Federal Form 2441, Line 3 Tax Ny

What is the Federal Form 2441, Line 3 Tax Ny

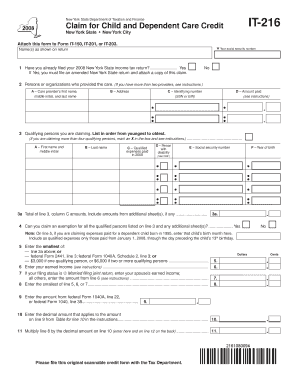

The Federal Form 2441, also known as the Child and Dependent Care Expenses form, is used by taxpayers to claim a credit for expenses incurred for the care of qualifying individuals. Line 3 specifically requires taxpayers to report the total amount of care expenses paid for qualifying individuals during the tax year. This form is essential for individuals who seek to reduce their tax liability by claiming credits for child and dependent care costs, making it a valuable tool for many families in New York and across the United States.

How to use the Federal Form 2441, Line 3 Tax Ny

To effectively use Line 3 of the Federal Form 2441, taxpayers must first gather all relevant documentation regarding care expenses. This includes receipts or invoices from care providers. Once the total amount of qualifying expenses is determined, taxpayers should accurately enter this amount on Line 3 of the form. It is important to ensure that the expenses reported meet IRS guidelines for eligibility to avoid issues during tax processing.

Steps to complete the Federal Form 2441, Line 3 Tax Ny

Completing Line 3 of the Federal Form 2441 involves several key steps:

- Identify qualifying individuals for whom care expenses were incurred, such as children under the age of thirteen or dependents who are physically or mentally incapable of self-care.

- Collect documentation of all care expenses, including receipts, invoices, and any other proof of payment.

- Calculate the total amount of qualifying care expenses for the year.

- Enter the total amount on Line 3 of the Federal Form 2441.

State-specific rules for the Federal Form 2441, Line 3 Tax Ny

While the Federal Form 2441 is a national form, New York may have specific rules regarding the eligibility of expenses and the types of care that qualify for the tax credit. Taxpayers in New York should be aware of any state-specific guidelines that may affect their claim. This includes understanding what constitutes a qualifying care provider and any limitations on the amount that can be claimed based on state regulations.

Eligibility Criteria

To be eligible to claim expenses on Line 3 of the Federal Form 2441, taxpayers must meet specific criteria. The care must be provided for a qualifying individual, which typically includes children under the age of thirteen or dependents who are unable to care for themselves. Additionally, the taxpayer must have earned income and must not have claimed the same expenses for other tax benefits. Understanding these criteria is crucial for ensuring that the claim is valid and compliant with IRS regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Federal Form 2441 coincide with the general tax filing deadlines in the United States. Typically, taxpayers must submit their tax returns by April fifteenth of the following year. However, it is important to check for any extensions or changes to deadlines, especially for those who may be filing for the first time or under special circumstances. Being aware of these dates helps ensure timely submission and compliance with tax regulations.

Quick guide on how to complete federal form 2441 line 3 tax ny

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight essential parts of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which requires only seconds and carries the same legal validity as a conventional wet signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Transform and electronically sign [SKS] and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Federal Form 2441, Line 3 Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the federal form 2441 line 3 tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Federal Form 2441, Line 3 Tax Ny, and why is it important?

Federal Form 2441, Line 3 Tax Ny, is a crucial part of the tax process for claiming child and dependent care expenses. Understanding this line ensures you accurately report your expenses to maximize potential tax credits. Utilizing airSlate SignNow can simplify the signing process for any documents related to this form.

-

How does airSlate SignNow help with Federal Form 2441, Line 3 Tax Ny submissions?

airSlate SignNow streamlines the document signing process, allowing you to prepare and eSign the necessary forms, including Federal Form 2441, Line 3 Tax Ny, quickly. Enjoy the efficiency of collecting signatures remotely, which speeds up your submission process and helps ensure accuracy.

-

Is there a cost associated with using airSlate SignNow for Federal Form 2441, Line 3 Tax Ny?

Yes, airSlate SignNow offers various pricing plans tailored to your needs, enabling you to choose an option that fits your budget for handling Federal Form 2441, Line 3 Tax Ny. The investment aims to save you time and avoid errors when eSigning essential tax documents.

-

What features does airSlate SignNow provide to support Federal Form 2441, Line 3 Tax Ny?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, which are extremely beneficial for Federal Form 2441, Line 3 Tax Ny handling. These features help reduce administrative burdens while ensuring compliance and security.

-

Can I integrate airSlate SignNow with other software for managing Federal Form 2441, Line 3 Tax Ny?

Yes, airSlate SignNow offers seamless integrations with various software solutions, enhancing your workflow related to Federal Form 2441, Line 3 Tax Ny. This connectivity allows you to streamline document management and ensure all related tasks are handled efficiently.

-

How does airSlate SignNow ensure the security of documents like Federal Form 2441, Line 3 Tax Ny?

Security is a top priority at airSlate SignNow, with encrypted document storage and secure eSigning processes. This means your Federal Form 2441, Line 3 Tax Ny and other sensitive information are protected against unauthorized access during transmission and storage.

-

What are the benefits of using airSlate SignNow for Federal Form 2441, Line 3 Tax Ny?

Using airSlate SignNow for Federal Form 2441, Line 3 Tax Ny simplifies the signing process, improves compliance, and saves time. Additionally, it helps you avoid costly mistakes, ensuring that your documents are signed and submitted correctly and on time.

Get more for Federal Form 2441, Line 3 Tax Ny

- The sociology project 2 5 pdf form

- Treatment certificate format 14816602

- Month questionnaire full spectrum pediatrics form

- Services tift regional medical center form

- Bsp online banking applicationamendment form bsp com sb

- Annex 1 page 1 of 2 application form for business permit

- Irs letter 324c fax number form

- Alanon literature list form

Find out other Federal Form 2441, Line 3 Tax Ny

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online