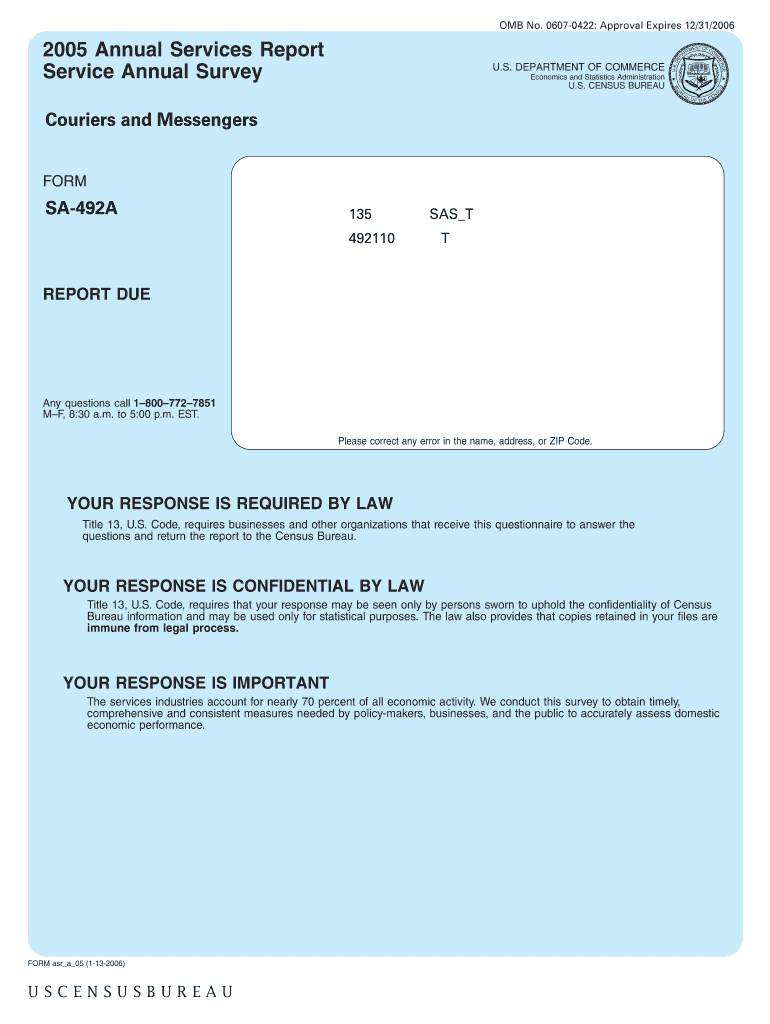

Couriers and Messengers Form

What is the Couriers And Messengers

The Couriers and Messengers form is a critical document used by businesses and individuals to report income received from courier and messenger services. This form is essential for ensuring compliance with federal tax regulations. It provides a structured way to disclose earnings, helping to maintain transparency in financial reporting. Understanding this form is vital for anyone involved in the delivery and logistics industry, as it outlines the necessary information required by the IRS.

How to use the Couriers And Messengers

Using the Couriers and Messengers form involves several steps to ensure accurate reporting. First, gather all relevant income information, including earnings from deliveries and any associated expenses. Next, fill out the form accurately, ensuring that all figures are correct. Once completed, the form must be submitted to the appropriate tax authority. It is crucial to keep a copy for your records, as this will be useful for future reference or in case of an audit.

Steps to complete the Couriers And Messengers

Completing the Couriers and Messengers form requires a systematic approach. Begin by collecting all necessary financial documents, such as invoices and payment records. Follow these steps:

- Enter your personal and business information at the top of the form.

- List all income received from courier and messenger services during the reporting period.

- Detail any deductions or expenses related to your operations.

- Review the form for accuracy before submission.

- Submit the completed form by the specified deadline.

