New York State Department of Taxation and Finance Claim for City of New York School Tax Credit NYC 210 Important You Must Enter Form

Understanding the New York State Department Of Taxation And Finance Claim For City Of New York School Tax Credit NYC 210

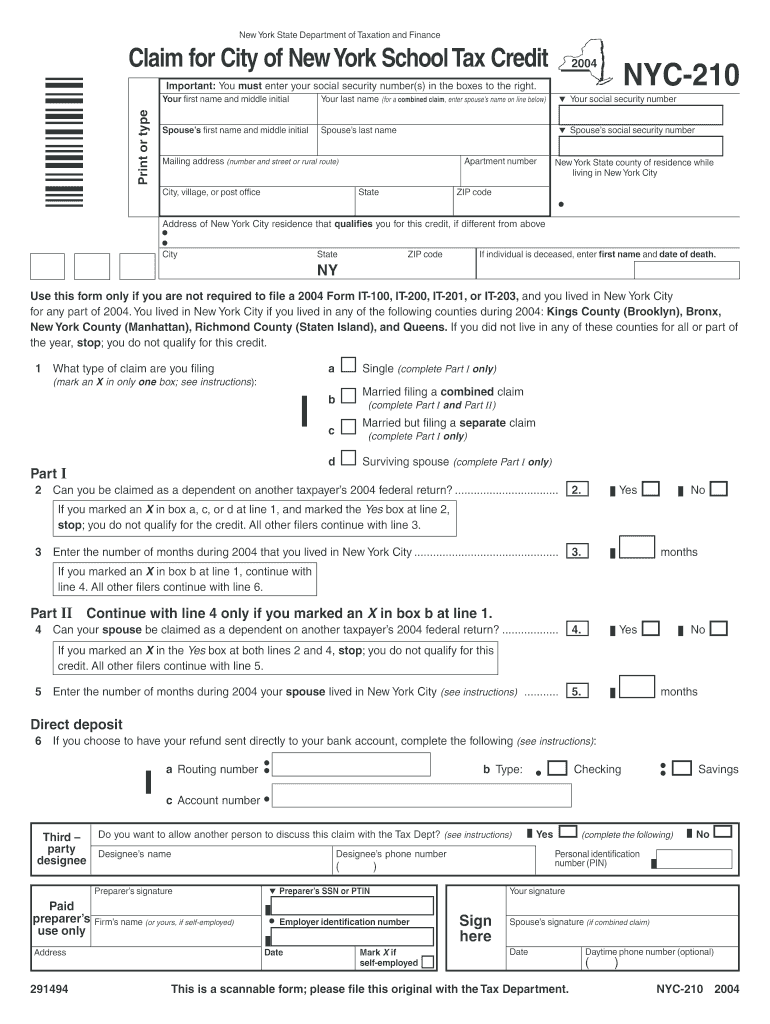

The New York State Department of Taxation and Finance Claim for City of New York School Tax Credit NYC 210 is a crucial form for residents of New York City who wish to claim a tax credit for school-related expenses. This form allows eligible taxpayers to reduce their tax liability, thereby easing the financial burden of educational costs. It is essential to ensure that all required information is accurately provided, including Social Security numbers, to avoid delays or complications in processing the claim.

Steps to Complete the NYC 210 Form

Completing the NYC 210 form involves several key steps. First, gather all necessary documentation, including proof of residency and any relevant financial information. Next, accurately fill out the form, ensuring that all sections are completed, particularly the boxes designated for Social Security numbers. After completing the form, review it for accuracy before submission. Finally, submit the form through the appropriate method, whether online, by mail, or in person, ensuring that it is sent before the specified deadline.

Eligibility Criteria for the NYC 210 School Tax Credit

To qualify for the NYC 210 School Tax Credit, applicants must meet specific eligibility requirements. Generally, this includes being a resident of New York City and having a valid Social Security number. Additionally, applicants should have incurred educational expenses that meet the criteria set forth by the New York State Department of Taxation and Finance. It is advisable to review the detailed eligibility guidelines provided with the form to ensure compliance.

Required Documents for Submission

When submitting the NYC 210 form, certain documents are typically required to support your claim. These may include proof of residency, such as a utility bill or lease agreement, and documentation of educational expenses, like receipts for school supplies or tuition payments. Having these documents ready will facilitate a smoother submission process and help substantiate your claim for the tax credit.

Form Submission Methods

The NYC 210 form can be submitted through various methods, providing flexibility for applicants. You can file the form online through the New York State Department of Taxation and Finance website, ensuring a quick and efficient process. Alternatively, you may choose to mail the completed form to the designated address or deliver it in person at a local tax office. It is important to choose the method that best suits your needs while adhering to submission deadlines.

Filing Deadlines for the NYC 210 Form

Filing deadlines for the NYC 210 form are crucial to ensure that you receive your tax credit. Typically, the form must be submitted by a specific date each year, often coinciding with the general tax filing deadline. It is important to check the current year's deadlines as they may vary. Missing the deadline could result in the forfeiture of the tax credit, so timely submission is essential.

Penalties for Non-Compliance

Failure to comply with the requirements for the NYC 210 form can lead to penalties, including the denial of the tax credit or potential fines. It is vital to ensure that all information is accurate and that the form is submitted on time. If discrepancies or errors are found, the New York State Department of Taxation and Finance may take action, which could affect your tax situation negatively. Being diligent in the completion and submission of this form helps mitigate such risks.

Quick guide on how to complete new york state department of taxation and finance claim for city of new york school tax credit nyc 210 important you must enter

Complete [SKS] seamlessly on any device

Online document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly option to conventional printed and signed papers, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents promptly without interruptions. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information using tools specifically designed for that by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to secure your modifications.

- Choose your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to New York State Department Of Taxation And Finance Claim For City Of New York School Tax Credit NYC 210 Important You Must Enter

Create this form in 5 minutes!

How to create an eSignature for the new york state department of taxation and finance claim for city of new york school tax credit nyc 210 important you must enter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New York State Department Of Taxation And Finance Claim For City Of New York School Tax Credit NYC 210?

The New York State Department Of Taxation And Finance Claim For City Of New York School Tax Credit NYC 210 is a form that residents can complete to claim their eligible school tax credit. To ensure accurate processing, it is crucial to enter your Social Security numbers in the designated boxes on the form. This process allows you to potentially reduce your taxes based on your income and property taxes paid.

-

How can airSlate SignNow assist with the NYC 210 tax credit form?

AirSlate SignNow streamlines the process of filling out the New York State Department Of Taxation And Finance Claim For City Of New York School Tax Credit NYC 210. With its easy-to-use interface, users can securely enter their information, including Social Security numbers, and electronically sign the document. This not only saves time but also ensures accuracy and compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for the NYC tax credit form?

AirSlate SignNow offers various pricing plans that cater to different needs, including a cost-effective solution suitable for both individuals and businesses. Potential users can explore these plans to find one that meets their budget while providing the necessary tools for managing the New York State Department Of Taxation And Finance Claim For City Of New York School Tax Credit NYC 210 efficiently. A free trial may also be available for new users.

-

What features does airSlate SignNow offer that are useful for filing tax forms?

AirSlate SignNow provides features such as electronic signatures, document templates, and secure cloud storage, making it ideal for filing the New York State Department Of Taxation And Finance Claim For City Of New York School Tax Credit NYC 210. Users can access their documents anytime and anywhere, facilitating a seamless application process. These features ensure you can fill out and submit your tax credit form with ease.

-

Can I integrate airSlate SignNow with other platforms for my tax filing needs?

Yes, airSlate SignNow offers integrations with various platforms, which can enhance the experience of handling the New York State Department Of Taxation And Finance Claim For City Of New York School Tax Credit NYC 210. Whether you are using accounting software or customer relationship management tools, these integrations enable a more efficient workflow, ensuring all necessary forms are filled out properly and submitted on time.

-

What benefits does using airSlate SignNow provide for individuals applying for tax credits?

Using airSlate SignNow for the New York State Department Of Taxation And Finance Claim For City Of New York School Tax Credit NYC 210 offers numerous benefits, including improved accuracy and reduced processing time. By electronically signing and submitting the form, individuals can avoid common pitfalls associated with paper submissions. This efficient process maximizes your chances of receiving the tax credits you are eligible for.

-

How does airSlate SignNow ensure the security of my personal information on tax forms?

AirSlate SignNow prioritizes user security by implementing robust encryption and secure access protocols to protect sensitive information, including Social Security numbers. When filling out the New York State Department Of Taxation And Finance Claim For City Of New York School Tax Credit NYC 210, users can feel confident their data is safe. Regular security audits also help maintain high standards of user privacy.

Get more for New York State Department Of Taxation And Finance Claim For City Of New York School Tax Credit NYC 210 Important You Must Enter

Find out other New York State Department Of Taxation And Finance Claim For City Of New York School Tax Credit NYC 210 Important You Must Enter

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast