Instruction 940 EZ Rev Instructions for Form 940 EZ Irs

Understanding the Instruction 940 EZ Rev

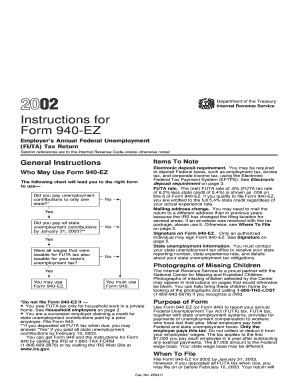

The Instruction 940 EZ Rev provides essential guidelines for completing Form 940 EZ, which is used by employers to report annual Federal Unemployment Tax Act (FUTA) taxes. This form is specifically designed for employers who meet certain eligibility criteria, allowing them to simplify their reporting process. The instructions detail the requirements for filing, including who must file and the specific information needed to accurately complete the form.

Steps to Complete the Instruction 940 EZ Rev

Completing the Instruction 940 EZ Rev involves several key steps. First, gather all necessary information about your business, including your Employer Identification Number (EIN) and total taxable wages paid. Next, follow the line-by-line instructions provided in the document to fill out the form accurately. Ensure you calculate your FUTA tax liability correctly, taking into account any credits you may be eligible for. Finally, review the completed form for accuracy before submission.

Obtaining the Instruction 940 EZ Rev

The Instruction 940 EZ Rev can be obtained directly from the Internal Revenue Service (IRS) website. It is available as a downloadable PDF, which can be printed for easy reference. Additionally, you may find copies at local IRS offices or request them through official IRS channels. Having the latest version is crucial, as tax laws and regulations can change annually.

Key Elements of the Instruction 940 EZ Rev

Several key elements are crucial for understanding the Instruction 940 EZ Rev. These include eligibility criteria for using Form 940 EZ, the specific information required for completion, and the deadlines for filing. The instructions also outline any penalties for late submission or inaccuracies, ensuring that employers are aware of their responsibilities. Understanding these elements helps ensure compliance with federal tax regulations.

IRS Guidelines for Filing

The IRS provides specific guidelines for filing Form 940 EZ, which are detailed in the Instruction 940 EZ Rev. These guidelines include information on filing deadlines, acceptable submission methods, and the importance of maintaining accurate records. Employers are encouraged to familiarize themselves with these guidelines to avoid potential issues during the filing process.

Penalties for Non-Compliance

Employers who fail to comply with the requirements outlined in the Instruction 940 EZ Rev may face penalties. These can include fines for late filing or inaccuracies in reported information. Understanding these potential penalties can motivate employers to adhere strictly to the guidelines and ensure timely and accurate submissions of their tax forms.

Quick guide on how to complete instruction 940 ez rev instructions for form 940 ez irs

Complete [SKS] effortlessly on any device

Online document management has become popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to generate, modify, and eSign your documents quickly without delays. Handle [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The most efficient way to edit and eSign [SKS] without difficulty

- Obtain [SKS] and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing out new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Edit and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instruction 940 EZ Rev Instructions For Form 940 EZ Irs

Create this form in 5 minutes!

How to create an eSignature for the instruction 940 ez rev instructions for form 940 ez irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Instruction 940 EZ Rev and how does it relate to Form 940 EZ?

The Instruction 940 EZ Rev provides essential guidelines on how to complete Form 940 EZ for your IRS tax reporting requirements. This form is specifically designed for employers to report their annual Federal Unemployment Tax Act (FUTA) liability. Following these instructions correctly ensures compliance with IRS regulations while minimizing the chances of penalties.

-

How much does it cost to use airSlate SignNow for handling documents related to Form 940 EZ?

airSlate SignNow offers a range of pricing plans to accommodate different business needs. The cost-effective solutions start with a free trial, allowing you to explore features that can streamline submitting the Instruction 940 EZ Rev and completing Form 940 EZ efficiently. Choosing SignNow can help you save time and money while ensuring you're compliant with IRS requirements.

-

What features does airSlate SignNow provide for businesses completing Instruction 940 EZ Rev?

airSlate SignNow offers features like e-signatures, document templates, and real-time collaboration. These tools make it simple for businesses to handle the necessary paperwork, including the Instruction 940 EZ Rev and Form 940 EZ. You can securely sign, store, and share documents from any device, improving workflow efficiency.

-

Can I integrate airSlate SignNow with other software I use for tax preparation?

Yes, airSlate SignNow seamlessly integrates with popular accounting software and tax preparation tools. This integration allows you to effortlessly manage your documents related to the Instruction 940 EZ Rev and Form 940 EZ, ensuring that your data flows smoothly between systems. Explore our integration options to enhance your overall productivity.

-

What are the benefits of using airSlate SignNow when handling IRS forms like the Instruction 940 EZ Rev?

Using airSlate SignNow provides numerous benefits, including increased efficiency and reduced errors when completing the Instruction 940 EZ Rev and Form 940 EZ. The user-friendly interface allows you to quickly prepare and e-sign documents, while secure cloud storage ensures your information is safe and easily accessible. Empower your business operations with a reliable solution.

-

Is there customer support available for questions regarding Instruction 940 EZ Rev?

Absolutely! airSlate SignNow offers dedicated customer support to assist you with any queries related to the Instruction 940 EZ Rev and other documentation needs. Whether you need help with the software or clarifications on IRS forms, our knowledgeable support team is here to help you achieve successful filing of Form 940 EZ.

-

What types of businesses benefit most from using airSlate SignNow for IRS forms?

airSlate SignNow is designed to benefit businesses of all sizes, from freelancers to large corporations. Any business that needs to file IRS forms such as the Instruction 940 EZ Rev can streamline their processes using our solution. Enhanced efficiency, cost savings, and compliance are just a few of the advantages our users experience.

Get more for Instruction 940 EZ Rev Instructions For Form 940 EZ Irs

Find out other Instruction 940 EZ Rev Instructions For Form 940 EZ Irs

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement