Form 199 California Franchise Tax Board

What is the Form 199 California Franchise Tax Board

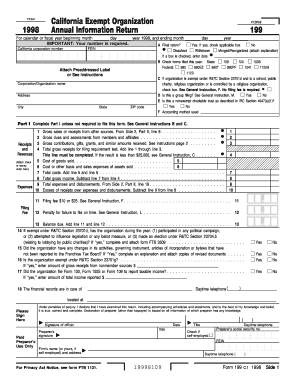

The Form 199 is a tax form used by the California Franchise Tax Board (FTB) for certain nonprofit organizations. This form is specifically designed for organizations that are exempt from federal income tax under Section 501(c)(3) of the Internal Revenue Code. It serves as a way for these entities to report their income, expenses, and other relevant financial information to the state of California, ensuring compliance with state tax regulations.

How to obtain the Form 199 California Franchise Tax Board

To obtain the Form 199, organizations can visit the California Franchise Tax Board's official website. The form is available for download in PDF format, allowing organizations to print and complete it. Additionally, physical copies may be requested directly from the FTB. It is important for organizations to ensure they are using the most current version of the form to comply with state regulations.

Steps to complete the Form 199 California Franchise Tax Board

Completing the Form 199 involves several key steps:

- Gather all necessary financial documents, including income statements and expense reports.

- Fill out the form accurately, providing detailed information about the organization’s activities, income sources, and expenditures.

- Review the completed form for accuracy and completeness to avoid delays in processing.

- Sign and date the form, ensuring that it is submitted by the appropriate deadline.

Key elements of the Form 199 California Franchise Tax Board

The Form 199 includes several critical sections that organizations must complete. These sections typically cover:

- Identification information, including the organization’s name, address, and federal employer identification number (EIN).

- Financial information detailing revenues, expenses, and net assets.

- Details of the organization’s activities and programs, demonstrating compliance with nonprofit regulations.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the Form 199 to avoid penalties. Typically, the form is due on the fifteenth day of the fifth month after the end of the organization's fiscal year. For organizations operating on a calendar year, this means the form is generally due by May 15. It is advisable to check for any specific extensions or changes in deadlines that may apply.

Penalties for Non-Compliance

Failure to file the Form 199 on time can result in penalties imposed by the California Franchise Tax Board. These penalties may include fines based on the organization's gross receipts and can accumulate if the form remains unfiled. Additionally, non-compliance may jeopardize the organization’s tax-exempt status, making it essential for organizations to adhere to filing requirements.

Quick guide on how to complete form 199 california franchise tax board

Complete [SKS] effortlessly on any device

Web-based document administration has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any hold-ups. Manage [SKS] across any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to modify and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize specific sections of the documents or redact sensitive data with the tools that airSlate SignNow offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form: via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form hunts, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Edit and eSign [SKS], ensuring outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 199 California Franchise Tax Board

Create this form in 5 minutes!

How to create an eSignature for the form 199 california franchise tax board

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 199 for the California Franchise Tax Board?

Form 199 is a California Franchise Tax Board form used by exempt organizations to report their annual information. It is essential for maintaining compliance with state regulations and is required to disclose specific financial information. Completing Form 199 is crucial for non-profits to ensure their tax-exempt status is upheld.

-

How can airSlate SignNow help with filling out Form 199 for the California Franchise Tax Board?

airSlate SignNow simplifies the process of completing Form 199 for the California Franchise Tax Board by providing an easy-to-use platform for eSigning and document management. Our user-friendly interface ensures you can fill out and send the form quickly, minimizing time spent on administrative tasks. Integration with various tools allows for seamless data transfer and enhanced accuracy.

-

Is airSlate SignNow cost-effective for non-profits needing to file Form 199?

Yes, airSlate SignNow offers affordable pricing plans tailored for non-profits, making it a cost-effective solution for organizations that need to file Form 199 with the California Franchise Tax Board. Our transparent pricing ensures that you only pay for what you need, with no hidden fees. This allows non-profits to manage their documentation without straining their budgets.

-

What features does airSlate SignNow offer for managing Form 199 submissions?

airSlate SignNow provides several features to streamline the management of Form 199 submissions, including customizable templates, secure eSigning, and automatic reminders. These tools help ensure that deadlines are met and that submissions to the California Franchise Tax Board are accurate and timely. Additionally, you can store all your documents in one secure location for easy access.

-

How secure is the information shared on airSlate SignNow when submitting Form 199?

The security of your information while submitting Form 199 to the California Franchise Tax Board is a top priority for airSlate SignNow. We employ advanced encryption techniques and comply with industry standards to safeguard your documents and data. Rest assured that your sensitive information remains protected throughout the eSigning process.

-

Can I integrate airSlate SignNow with other tools for easier Form 199 processing?

Absolutely! airSlate SignNow offers a variety of integrations with popular tools that can assist in the processing of Form 199 for the California Franchise Tax Board. This includes accounting software, CRM systems, and cloud storage services, allowing for seamless data flow and enhanced productivity. Integrations help reduce redundant data entry and streamline your workflow.

-

What support options does airSlate SignNow provide for users working on Form 199?

airSlate SignNow offers multiple support options for users needing assistance with Form 199. You can access our comprehensive help center, which includes tutorials and FAQs, or signNow out to our customer service team for personalized support. Our commitment to helping you navigate the Form 199 submission process ensures you have the assistance you need.

Get more for Form 199 California Franchise Tax Board

Find out other Form 199 California Franchise Tax Board

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU