Form it 602Claim for EZ Capital Tax CreditIT602 Tax Ny

What is the Form IT-602 Claim for EZ Capital Tax Credit?

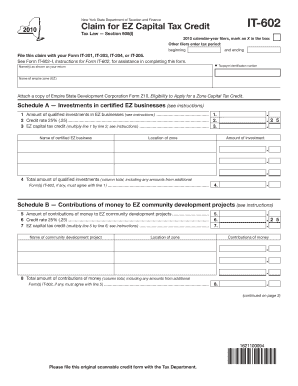

The Form IT-602 is a tax form used in New York State for claiming the EZ Capital Tax Credit. This credit is designed to incentivize businesses to invest in certain economic development projects within designated areas. By completing this form, eligible taxpayers can reduce their tax liability, thus promoting growth and job creation in targeted regions. The form requires specific information regarding the business, the nature of the investment, and compliance with state guidelines.

How to Obtain the Form IT-602 Claim for EZ Capital Tax Credit

To obtain the Form IT-602, taxpayers can visit the New York State Department of Taxation and Finance website. The form is available for download in PDF format, allowing users to print it for completion. Additionally, taxpayers can request a physical copy by contacting the department directly. It is essential to ensure that you are using the most current version of the form to avoid any issues during submission.

Steps to Complete the Form IT-602 Claim for EZ Capital Tax Credit

Completing the Form IT-602 involves several key steps:

- Gather necessary documentation, including proof of eligible investments and business identification.

- Fill out the form with accurate information regarding your business and the capital investments made.

- Calculate the credit amount based on the guidelines provided by the New York State Department of Taxation and Finance.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline, either online or via mail.

Eligibility Criteria for the Form IT-602 Claim for EZ Capital Tax Credit

To qualify for the EZ Capital Tax Credit using Form IT-602, businesses must meet specific eligibility criteria. Generally, this includes being located in a designated EZ area and making qualified investments in property or equipment. Additionally, businesses must demonstrate that the investment will create or retain jobs within the community. It is essential to review the detailed eligibility requirements provided by the New York State Department of Taxation and Finance to ensure compliance.

Form Submission Methods for IT-602 Claim for EZ Capital Tax Credit

The Form IT-602 can be submitted through various methods. Taxpayers have the option to file online through the New York State Department of Taxation and Finance's electronic filing system. Alternatively, the completed form can be mailed to the appropriate address specified in the form instructions. In-person submissions may also be available at designated tax offices, providing flexibility for taxpayers to choose the method that best suits their needs.

Key Elements of the Form IT-602 Claim for EZ Capital Tax Credit

The Form IT-602 includes several key elements that must be completed for a successful claim. These elements typically include:

- Business name and identification number.

- Description of the capital investment made.

- Calculation of the tax credit amount.

- Signature of the authorized representative of the business.

Each section must be filled out accurately to ensure that the claim is processed without delays.

Quick guide on how to complete form it 602claim for ez capital tax creditit602 tax ny

Complete [SKS] seamlessly on any device

Online document handling has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without interruptions. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management requirements in just a few clicks from your device of choice. Modify and eSign [SKS] and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 602claim for ez capital tax creditit602 tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 602Claim For EZ Capital Tax CreditIT602 Tax Ny?

Form IT 602Claim For EZ Capital Tax CreditIT602 Tax Ny is a specific tax form used to claim tax credits for businesses investing in qualified capital projects in New York. By utilizing this form, companies can signNowly reduce their tax liability and enhance their cash flow. It is essential for businesses looking to maximize the benefits of available tax credits.

-

How can airSlate SignNow help with Form IT 602Claim For EZ Capital Tax CreditIT602 Tax Ny?

airSlate SignNow provides an efficient platform for businesses to easily fill out, sign, and manage Form IT 602Claim For EZ Capital Tax CreditIT602 Tax Ny. Our user-friendly interface simplifies the electronic signing process, ensuring that your forms are completed promptly and securely. As a result, businesses can focus on their operations while efficiently handling tax documentation.

-

What features does airSlate SignNow offer for processing tax forms like Form IT 602Claim For EZ Capital Tax CreditIT602 Tax Ny?

airSlate SignNow offers a range of features tailored for processing tax forms, including customizable templates, secure eSigning, document tracking, and integration with various business applications. These features ensure that Form IT 602Claim For EZ Capital Tax CreditIT602 Tax Ny is completed accurately and efficiently. Moreover, the platform reduces the likelihood of errors and streamlines the entire signing process.

-

Is airSlate SignNow a cost-effective solution for managing Form IT 602Claim For EZ Capital Tax CreditIT602 Tax Ny?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing Form IT 602Claim For EZ Capital Tax CreditIT602 Tax Ny. Our pricing plans are affordable, enabling businesses of all sizes to access features that simplify document management and electronic signing. By reducing paper usage and streamlining processes, businesses can save both time and money.

-

Can I integrate airSlate SignNow with other applications for better management of Form IT 602Claim For EZ Capital Tax CreditIT602 Tax Ny?

Absolutely! airSlate SignNow offers integrations with popular tools such as Google Drive, Salesforce, and Dropbox, enabling seamless management of Form IT 602Claim For EZ Capital Tax CreditIT602 Tax Ny. This ensures that your tax documentation is organized and accessible within your existing workflows. Integrations help improve overall productivity and efficiency when handling tax forms.

-

What are the benefits of using airSlate SignNow for Form IT 602Claim For EZ Capital Tax CreditIT602 Tax Ny?

Using airSlate SignNow for Form IT 602Claim For EZ Capital Tax CreditIT602 Tax Ny provides several benefits, including speed, security, and ease of use. You can quickly complete and eSign your tax forms, ensuring compliance and timely submission. Additionally, our platform guarantees the security of your sensitive information throughout the signing process.

-

Is there a mobile app for airSlate SignNow to handle Form IT 602Claim For EZ Capital Tax CreditIT602 Tax Ny?

Yes, airSlate SignNow offers a mobile app that allows users to manage Form IT 602Claim For EZ Capital Tax CreditIT602 Tax Ny on the go. The mobile functionality ensures that you can access, fill out, and sign your documents anytime and anywhere. This flexibility is especially valuable for professionals needing to manage tax forms while traveling.

Get more for Form IT 602Claim For EZ Capital Tax CreditIT602 Tax Ny

- Cabelas gun dog gs 3500 manual form

- Abap online editor form

- Rezoning from okc form

- Subway surfers game download tpb form

- City of beaumont texas alarm permit application form

- Certificate of incapacity form clark county nevada clarkcountynv

- Senior night information sheet 293867660

- Infr membership form

Find out other Form IT 602Claim For EZ Capital Tax CreditIT602 Tax Ny

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document