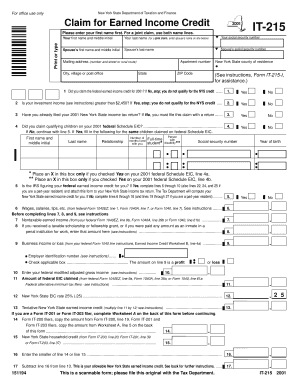

New York State Department of Taxation and Finance for Office Use Only Claim for Earned Income Credit it 215 Please Enter Your Fi Form

Understanding the New York State Department Of Taxation And Finance For Office Use Only Claim For Earned Income Credit IT-215

The New York State Department Of Taxation And Finance For Office Use Only Claim For Earned Income Credit IT-215 is a crucial form for individuals seeking to claim the Earned Income Credit (EIC). This tax credit is designed to assist low to moderate-income working individuals and families by reducing their tax liability. The IT-215 form helps taxpayers determine eligibility and calculate the amount of credit they may receive. Proper completion of this form is essential to ensure that eligible claimants receive the financial benefits intended by the state.

Steps to Complete the New York State Department Of Taxation And Finance For Office Use Only Claim For Earned Income Credit IT-215

Completing the IT-215 form involves several important steps:

- Gather Required Information: Collect all necessary documents, including your Social Security number, income statements, and any other relevant tax documents.

- Fill Out Personal Information: Enter your first name, last name, and any other requested personal details accurately on the form.

- Report Income: Provide information regarding your earned income, including wages, salaries, and any self-employment income.

- Claim Dependents: If applicable, list any qualifying dependents that may affect your eligibility for the credit.

- Review and Sign: Carefully review all entries for accuracy before signing the form to certify that the information provided is true.

Eligibility Criteria for the New York State Department Of Taxation And Finance For Office Use Only Claim For Earned Income Credit IT-215

To qualify for the Earned Income Credit using the IT-215 form, taxpayers must meet specific eligibility criteria:

- Income Limits: Your earned income must fall below certain thresholds, which vary based on filing status and number of dependents.

- Filing Status: You must file as a single, married filing jointly, or head of household to be eligible.

- Residency Requirements: You must be a resident of New York State for the entire tax year.

- Age Requirements: Generally, you must be at least 25 years old but younger than 65 years old.

Required Documents for the New York State Department Of Taxation And Finance For Office Use Only Claim For Earned Income Credit IT-215

When preparing to submit the IT-215 form, ensure you have the following documents ready:

- Proof of Income: W-2 forms from employers, 1099 forms for self-employment income, and any other relevant income documentation.

- Social Security Numbers: Social Security numbers for yourself, your spouse (if applicable), and any qualifying dependents.

- Tax Returns: Copies of your federal and state tax returns for the year you are claiming the credit.

Form Submission Methods for the New York State Department Of Taxation And Finance For Office Use Only Claim For Earned Income Credit IT-215

There are several methods to submit the IT-215 form:

- Online Submission: If using tax preparation software, you may be able to submit your claim electronically.

- Mail Submission: Print the completed form and send it to the appropriate address provided by the New York State Department of Taxation and Finance.

- In-Person Submission: Visit a local tax office to submit the form in person if you prefer direct assistance.

Legal Use of the New York State Department Of Taxation And Finance For Office Use Only Claim For Earned Income Credit IT-215

The IT-215 form is legally recognized as a means for eligible taxpayers to claim the Earned Income Credit. It is important to complete the form accurately and truthfully to avoid penalties. Misrepresentation or fraudulent claims can lead to legal consequences, including fines or disqualification from future credits. Therefore, understanding the legal implications of this form is essential for all applicants.

Quick guide on how to complete new york state department of taxation and finance for office use only claim for earned income credit it 215 please enter your

Accomplish [SKS] effortlessly on any device

Digital document management has become increasingly prevalent among companies and individuals. It offers an excellent eco-friendly option to traditional printed and manually signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Handle [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign [SKS] without hassle

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Alter and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to New York State Department Of Taxation And Finance For Office Use Only Claim For Earned Income Credit IT 215 Please Enter Your Fi

Create this form in 5 minutes!

How to create an eSignature for the new york state department of taxation and finance for office use only claim for earned income credit it 215 please enter your

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New York State Department Of Taxation And Finance For Office Use Only Claim For Earned Income Credit IT 215?

The New York State Department Of Taxation And Finance For Office Use Only Claim For Earned Income Credit IT 215 is a form used to apply for the Earned Income Credit in New York. This form helps eligible taxpayers receive a refund based on their income and family size, potentially increasing their tax return signNowly.

-

How can airSlate SignNow help with submitting the IT 215 form?

airSlate SignNow simplifies the process of submitting the New York State Department Of Taxation And Finance For Office Use Only Claim For Earned Income Credit IT 215 by allowing users to fill out and eSign the form electronically. This streamlines the submission process and ensures that your documents are submitted on time.

-

Is there a cost associated with using airSlate SignNow for the IT 215 form?

Yes, airSlate SignNow offers various pricing plans that are cost-effective for businesses looking to manage documents and eSignatures. Investing in this solution can save time and resources, especially for those frequently handling the New York State Department Of Taxation And Finance For Office Use Only Claim For Earned Income Credit IT 215.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides features like customizable templates, secure storage, and real-time tracking of document status. These features enhance the experience of filling out forms like the New York State Department Of Taxation And Finance For Office Use Only Claim For Earned Income Credit IT 215 efficiently.

-

Can airSlate SignNow be integrated with other software?

Absolutely! airSlate SignNow can integrate with a variety of software solutions, including CRM tools and document management systems, allowing for seamless workflows. This makes managing the New York State Department Of Taxation And Finance For Office Use Only Claim For Earned Income Credit IT 215 even easier.

-

What are the benefits of using airSlate SignNow for tax-related forms?

Using airSlate SignNow for tax-related forms, like the New York State Department Of Taxation And Finance For Office Use Only Claim For Earned Income Credit IT 215, enhances efficiency and reduces the likelihood of errors. The electronic signing process also ensures compliance and security for sensitive financial documents.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow employs advanced encryption and security measures to protect your documents and personal information. This commitment to security is crucial when handling forms such as the New York State Department Of Taxation And Finance For Office Use Only Claim For Earned Income Credit IT 215.

Get more for New York State Department Of Taxation And Finance For Office Use Only Claim For Earned Income Credit IT 215 Please Enter Your Fi

Find out other New York State Department Of Taxation And Finance For Office Use Only Claim For Earned Income Credit IT 215 Please Enter Your Fi

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document