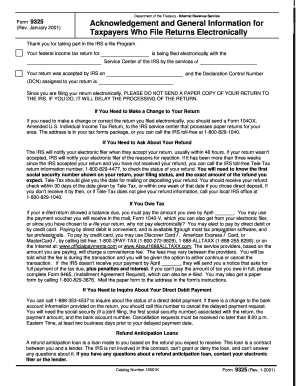

Form 9325 Rev January Acknowledgement and General Information for Taxpayers Who File Returns Electronically

What is Form 9325 Rev January Acknowledgement And General Information For Taxpayers Who File Returns Electronically

Form 9325 Rev January is an official document issued by the IRS that serves as an acknowledgment and general information guide for taxpayers who file their returns electronically. This form is crucial for confirming that the IRS has received your electronic tax return. It provides essential details regarding the submission process, including confirmation of receipt, which can be beneficial in case of any discrepancies or inquiries regarding your filing.

How to use Form 9325 Rev January Acknowledgement And General Information For Taxpayers Who File Returns Electronically

To effectively use Form 9325, taxpayers should ensure they complete the electronic filing process through an IRS-approved e-file provider. Once the electronic filing is submitted, the e-file provider will generate Form 9325, which includes a confirmation number and details about the return. This form should be retained for your records, as it serves as proof of filing and can be referenced if any issues arise with your tax return.

Steps to complete Form 9325 Rev January Acknowledgement And General Information For Taxpayers Who File Returns Electronically

Completing Form 9325 involves several straightforward steps:

- Choose an IRS-approved e-file provider to submit your tax return electronically.

- After submission, the e-file provider will automatically generate Form 9325.

- Review the details on Form 9325, ensuring that your name, Social Security number, and confirmation number are accurate.

- Store the completed form in a secure location for future reference.

Key elements of Form 9325 Rev January Acknowledgement And General Information For Taxpayers Who File Returns Electronically

Form 9325 includes several key elements that are important for taxpayers:

- Confirmation Number: A unique identifier assigned to your electronic filing.

- Filing Date: The date when your tax return was submitted electronically.

- Tax Year: The tax year for which the return is being filed.

- Taxpayer Information: Your name and Social Security number, ensuring proper identification.

IRS Guidelines

The IRS provides specific guidelines for the use of Form 9325. Taxpayers are encouraged to familiarize themselves with these guidelines to ensure compliance and proper filing. The guidelines outline the importance of retaining Form 9325 as proof of electronic filing and detail the steps to take if you do not receive the form after submitting your return. It's essential to follow these guidelines closely to avoid any potential issues with your tax return.

Form Submission Methods (Online / Mail / In-Person)

Form 9325 is primarily generated and submitted electronically through an IRS-approved e-file provider. There are no options for mailing or in-person submission for this specific form, as it is designed to be part of the electronic filing process. Retaining a digital copy of Form 9325 is recommended for your records, as it serves as proof of your electronic filing.

Quick guide on how to complete form 9325 rev january acknowledgement and general information for taxpayers who file returns electronically

Effortlessly manage [SKS] on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and eSign [SKS] seamlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow portions of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 9325 Rev January Acknowledgement And General Information For Taxpayers Who File Returns Electronically

Create this form in 5 minutes!

How to create an eSignature for the form 9325 rev january acknowledgement and general information for taxpayers who file returns electronically

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 9325 Rev January Acknowledgement And General Information For Taxpayers Who File Returns Electronically?

Form 9325 Rev January Acknowledgement And General Information For Taxpayers Who File Returns Electronically is a document that provides important details to taxpayers who have submitted their returns electronically. It serves as an acknowledgment of receipt and outlines necessary information regarding the submission. Utilizing this form helps ensure taxpayers have a clear understanding of their electronic filing status.

-

How can airSlate SignNow help with Form 9325?

airSlate SignNow simplifies the process of preparing and managing forms like Form 9325 Rev January Acknowledgement And General Information For Taxpayers Who File Returns Electronically. With our easy-to-use platform, you can create, sign, and send this form quickly, ensuring timely submission and compliance. Our eSignature feature enhances the overall efficiency of your electronic filing process.

-

What are the pricing options for using airSlate SignNow with Form 9325?

airSlate SignNow offers various pricing plans to meet diverse business needs while providing access to tools necessary for managing forms like Form 9325 Rev January Acknowledgement And General Information For Taxpayers Who File Returns Electronically. Each plan is designed to fit different user requirements, ensuring cost-effective solutions. Please visit our pricing page for detailed information on plans.

-

What features does airSlate SignNow offer for electronic forms like Form 9325?

With airSlate SignNow, you gain access to several features that enhance the handling of electronic forms such as Form 9325 Rev January Acknowledgement And General Information For Taxpayers Who File Returns Electronically. These include secure eSigning, document templates, real-time notifications, and integration options with various applications. Our platform delivers a seamless experience for managing your documents efficiently.

-

Are there any integrations available for managing Form 9325 with airSlate SignNow?

Yes, airSlate SignNow offers robust integrations with popular software and applications, making it easy to manage Form 9325 Rev January Acknowledgement And General Information For Taxpayers Who File Returns Electronically. You can connect our platform to various CRM systems, cloud storage solutions, and project management tools. This integration capability enhances workflow efficiency and document management.

-

What are the benefits of using airSlate SignNow for Filing Form 9325?

By using airSlate SignNow for filing Form 9325 Rev January Acknowledgement And General Information For Taxpayers Who File Returns Electronically, taxpayers can enjoy enhanced efficiency, improved accuracy, and a streamlined process. Our user-friendly platform allows for quick preparation and submission of forms, reducing paperwork and the associated stress. Additionally, secure eSigning ensures compliance with legal standards.

-

Is there customer support available for questions about Form 9325?

Absolutely! airSlate SignNow provides comprehensive customer support to assist users with inquiries related to Form 9325 Rev January Acknowledgement And General Information For Taxpayers Who File Returns Electronically. Our support team is available via chat, email, and phone to ensure you receive timely help with any issues or questions you may have regarding electronic filing.

Get more for Form 9325 Rev January Acknowledgement And General Information For Taxpayers Who File Returns Electronically

- Application for extension of idaho drivers license or id card form

- Identification card application for minors under virginia dmv form

- Standard form residential tenancy agreement gerber

- Claim for refund of bond money form primus property

- An association is a tier 2 association if form

- Please provide at time of submission form

- Illinois drivers license reinstatement payment form

- Temporary visitor drivers license tvdl quick guide spanish form

Find out other Form 9325 Rev January Acknowledgement And General Information For Taxpayers Who File Returns Electronically

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document