Legal use of the Couriers And Messengers

The legal use of the Couriers and Messengers form is governed by IRS regulations. It is essential for businesses to understand their obligations under tax law. This form must be filed accurately to avoid penalties and ensure compliance with federal requirements. Businesses should consult legal or tax professionals if they have questions about their specific obligations or the legal implications of their reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Couriers and Messengers form are crucial to avoid penalties. Typically, forms must be submitted by the end of the tax year, with specific dates varying based on the type of entity filing. It is important to stay informed about these deadlines to ensure timely submission. Mark your calendar with important dates to help manage your filing responsibilities effectively.

Required Documents

To complete the Couriers and Messengers form, several documents are required. These may include:

- Records of all income received from courier and messenger services.

- Invoices issued to clients.

- Receipts for any business-related expenses.

- Previous year’s tax returns, if applicable, for reference.

Having these documents readily available will streamline the completion process and ensure accuracy in reporting.

Quick guide on how to complete couriers and messengers

Prepare [SKS] with ease on any gadget

Online document organization has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to locate the required template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage [SKS] on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to alter and eSign [SKS] effortlessly

- Obtain [SKS] and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your revisions.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Couriers And Messengers

Create this form in 5 minutes!

How to create an eSignature for the couriers and messengers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for Couriers And Messengers?

airSlate SignNow provides a range of features specifically designed for Couriers And Messengers, including customizable templates, real-time tracking, and secure document storage. These features enable efficient document handling, ensuring that your courier operations run smoothly and professionally. You can also integrate electronic signatures to streamline your workflow.

-

How does airSlate SignNow benefit Couriers And Messengers?

The benefit of using airSlate SignNow for Couriers And Messengers lies in its enhanced efficiency and cost-effectiveness. It helps businesses reduce paperwork, speeds up the delivery process with electronic signatures, and minimizes errors. This allows couriers and messengers to focus more on their core operations rather than administrative tasks.

-

What are the pricing options available for airSlate SignNow for Couriers And Messengers?

airSlate SignNow offers flexible pricing plans tailored for different needs of Couriers And Messengers. Whether you are a small business or a large courier service, you can choose a plan that best suits your budget. Each plan provides access to key features that facilitate efficient document management.

-

Can I integrate airSlate SignNow with other tools that I use for Couriers And Messengers?

Yes, airSlate SignNow is designed to seamlessly integrate with various tools and platforms that Couriers And Messengers may already be using. This includes CRM systems, cloud storage solutions, and more. Such integrations ensure that your workflow remains uninterrupted and synchronized across all platforms.

-

Is airSlate SignNow secure for Couriers And Messengers handling sensitive documents?

Absolutely, airSlate SignNow ensures top-notch security for Couriers And Messengers dealing with sensitive documents. It employs industry-standard encryption and adheres to compliance regulations to protect your data. This guarantees that your documents remain secure and confidential throughout the signing process.

-

How user-friendly is airSlate SignNow for Couriers And Messengers?

airSlate SignNow is exceptionally user-friendly, making it ideal for Couriers And Messengers who may not be tech-savvy. The intuitive interface allows for easy navigation and quick adoption. Users can swiftly learn to send, sign, and manage documents without extensive training.

-

What customer support options are available for Couriers And Messengers using airSlate SignNow?

airSlate SignNow provides comprehensive customer support for Couriers And Messengers, including email assistance, live chat, and an extensive help center. Whether you have questions about the features or need technical support, our team is available to assist you promptly. This ensures that any issues can be resolved quickly to maintain your workflow.

Get more for Couriers And Messengers

- The marriage application fee is 35 00 we accept cash or form

- Form 4 831 petition for writ of certiorari in

- Forms librarydomestic relations court of clermont county

- Joint custody plan 446928201 form

- Special reinstatement questionnaire form db 36a

- How to find my email address associated with my microsoft account form

- Affidavit of receipt of direct payments affidavit of receipt of direct payments form

- Utah courts procedure for appointing a guardian for an adult form

Find out other Couriers And Messengers

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form