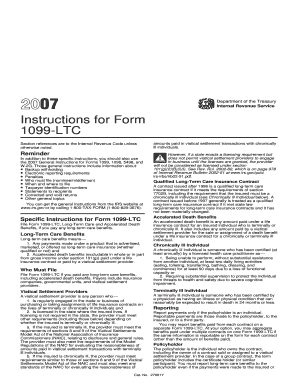

Instructions for Form 1099 LTC Instructions for Form 1099 LTC, Form 1099 LTC

Understanding Form 1099 LTC

Form 1099 LTC is used to report long-term care benefits paid to individuals. This form is essential for both the payers and recipients of these benefits. It helps ensure that the income is accurately reported to the IRS, which is crucial for tax purposes. The form includes details about the amount paid and the type of benefits received, making it a key document for anyone involved in long-term care insurance transactions.

Steps to Complete Form 1099 LTC

Completing Form 1099 LTC involves several steps to ensure accuracy and compliance with IRS regulations. First, gather all relevant information, including the recipient's name, address, and taxpayer identification number. Next, enter the total amount of long-term care benefits paid during the tax year in the appropriate box. It is also necessary to indicate whether the benefits were paid under a qualified long-term care insurance contract. Finally, review the form for any errors before submitting it to the IRS and providing a copy to the recipient.

Obtaining Form 1099 LTC

Form 1099 LTC can be obtained directly from the IRS website, where it is available for download. Additionally, many tax preparation software programs include the form as part of their offerings, allowing users to fill it out electronically. It is important to ensure that the version of the form used is the most current, as tax regulations may change from year to year.

Key Elements of Form 1099 LTC

The key elements of Form 1099 LTC include the payer's information, the recipient's details, and the amounts paid. Specifically, the form requires the payer's name, address, and taxpayer identification number, along with the recipient's name, address, and taxpayer identification number. The form also includes specific boxes to report the total long-term care benefits and any other relevant information, such as the type of contract under which the benefits were paid.

Filing Deadlines for Form 1099 LTC

Filing deadlines for Form 1099 LTC are crucial to avoid penalties. Generally, the form must be filed with the IRS by the end of February if submitted on paper, or by the end of March if filed electronically. Recipients should also receive their copy by January 31 of the following tax year. Adhering to these deadlines is essential for compliance and to ensure that all parties have the necessary information for their tax filings.

Legal Use of Form 1099 LTC

The legal use of Form 1099 LTC is primarily for reporting long-term care benefits to the IRS. It is important for both payers and recipients to understand that failing to report these benefits can lead to tax penalties. The form serves as an official record of income received from long-term care insurance, which must be reported accurately on tax returns. Understanding the legal implications of this form helps ensure compliance with federal tax laws.

Quick guide on how to complete instructions for form 1099 ltc instructions for form 1099 ltc form 1099 ltc

Complete [SKS] effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documentation, as you can locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The most efficient way to modify and eSign [SKS] without hassle

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Verify all information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Form 1099 LTC Instructions For Form 1099 LTC, Form 1099 LTC

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 1099 ltc instructions for form 1099 ltc form 1099 ltc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Form 1099 LTC?

The Instructions For Form 1099 LTC guide you on how to report long-term care benefits. This form is essential for both insurers and recipients to accurately report distributions. Understanding these instructions ensures compliance and helps manage tax implications related to long-term care payments.

-

How can airSlate SignNow assist with completing Form 1099 LTC?

With airSlate SignNow, completing Form 1099 LTC is streamlined through our secure eSigning platform. Our user-friendly interface allows for easy document management, making it simple to fill out and send the form to recipients. This ensures you meet your reporting obligations without hassle.

-

What are the pricing options for using airSlate SignNow for Form 1099 LTC?

airSlate SignNow offers competitive pricing to suit various business needs, including options for single users and teams. Our subscription plans provide access to features that simplify the completion and submission of forms like the Form 1099 LTC. Exploring our pricing plans can help you find the right fit for your business.

-

Can I integrate airSlate SignNow with other software for managing Form 1099 LTC?

Yes, airSlate SignNow allows for seamless integration with various applications such as accounting software and CRM platforms. This integration facilitates easier management of Form 1099 LTC and other documents, ensuring accurate data transfer and enhanced workflow efficiency. By linking your tools, you can optimize your document processes.

-

What are the benefits of using airSlate SignNow for Form 1099 LTC?

Using airSlate SignNow to handle your Form 1099 LTC provides efficiency, security, and convenience. Our platform enables secure eSigning, reducing paperwork and expediting processes. Additionally, you can track the status of your forms in real-time, ensuring that you meet deadlines without stress.

-

Is there a way to track the status of Form 1099 LTC sent through airSlate SignNow?

Absolutely! airSlate SignNow offers tracking features that allow you to monitor the status of your Form 1099 LTC. You will receive notifications when documents are viewed and signed, helping you stay informed and ensuring that nothing falls through the cracks in your reporting process.

-

Are there templates available for Form 1099 LTC in airSlate SignNow?

Yes, airSlate SignNow provides templates specifically designed for Form 1099 LTC. These templates help you quickly fill out necessary information, ensuring compliance with all guidelines. Utilizing our templates can save you time while helping to reduce errors in your documentation.

Get more for Instructions For Form 1099 LTC Instructions For Form 1099 LTC, Form 1099 LTC

- Pdf aor 102 xavier university form

- The lincoln national life insurance company at one of the following form

- Please forward this cover sheet with your completed evidence form

- Pdf proceedings of the 13th hokkaido indonesian student form

- Uncw university housing agreement residence halls and form

- Bi mart online form

- 2018 form 941

- Client affidavit for self employed examinees d17 american concrete form

Find out other Instructions For Form 1099 LTC Instructions For Form 1099 LTC, Form 1099 LTC

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word