Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne

What is the Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne

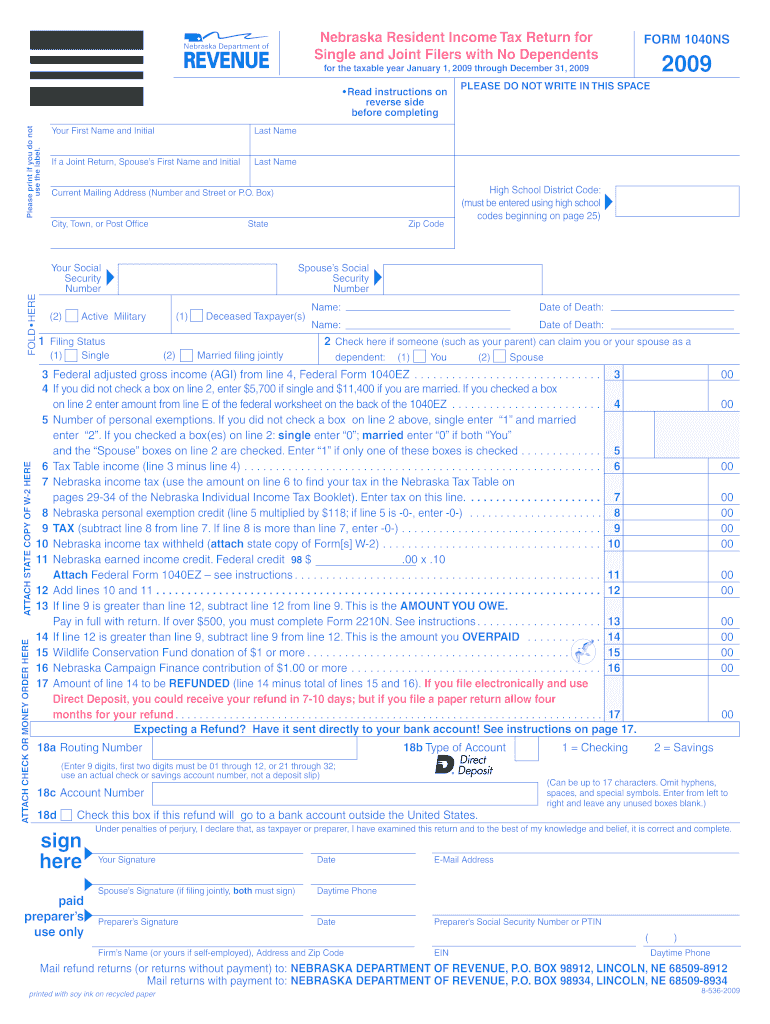

The Form 1040NS is the Nebraska Resident Income Tax Return designed for individuals who reside in Nebraska and need to report their income for state tax purposes. This form is essential for residents to accurately calculate their tax liability based on their income, deductions, and credits applicable under Nebraska law. It serves as the primary document for filing state income taxes, ensuring compliance with state tax regulations.

How to use the Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne

Using the Form 1040NS involves several steps to ensure accurate completion. Taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any other income statements. After obtaining the form, individuals must fill out their personal information, report their total income, and apply any eligible deductions or credits. Once completed, the form can be submitted either online or via mail, depending on the taxpayer's preference and eligibility.

Steps to complete the Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne

Completing the Form 1040NS requires a systematic approach:

- Gather all required documents, including income statements and deduction records.

- Fill in personal information accurately, including name, address, and Social Security number.

- Report total income, ensuring all sources are included.

- Calculate deductions and credits, applying any that are applicable to your situation.

- Review the completed form for accuracy before submission.

Key elements of the Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne

The Form 1040NS includes several key elements that taxpayers must understand:

- Personal Information: This section requires basic identification details.

- Income Reporting: Taxpayers must list all income sources, including wages and interest.

- Deductions and Credits: This section allows individuals to reduce their taxable income based on eligible deductions.

- Tax Calculation: The form provides a method to calculate the total tax owed or refund due.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040NS are crucial for compliance. Typically, the deadline for submitting the Nebraska Resident Income Tax Return aligns with the federal tax deadline, which is usually April 15. However, taxpayers should verify specific dates each year, as extensions or changes may occur. Late submissions may incur penalties, making timely filing essential.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the Form 1040NS through various methods to suit their preferences:

- Online Submission: Eligible taxpayers may file electronically through approved software or platforms.

- Mail Submission: Completed forms can be mailed to the designated Nebraska Department of Revenue address.

- In-Person Submission: Some individuals may choose to file in person at local tax offices, where assistance may be available.

Quick guide on how to complete form 1040ns nebraska resident income tax return revenue ne

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign [SKS] without difficulty

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark relevant sections of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Modify and eSign [SKS] and guarantee effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne

Create this form in 5 minutes!

How to create an eSignature for the form 1040ns nebraska resident income tax return revenue ne

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne?

The Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne, is a tax document used by residents of Nebraska to report their income and calculate their state tax obligations. This form is specifically designed for individuals and must be completed accurately to ensure compliance with Nebraska state tax laws.

-

How can airSlate SignNow assist with the Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne?

airSlate SignNow provides a simple and efficient way to complete and e-sign your Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne. Our platform ensures that the document is filled out correctly and securely shared with state tax offices, making the process quick and hassle-free.

-

What are the pricing options for airSlate SignNow when using the Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne?

airSlate SignNow offers flexible pricing plans that cater to different needs when managing the Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne. You can choose from monthly or annual subscriptions, ensuring you only pay for the features you require for document management and electronic signatures.

-

Are there any features included for completing Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne?

Yes, airSlate SignNow includes various features that streamline the process of completing the Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne. Features include document templates, collaborative editing, and automated reminders for timely submission, ensuring a smooth user experience.

-

Is my data secure when using airSlate SignNow for the Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne?

Absolutely! airSlate SignNow prioritizes your data security, employing advanced encryption methods to protect sensitive information related to the Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne. Our platform is compliant with regulations to ensure that your documents remain confidential and secure.

-

Can I integrate airSlate SignNow with other applications while filling out the Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne?

Yes, airSlate SignNow allows for easy integration with various applications that can assist you in managing the Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne. These integrations streamline workflow and ensure you have access to all the necessary tools during the tax preparation process.

-

What benefits can I expect from using airSlate SignNow for the Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne?

Using airSlate SignNow for the Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne, provides numerous benefits, including increased efficiency, reduced paper usage, and faster turnaround times for signatures. This innovative solution helps keep your operations organized while ensuring timely compliance with state tax regulations.

Get more for Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne

Find out other Form 1040NS, Nebraska Resident Income Tax Return Revenue Ne

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy