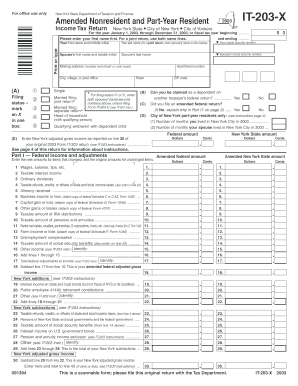

For Office Use Only it 203 X New York State Department of Taxation and Finance Amended Nonresident and Part Year Resident Income Form

Understanding the IT-203-X Form

The IT-203-X is an amended income tax return specifically designed for nonresidents and part-year residents of New York State. This form allows individuals to correct previously filed tax returns for the year, ensuring accurate reporting of income and tax liabilities. It is particularly relevant for those who have lived or worked in New York City or Yonkers during the tax year, as it addresses specific local tax obligations. The form must be completed accurately to reflect any changes in income, deductions, or credits that may affect the taxpayer's overall tax situation.

Steps to Complete the IT-203-X Form

Completing the IT-203-X form involves several key steps:

- Gather all relevant financial documents, including W-2s, 1099s, and previous tax returns.

- Clearly indicate the tax year for which you are amending your return.

- Fill out the personal information section, ensuring names and addresses are correct.

- Detail the changes being made, including any adjustments to income or deductions.

- Calculate the new tax liability based on the amended information provided.

- Sign and date the form before submission.

Obtaining the IT-203-X Form

The IT-203-X form can be obtained through the New York State Department of Taxation and Finance website. It is available for download in a PDF format, which can be printed and filled out manually. Additionally, taxpayers may request a paper copy by contacting the department directly. It is essential to ensure that the most current version of the form is used to avoid any processing delays.

Legal Use of the IT-203-X Form

The IT-203-X form is legally recognized for amending tax returns in New York State. It is important for taxpayers to use this form when they need to correct errors or omissions on their original filings. Failure to use the appropriate form may result in penalties or delays in processing. Taxpayers should ensure that all amendments comply with state tax laws and regulations.

Key Elements of the IT-203-X Form

Several key elements are crucial when completing the IT-203-X form:

- Taxpayer identification information, including Social Security numbers.

- Details of the original return being amended.

- Specific changes being made, with clear explanations for each adjustment.

- Revised tax calculations based on the amended information.

- Signature and date of the taxpayer or authorized representative.

Filing Deadlines for the IT-203-X Form

When amending a tax return using the IT-203-X form, it is important to adhere to filing deadlines. Generally, amended returns must be filed within three years from the original due date of the return or within two years from the date the tax was paid, whichever is later. Missing these deadlines may result in the inability to claim refunds or make necessary corrections.

Quick guide on how to complete for office use only it 203 x new york state department of taxation and finance amended nonresident and part year resident

Effortlessly Prepare [SKS] on Any Device

Online document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing access to the correct form and secure online storage. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly and without any delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The Easiest Way to Edit and eSign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to For Office Use Only IT 203 X New York State Department Of Taxation And Finance Amended Nonresident And Part Year Resident Income

Create this form in 5 minutes!

How to create an eSignature for the for office use only it 203 x new york state department of taxation and finance amended nonresident and part year resident

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the For Office Use Only IT 203 X New York State Department Of Taxation And Finance Amended Nonresident And Part Year Resident Income Tax Return?

The For Office Use Only IT 203 X New York State Department Of Taxation And Finance Amended Nonresident And Part Year Resident Income Tax Return is a form used by individuals who need to amend their income tax returns for New York State. This form allows you to correct previously filed information for the year January 1, , Through December, ensuring compliance with New York tax regulations.

-

What are the benefits of using airSlate SignNow for e-signing the IT 203 X?

Using airSlate SignNow simplifies the process of e-signing the For Office Use Only IT 203 X New York State Department Of Taxation And Finance Amended Nonresident And Part Year Resident Income Tax Return. Our solution is user-friendly and cost-effective, allowing for quick completion and submission of officially required documents.

-

Is airSlate SignNow compliant with New York State regulations regarding tax forms?

Yes, airSlate SignNow is fully compliant with New York State regulations. By utilizing our platform to manage the For Office Use Only IT 203 X New York State Department Of Taxation And Finance Amended Nonresident And Part Year Resident Income Tax Return, you can be assured that your e-signatures are legally binding and secure.

-

What features does airSlate SignNow offer specifically for tax documents?

AirSlate SignNow offers features such as customizable templates, document editing, and secure electronic signature capabilities. When dealing with the For Office Use Only IT 203 X New York State Department Of Taxation And Finance Amended Nonresident And Part Year Resident Income Tax Return, these tools streamline the filing process and enhance accuracy.

-

How does airSlate SignNow integrate with other financial software for tax reporting?

AirSlate SignNow integrates seamlessly with various financial software applications, making it easier to manage tax reporting processes. When filling out the For Office Use Only IT 203 X New York State Department Of Taxation And Finance Amended Nonresident And Part Year Resident Income Tax Return, these integrations help automate data entry and reduce errors.

-

What are the pricing options for using airSlate SignNow?

AirSlate SignNow offers flexible pricing plans to cater to different business needs, ensuring you can afford to e-sign crucial documents like the For Office Use Only IT 203 X New York State Department Of Taxation And Finance Amended Nonresident And Part Year Resident Income Tax Return. Pricing is based on usage and the number of users, providing a cost-effective solution.

-

Can I track the status of my IT 203 X submission using airSlate SignNow?

Yes, you can easily track the status of your For Office Use Only IT 203 X New York State Department Of Taxation And Finance Amended Nonresident And Part Year Resident Income Tax Return submissions through airSlate SignNow. Our platform provides real-time updates and notifications when documents are viewed and signed.

Get more for For Office Use Only IT 203 X New York State Department Of Taxation And Finance Amended Nonresident And Part Year Resident Income

- Ctoc owner form

- Primerica rollover form

- Reset document form

- Caps payroll direct deposit request castandcrew com form

- Fixed deposit certificate sample form

- Wells fargo homeowners association certification review form

- Www uslegalforms com form library 524366 httpsget httpsapi28 ilovepdf comv1download us legal forms

- Financial disclosure statement of petitionerjoint petitioner a form

Find out other For Office Use Only IT 203 X New York State Department Of Taxation And Finance Amended Nonresident And Part Year Resident Income

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free