990 T submissions?

airSlate SignNow offers an easy-to-use platform that allows users to electronically sign and send Form IL 990 T to the Illinois Department of Revenue. The software simplifies document management and enhances compliance, ensuring that your tax forms are filled out correctly and submitted on time. This service reduces the hassle of manual paperwork and expedites the filing process.

-

Is there a cost associated with using airSlate SignNow for Form IL 990 T?

Yes, airSlate SignNow offers various pricing plans to cater to different user needs, making it a cost-effective solution for handling Form IL 990 T submissions. The pricing is competitive and designed to provide value, ensuring you get the features necessary for seamless document management. Additionally, investing in this solution can save you time and potential penalties associated with late submissions.

-

What features does airSlate SignNow provide for managing tax documents?

airSlate SignNow comes with robust features like eSignature capabilities, document templates, and automated workflows specifically tailored for managing tax documents like Form IL 990 T. These features enhance efficiency, allowing users to send, sign, and store documents securely. The user-friendly interface makes it accessible for businesses of all sizes to manage their tax filings effortlessly.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely! airSlate SignNow supports integration with various accounting and tax management software, allowing users to manage Form IL 990 T seamlessly within their existing workflow. This means you can easily connect your tools, enhancing collaboration between teams and ensuring that all relevant data is centralized. Integration further streamlines the submission process for the Illinois Department of Revenue.

-

What benefits does airSlate SignNow provide for nonprofits filing Form IL 990 T?

Nonprofits can benefit greatly from using airSlate SignNow to file Form IL 990 T due to its easy electronic signing capabilities and secure document management. This platform helps organizations remain compliant with the Illinois Department of Revenue by simplifying the filing process. Additionally, nonprofits can save valuable time, allowing them to focus on their mission rather than paperwork.

-

How does airSlate SignNow ensure the security of Form IL 990 T?

airSlate SignNow prioritizes security by offering advanced encryption and compliance with industry standards, ensuring that your Form IL 990 T and other sensitive documents are protected. The platform provides secure storage and access controls to keep tax information confidential. Businesses can trust that their submissions to the Illinois Department of Revenue are handled with the utmost security.

Get more for Form IL 990 T Illinois Department Of Revenue Tax Illinois

Find out other Form IL 990 T Illinois Department Of Revenue Tax Illinois

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed