Note You Cannot Claim Exemption from Withholding If a Your Income Exceeds $800 and Form

Understanding the Exemption from Withholding

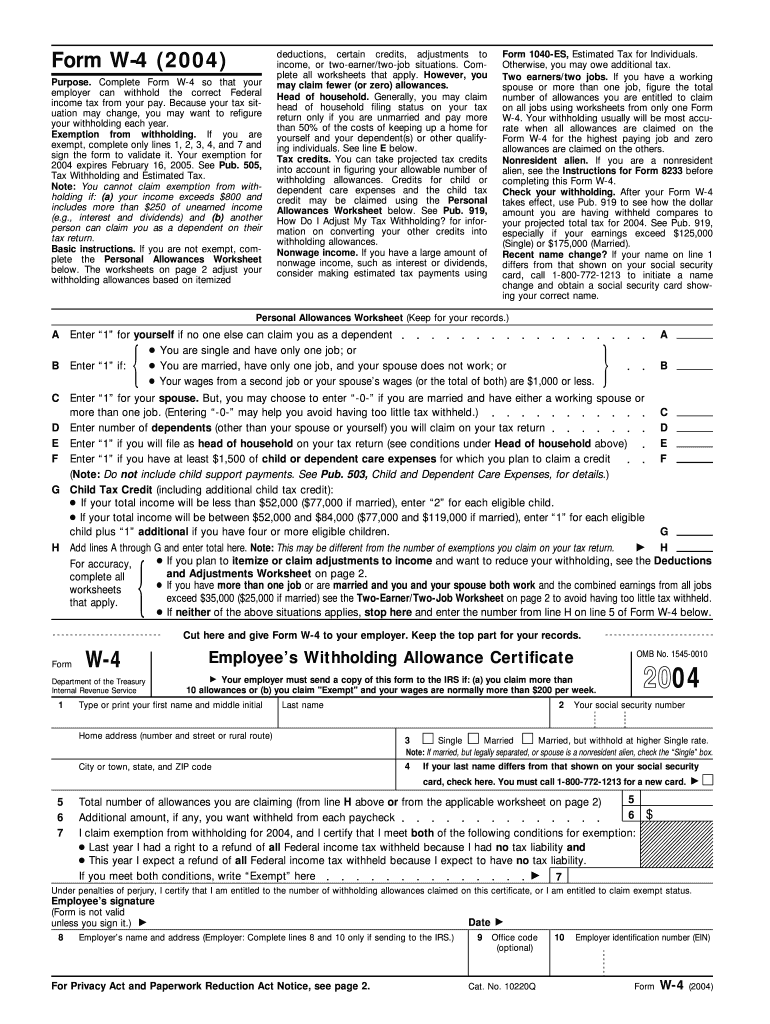

The phrase "Note You Cannot Claim Exemption From Withholding If Your Income Exceeds $800" refers to a specific guideline in U.S. tax law. This guideline indicates that individuals whose income surpasses eight hundred dollars are not eligible to claim an exemption from federal income tax withholding. This means that employers are required to withhold a portion of their earnings for federal taxes, ensuring that individuals contribute to their tax obligations throughout the year.

How to Use the Exemption Note

To utilize the exemption note effectively, taxpayers must first assess their total expected income for the year. If this amount is projected to exceed eight hundred dollars, they should not claim an exemption on their W-4 form. Instead, they should allow their employer to withhold the appropriate federal taxes from their paychecks. This helps prevent underpayment and potential penalties when filing tax returns.

Steps to Complete the Exemption Note

Completing the exemption note involves a few straightforward steps:

- Gather all necessary income information, including wages, salaries, and any additional sources of income.

- Determine if your total income is likely to exceed eight hundred dollars for the year.

- If your income exceeds this threshold, fill out the W-4 form without claiming exemption.

- Submit the completed W-4 to your employer to ensure proper withholding.

IRS Guidelines on Exemption from Withholding

The Internal Revenue Service (IRS) provides clear guidelines regarding exemptions from withholding. According to IRS regulations, individuals must accurately report their expected income and determine their eligibility for exemptions. If income exceeds eight hundred dollars, individuals must adhere to withholding requirements to avoid potential tax liabilities.

Penalties for Non-Compliance

Failing to comply with the exemption guidelines can lead to penalties. If individuals incorrectly claim an exemption and their income exceeds eight hundred dollars, they may face underpayment penalties when filing their tax returns. It is crucial to remain informed about income levels and withholding obligations to avoid these financial repercussions.

Eligibility Criteria for Claiming Exemption

Eligibility to claim exemption from withholding is primarily based on income levels. Individuals must ensure that their total income does not exceed eight hundred dollars. Additionally, they should consider other factors such as their filing status and any deductions or credits they may qualify for, as these can impact their overall tax liability.

Quick guide on how to complete note you cannot claim exemption from withholding if a your income exceeds 800 and

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without any delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to alter and electronically sign [SKS] effortlessly

- Find [SKS] and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark essential sections of your documents or conceal sensitive information with features that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to record your modifications.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your preferred device. Edit and electronically sign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Note You Cannot Claim Exemption From Withholding If a Your Income Exceeds $800 And

Create this form in 5 minutes!

How to create an eSignature for the note you cannot claim exemption from withholding if a your income exceeds 800 and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the statement 'Note You Cannot Claim Exemption From Withholding If Your Income Exceeds $800 And'?

This statement serves as a crucial reminder for individuals regarding tax withholding exemptions. Specifically, if your income surpasses $800, you cannot claim such an exemption, ensuring that you have appropriate taxes withheld from your earnings. This ensures compliance with federal tax regulations.

-

How does airSlate SignNow support tax document management?

airSlate SignNow simplifies the management of tax-related documents, allowing users to eSign forms securely and efficiently. With our platform, you can easily store and retrieve essential documents like W-4s, ensuring you address statements like 'Note You Cannot Claim Exemption From Withholding If Your Income Exceeds $800 And' appropriately. This streamlines your tax preparation process.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to cater to different business needs. Whether you're a solo entrepreneur or part of a larger organization, our pricing tiers provide access to necessary features, enabling efficient document handling, including forms associated with tax withholding. Always consider the rules related to exemption claims when evaluating your tax liabilities.

-

What features does airSlate SignNow offer for eSigning documents?

Our eSigning features allow users to electronically sign documents, ensuring a quick and efficient process. You can add signatures, initials, and even text fields where necessary. This is especially useful when managing tax documents and understanding conditions like 'Note You Cannot Claim Exemption From Withholding If Your Income Exceeds $800 And.'

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow seamlessly integrates with various software, ranging from CRMs to project management tools. This integration capability enhances your workflow, allowing for easy sharing and signing of documents, including tax forms that relate to exemption claims. Ensure compliance while automating your processes with these powerful integrations.

-

How can businesses benefit from using airSlate SignNow?

By utilizing airSlate SignNow, businesses can streamline their document workflows, reduce paper usage, and improve turnaround times. Our platform enables timely eSigning, which is critical for managing forms that require adherence to statements like 'Note You Cannot Claim Exemption From Withholding If Your Income Exceeds $800 And.' This results in enhanced efficiency and compliance.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes security with bank-level encryption and compliance with regulations. Your sensitive documents, including those that address tax exemptions, are protected throughout the signing process. We ensure that you can confidently manage your documentation without compromising on security.

Get more for Note You Cannot Claim Exemption From Withholding If a Your Income Exceeds $800 And

- Dcps tuition reimbursement 21316022 form

- College research worksheet form

- Sprinkler system testing and inspection form appendix c

- Payroll separation check request form

- Form 13e maryland state ethics commission ethics gov state md

- Bsn curriculum olfu form

- Ohio motor fuel tax refund claim for school districts form 28432877

- Conplan 8888 pdf form

Find out other Note You Cannot Claim Exemption From Withholding If a Your Income Exceeds $800 And

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors