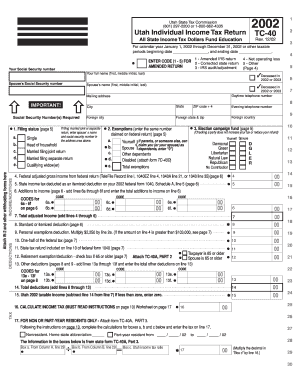

Utah Individual Income Tax Return Tax Utah Form

What is the Utah Individual Income Tax Return?

The Utah Individual Income Tax Return is a form used by residents of Utah to report their annual income and calculate their state tax liability. This form is essential for ensuring compliance with state tax laws and is typically required for individuals who earn income within the state. The return includes various sections to report different types of income, deductions, and credits applicable to the taxpayer's situation.

Steps to complete the Utah Individual Income Tax Return

Completing the Utah Individual Income Tax Return involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any relevant receipts for deductions.

- Fill out personal information, such as your name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim any eligible deductions and credits to reduce your taxable income.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy before submission.

How to obtain the Utah Individual Income Tax Return

The Utah Individual Income Tax Return can be obtained through several methods. You can download the form directly from the Utah State Tax Commission website or request a paper form to be mailed to you. Additionally, tax preparation software often includes the Utah return as part of their services, making it convenient to complete and file electronically.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Utah Individual Income Tax Return. Typically, the deadline for filing is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also note that extensions are available but must be filed before the original deadline.

Required Documents

To complete the Utah Individual Income Tax Return accurately, you will need several key documents:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Documentation for any additional income sources

- Receipts for deductible expenses, such as medical costs or charitable contributions

- Previous year's tax return for reference

Penalties for Non-Compliance

Failure to file the Utah Individual Income Tax Return on time can result in penalties. The state may impose a late filing fee, which can accumulate over time. Additionally, underreporting income or failing to pay the correct amount of tax owed can lead to further penalties and interest charges. It is essential to adhere to filing requirements to avoid these financial repercussions.

Quick guide on how to complete utah individual income tax return tax utah

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The simplest way to modify and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and then click on the Done button to save your modifications.

- Select how you wish to share your form: via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and eSign [SKS] and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Utah Individual Income Tax Return Tax Utah

Create this form in 5 minutes!

How to create an eSignature for the utah individual income tax return tax utah

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing my Utah Individual Income Tax Return using airSlate SignNow?

To file your Utah Individual Income Tax Return, simply prepare your documents using airSlate SignNow's intuitive platform. You can upload your tax forms, eSign them securely, and then submit them directly to the Utah State Tax Commission. The entire process is streamlined, making it easy to manage your tax obligations efficiently.

-

How does airSlate SignNow help me save on my Utah Individual Income Tax Return?

Using airSlate SignNow can cut down costs associated with paper filing and mailing fees for your Utah Individual Income Tax Return. Our solution allows for quick eSigning and electronic submission, reducing turnaround times and potential errors. This efficiency translates to savings, both in time and money, for your tax filing needs.

-

Can I integrate airSlate SignNow with other accounting software for my Utah Individual Income Tax Return?

Yes, airSlate SignNow offers seamless integrations with various accounting software that can assist in preparing your Utah Individual Income Tax Return. This ensures you can import financial data directly and simplify the filing process. Our integrations work to enhance your productivity and accuracy in tax preparation.

-

What features does airSlate SignNow offer for managing my Utah Individual Income Tax Return?

airSlate SignNow provides key features such as secure eSigning, document storage, and real-time collaboration to manage your Utah Individual Income Tax Return effectively. These features ensure your tax documents are organized, accessible, and compliant with Utah state regulations. Additionally, you can track the status of your documents, giving you peace of mind.

-

Are there any fees associated with using airSlate SignNow for my Utah Individual Income Tax Return?

airSlate SignNow offers cost-effective pricing plans that cater to individuals and businesses filing Utah Individual Income Tax Returns. There may be a subscription fee based on the plan selected, but the savings from reduced paper and mailing costs can offset this expense. We also provide a free trial to help you get started without any commitment.

-

What benefits can I expect when using airSlate SignNow for my Utah Individual Income Tax Return?

By choosing airSlate SignNow for your Utah Individual Income Tax Return, you can expect faster processing times, increased document security, and easy collaboration with your tax preparers. The platform is designed to simplify your filing experience, making it more efficient and less stressful. Users frequently report a smoother tax season thanks to our user-friendly tools.

-

Is airSlate SignNow compliant with Utah tax laws for individual income tax returns?

Absolutely, airSlate SignNow is designed to comply with all relevant Utah tax laws and regulations regarding individual income tax returns. Our platform is updated regularly to reflect changes in tax legislation, ensuring that your documents meet the necessary compliance standards. Rely on us to help you stay informed and file correctly.

Get more for Utah Individual Income Tax Return Tax Utah

- Chp background investigation questionnaire form

- Wyoming statutory trust form

- Wynberg girls high school uniform

- Declaration of acceptance letter form

- Accident register form 29

- Infant feeding form for daycare

- Ssa 581 scibew neca trust funds scibew neca form

- Move fedex ship manager to new computer form

Find out other Utah Individual Income Tax Return Tax Utah

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF