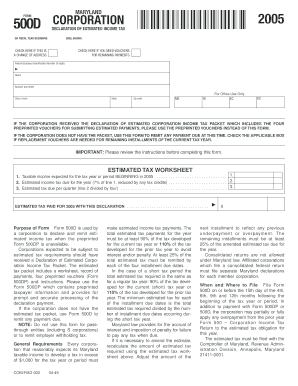

MARYLAND FORM 500D CORPORATION DECLARATION of ESTIMATED INCOME TAX or FISCAL YEAR BEGINNING , ENDING CHECK HERE IF THIS is a CHA

Understanding the Maryland Form 500D

The Maryland Form 500D, officially known as the Corporation Declaration of Estimated Income Tax, is a crucial document for corporations operating in Maryland. This form is designed to help corporations estimate their income tax obligations for the fiscal year. It requires specific details such as the fiscal year beginning and ending dates, along with the corporation's Federal Employer Identification Number (FEIN). Corporations must also indicate whether there is a change of address and if they require vouchers for remaining payments.

Steps to Complete the Maryland Form 500D

Filling out the Maryland Form 500D involves several key steps:

- Begin by entering your corporation's name and FEIN at the top of the form.

- Specify the fiscal year start and end dates to establish the reporting period.

- Indicate if there is a change of address by checking the appropriate box.

- Calculate the estimated income tax based on projected income for the fiscal year.

- Complete the section regarding vouchers for remaining payments if applicable.

- Review all information for accuracy before submission.

Obtaining the Maryland Form 500D

The Maryland Form 500D can be obtained through the Maryland State Comptroller's website or directly from their office. It is essential to ensure you have the most current version of the form to comply with state regulations. Additionally, many tax preparation software programs include the Maryland Form 500D, making it easier to fill out and submit electronically.

Legal Use of the Maryland Form 500D

Corporations are legally required to file the Maryland Form 500D if they expect to owe $500 or more in income tax for the year. This form helps ensure compliance with state tax laws and avoids potential penalties for underpayment. Accurate completion of the form is critical, as it serves as a declaration of estimated tax liability.

Filing Deadlines for the Maryland Form 500D

Corporations must submit the Maryland Form 500D by the due date specified for estimated tax payments. Typically, this deadline aligns with the corporation's fiscal year. It is important to stay informed about specific deadlines to avoid late fees and penalties. Check the Maryland State Comptroller's website for the most current deadlines and any changes to filing requirements.

Penalties for Non-Compliance

Failure to file the Maryland Form 500D or underestimating tax obligations can result in significant penalties. These may include interest on unpaid taxes, late filing fees, and potential legal action. Corporations should take care to file accurately and on time to mitigate these risks.

Quick guide on how to complete maryland form 500d corporation declaration of estimated income tax or fiscal year beginning ending check here if this is a

Complete [SKS] seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly and without interruption. Manage [SKS] on any device through airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and facilitate excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MARYLAND FORM 500D CORPORATION DECLARATION OF ESTIMATED INCOME TAX OR FISCAL YEAR BEGINNING , ENDING CHECK HERE IF THIS IS A CHA

Create this form in 5 minutes!

How to create an eSignature for the maryland form 500d corporation declaration of estimated income tax or fiscal year beginning ending check here if this is a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MARYLAND FORM 500D CORPORATION DECLARATION OF ESTIMATED INCOME TAX?

The MARYLAND FORM 500D CORPORATION DECLARATION OF ESTIMATED INCOME TAX is a form used by corporations to declare estimated income tax for fiscal years. It is essential for businesses to file this form to ensure compliance with Maryland tax laws. Proper submission helps corporations avoid penalties and ensures they are on track with their estimated taxes.

-

How do I submit the MARYLAND FORM 500D CORPORATION DECLARATION OF ESTIMATED INCOME TAX?

You can submit the MARYLAND FORM 500D CORPORATION DECLARATION OF ESTIMATED INCOME TAX electronically via the Maryland State Department of Assessments and Taxation's online platform or through traditional mail. Using digital solutions like airSlate SignNow can streamline this process by allowing you to eSign and send documents securely and efficiently.

-

Are there any fees associated with the MARYLAND FORM 500D CORPORATION DECLARATION?

Filing the MARYLAND FORM 500D CORPORATION DECLARATION does not incur a direct fee, but be mindful of potential penalties for late submissions. Using airSlate SignNow can help avoid these fees by ensuring timely document updates and submissions. Always check the Maryland tax website for the latest fee structures.

-

Can I make changes to my MARYLAND FORM 500D if my address changes?

Yes, if you have a change of address, you can indicate this on your MARYLAND FORM 500D CORPORATION DECLARATION OF ESTIMATED INCOME TAX. This ensures that all correspondence from the state signNowes you without any issues. Utilizing airSlate SignNow allows for easy modifications and timely submissions of updated forms.

-

What are the benefits of using airSlate SignNow for the MARYLAND FORM 500D?

Using airSlate SignNow for the MARYLAND FORM 500D CORPORATION DECLARATION simplifies the eSigning process, making it easier to manage and submit important tax documents. It enhances security and offers a cost-effective solution for handling your corporation's tax declarations efficiently. Additionally, you can track the document status for peace of mind.

-

How can airSlate SignNow help me with estimated tax payments?

airSlate SignNow provides tools to help you manage and track your estimated tax payments, including those required with the MARYLAND FORM 500D CORPORATION DECLARATION OF ESTIMATED INCOME TAX. You can set reminders, generate reports, and create payment vouchers all within the platform. This ensures that you stay organized and do not miss any payment deadlines.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers various features such as eSigning, document templates, secure cloud storage, and integration with other software for managing forms like the MARYLAND FORM 500D. These features promote ease of use and enhance workflow efficiency, making it ideal for businesses that need to complete tax-related documents quickly and effectively.

Get more for MARYLAND FORM 500D CORPORATION DECLARATION OF ESTIMATED INCOME TAX OR FISCAL YEAR BEGINNING , ENDING CHECK HERE IF THIS IS A CHA

Find out other MARYLAND FORM 500D CORPORATION DECLARATION OF ESTIMATED INCOME TAX OR FISCAL YEAR BEGINNING , ENDING CHECK HERE IF THIS IS A CHA

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free