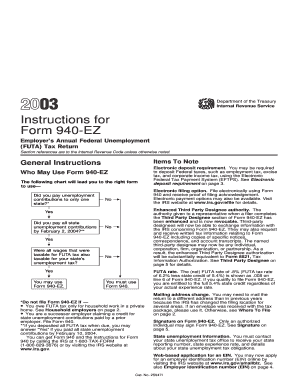

Irs2003 Application Form

What is the Irs2003 Application Form

The Irs2003 Application Form is a specific document utilized for various tax-related purposes within the United States. This form is typically associated with applications for tax identification numbers, adjustments to tax filings, or other official requests to the Internal Revenue Service (IRS). Understanding the purpose of this form is essential for individuals and businesses seeking to ensure compliance with federal tax regulations.

How to obtain the Irs2003 Application Form

To obtain the Irs2003 Application Form, individuals can visit the official IRS website, where forms are available for download in PDF format. Additionally, physical copies of the form can be requested by contacting the IRS directly. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Steps to complete the Irs2003 Application Form

Completing the Irs2003 Application Form involves several key steps:

- Gather necessary information, including personal identification details and tax information.

- Carefully read the instructions provided with the form to understand specific requirements.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the form through the appropriate channel, whether online, by mail, or in person.

Legal use of the Irs2003 Application Form

The Irs2003 Application Form must be used in accordance with IRS regulations. This means that it should only be submitted for legitimate purposes related to tax filings or requests. Misuse of the form can lead to penalties, including fines or legal action. It is crucial to ensure that all information provided is truthful and accurate to maintain compliance with tax laws.

Required Documents

When submitting the Irs2003 Application Form, certain documents may be required to support your application. These can include:

- Proof of identity, such as a driver's license or passport.

- Tax documents from previous years, if applicable.

- Any additional forms or schedules that may be relevant to your application.

Ensuring that all required documents are included can help expedite the processing of your application.

Form Submission Methods

The Irs2003 Application Form can be submitted through various methods, depending on the preferences of the filer:

- Online: Many users prefer to submit the form electronically through the IRS website, which can provide faster processing times.

- Mail: The form can also be printed and mailed to the appropriate IRS address, as indicated in the form instructions.

- In-Person: For those who prefer face-to-face interactions, the form can be submitted at local IRS offices.

Quick guide on how to complete irs2003 application form

Complete [SKS] effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to edit and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize signNow sections of your documents or redact sensitive data with tools available from airSlate SignNow designed specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your updates.

- Select your preferred method to submit your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate concerns about misplaced or lost documents, exhausting form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and eSign [SKS] and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Irs2003 Application Form

Create this form in 5 minutes!

How to create an eSignature for the irs2003 application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Irs2003 Application Form and why is it important?

The Irs2003 Application Form is a vital document used by individuals and businesses to apply for specific tax considerations. Understanding this form is crucial for ensuring compliance with IRS regulations and maximizing potential benefits. airSlate SignNow simplifies the process of completing and submitting the Irs2003 Application Form.

-

How does airSlate SignNow support users in completing the Irs2003 Application Form?

airSlate SignNow provides an intuitive interface that allows users to easily fill out the Irs2003 Application Form and other documents. Our platform includes templates and guidance to ensure that all necessary information is accurately captured. This ensures a smooth and efficient filing process.

-

What are the pricing options for using airSlate SignNow for the Irs2003 Application Form?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our competitive pricing ensures that you can efficiently manage your documents, including the Irs2003 Application Form, without breaking the bank. Check our website for detailed pricing tiers that fit your needs.

-

Can I integrate airSlate SignNow with my existing tools when working on the Irs2003 Application Form?

Yes, airSlate SignNow seamlessly integrates with various business tools and platforms, allowing users to manage their documents more effectively. This integration enhances your workflow, especially when preparing the Irs2003 Application Form, by enabling the use of your preferred applications.

-

What security measures does airSlate SignNow have for the Irs2003 Application Form?

Security is a top priority for airSlate SignNow. We employ advanced encryption and authentication protocols to protect your sensitive data while processing the Irs2003 Application Form. This gives our users peace of mind that their information is secure and compliant.

-

Is it easy to track the status of the Irs2003 Application Form with airSlate SignNow?

Absolutely! airSlate SignNow offers real-time tracking features for all documents, including the Irs2003 Application Form. Users can easily monitor the progress of their submissions and receive notifications when actions are taken, ensuring that everything is handled promptly.

-

What are the benefits of using airSlate SignNow for the Irs2003 Application Form?

Using airSlate SignNow for the Irs2003 Application Form streamlines the signing and submission process, saving time and reducing errors. Our platform enhances collaboration among stakeholders and simplifies the entire document workflow, leading to increased efficiency and productivity.

Get more for Irs2003 Application Form

- Annual medical report sample form

- Labour register form

- Grant invoice template form

- Cif concussion return to play rtp protocol e 6145 2 form

- Bokepmi form

- The rules and conditions miss international queen form

- Please affix your passport size photograph here genetix biotech asia form

- Naic fillable application form

Find out other Irs2003 Application Form

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF