New York City Attach This Form to Form it 150, it 201, or it 203

Understanding the New York City Attach This Form To Form IT 150, IT 201, Or IT 203

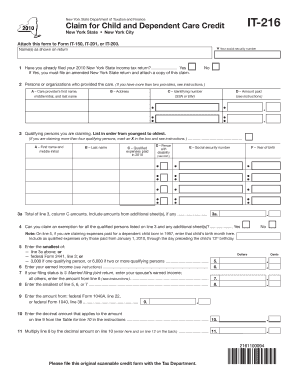

The New York City Attach This Form To Form IT 150, IT 201, Or IT 203 is a crucial document for taxpayers in New York City. This form is specifically designed to provide the necessary information that complements the state income tax returns filed using IT 150, IT 201, or IT 203. It helps ensure that all relevant financial details are accurately reported to the New York City Department of Finance, which is essential for proper tax assessment and compliance.

Steps to Complete the New York City Attach This Form To Form IT 150, IT 201, Or IT 203

Completing the New York City Attach This Form To Form IT 150, IT 201, Or IT 203 involves several important steps:

- Gather all necessary financial documents, including income statements, deductions, and credits.

- Fill out the form accurately, ensuring all fields are completed as required.

- Double-check the information for accuracy to prevent errors that could lead to delays or penalties.

- Attach the completed form to your IT 150, IT 201, or IT 203 before submission.

- Submit your tax return by the designated deadline, whether electronically or via mail.

Key Elements of the New York City Attach This Form To Form IT 150, IT 201, Or IT 203

This form includes several key elements that taxpayers must pay attention to:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Details: Report all sources of income, including wages, self-employment income, and interest.

- Deductions and Credits: Include any applicable deductions or credits that may reduce your taxable income.

- Signature: Ensure that the form is signed and dated to validate the information provided.

Legal Use of the New York City Attach This Form To Form IT 150, IT 201, Or IT 203

The legal use of this form is imperative for compliance with New York City tax laws. It serves as an official document that supports the information provided in your income tax return. Failure to attach this form when required may result in penalties, including fines or additional tax assessments. Therefore, understanding its legal implications is essential for all taxpayers.

Filing Deadlines for the New York City Attach This Form To Form IT 150, IT 201, Or IT 203

Timely submission of the New York City Attach This Form To Form IT 150, IT 201, Or IT 203 is critical. The standard filing deadline for personal income tax returns in New York City typically aligns with the federal tax deadline, which is usually April 15. However, taxpayers should verify specific dates each year, as extensions or changes may occur.

Form Submission Methods for the New York City Attach This Form To Form IT 150, IT 201, Or IT 203

Taxpayers have several options for submitting the New York City Attach This Form To Form IT 150, IT 201, Or IT 203:

- Online Submission: Many taxpayers choose to file their returns electronically through approved software.

- Mail: If filing by mail, ensure the form is sent to the correct address as specified by the New York City Department of Finance.

- In-Person: Some taxpayers may opt to submit their forms in person at designated tax offices.

Quick guide on how to complete new york city attach this form to form it 150 it 201 or it 203

Organize [SKS] effortlessly on any gadget

Digital document oversight has gained traction among businesses and people alike. It offers an ideal sustainable option to conventional printed and signed paperwork, allowing you to locate the right template and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, adjust, and eSign your records quickly without delays. Handle [SKS] on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

Steps to modify and eSign [SKS] without much hassle

- Locate [SKS] and then select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight key sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Alter and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to New York City Attach This Form To Form IT 150, IT 201, Or IT 203

Create this form in 5 minutes!

How to create an eSignature for the new york city attach this form to form it 150 it 201 or it 203

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the New York City Attach This Form To Form IT 150, IT 201, Or IT 203?

The New York City Attach This Form To Form IT 150, IT 201, Or IT 203 is crucial for taxpayers who need to report income accurately. This form helps ensure that all applicable credits and deductions are applied correctly. Using airSlate SignNow, businesses can easily attach and submit this form, streamlining the tax filing process.

-

How can airSlate SignNow help with the New York City Attach This Form To Form IT 150, IT 201, Or IT 203?

With airSlate SignNow, users can seamlessly eSign and attach the New York City Attach This Form To Form IT 150, IT 201, Or IT 203 to their tax documents. The platform offers an intuitive interface that simplifies document management and ensures compliance. This reduces the risk of errors and speeds up the submission process.

-

Is there a cost associated with using airSlate SignNow for the New York City Attach This Form To Form IT 150, IT 201, Or IT 203?

airSlate SignNow provides a cost-effective solution for managing documents, including the New York City Attach This Form To Form IT 150, IT 201, Or IT 203. Subscription plans vary based on user needs, offering flexibility at competitive prices. Users can choose a plan that suits their volume of documents and features required.

-

What features does airSlate SignNow offer for handling tax forms like the New York City Attach This Form To Form IT 150, IT 201, Or IT 203?

airSlate SignNow includes features such as eSigning, document templates, and cloud storage, specifically for tax forms like the New York City Attach This Form To Form IT 150, IT 201, Or IT 203. These tools ensure that users can create, sign, and store their documents efficiently. The platform's automation capabilities further enhance productivity.

-

Can airSlate SignNow integrate with other software for filing the New York City Attach This Form To Form IT 150, IT 201, Or IT 203?

Yes, airSlate SignNow offers integrations with various accounting and tax software, facilitating the filing of the New York City Attach This Form To Form IT 150, IT 201, Or IT 203. This ensures a smooth workflow by allowing users to manage all tax-related documents from a single platform. These integrations help streamline the entire tax preparation process.

-

What are the benefits of using airSlate SignNow for the New York City Attach This Form To Form IT 150, IT 201, Or IT 203?

Using airSlate SignNow for the New York City Attach This Form To Form IT 150, IT 201, Or IT 203 offers enhanced efficiency and accuracy in document handling. Users can quickly eSign documents and attach them as needed, reducing paperwork and saving time. Additionally, the platform ensures that all submissions are secure and compliant with regulations.

-

How does airSlate SignNow ensure the security of documents like the New York City Attach This Form To Form IT 150, IT 201, Or IT 203?

airSlate SignNow prioritizes security by employing advanced encryption and access controls for documents, including the New York City Attach This Form To Form IT 150, IT 201, Or IT 203. This provides users peace of mind when handling sensitive tax information. Regular audits and compliance with industry standards further strengthen document security.

Get more for New York City Attach This Form To Form IT 150, IT 201, Or IT 203

- Tad ms 400v 230v d montage und novoferm novoferm dewebmediaget form

- Diplomatic posting to uk vafdip1 dec form

- Non germain objector form

- Now hiring pdf form

- Tcq standard bailment agreement schedule a variation fuel form

- Shipping instructions form rev a xls

- Business banking online form

- Nkf application form 65025573

Find out other New York City Attach This Form To Form IT 150, IT 201, Or IT 203

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile