Enter the Line 15 Amount on Form it 203, Line 32, and Mark an X in the Itemized Box Next to Line 32 Tax Ny

Understanding the Form IT-203 Requirements

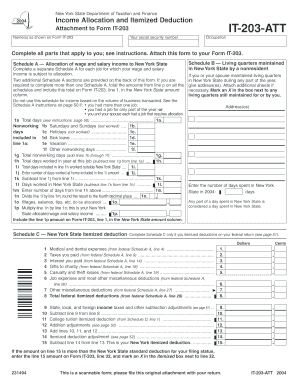

The form IT-203 is essential for non-residents and part-year residents of New York State to report income earned in New York. When filling out this form, it is crucial to accurately enter the amount from Line 15 on Line 32. This action indicates the total amount of income that is subject to New York State tax. Additionally, marking an X in the itemized box next to Line 32 signifies that you are opting for itemized deductions rather than the standard deduction, which can impact your overall tax liability.

Steps to Complete the IT-203 Form

To complete the IT-203 form accurately, follow these steps:

- Gather all necessary financial documents, including W-2s and 1099s that report your New York income.

- Locate Line 15 on the form, which typically reflects your total income from New York sources.

- Transfer the amount from Line 15 to Line 32.

- Check the itemized box next to Line 32 if you are claiming itemized deductions.

- Review the entire form for accuracy before submission.

Legal Use of the IT-203 Form

The IT-203 form is legally required for non-residents and part-year residents who earn income in New York. Filing this form ensures compliance with state tax laws and avoids potential penalties. It is important to provide accurate information, as any discrepancies can lead to audits or legal issues. Understanding the legal implications of this form helps taxpayers fulfill their obligations responsibly.

State-Specific Rules for the IT-203 Form

New York has specific regulations regarding the IT-203 form that differ from federal tax requirements. For instance, non-residents must only report income earned within the state. Additionally, certain deductions and credits may be available exclusively to New York taxpayers. Familiarizing yourself with these state-specific rules ensures that you maximize your deductions and comply with local tax laws.

Examples of IT-203 Form Usage

Consider a scenario where a part-year resident worked in New York from January to June. This individual must report only the income earned during this period on the IT-203 form. If their total income for that time was $50,000, they would enter this amount on Line 15 and subsequently on Line 32. If they choose to itemize deductions, they would mark the box next to Line 32, which may allow for greater tax savings compared to taking the standard deduction.

Filing Deadlines for the IT-203 Form

The IT-203 form must be filed by the due date of your federal tax return, which is typically April 15. If you require additional time, you may file for an extension, but it is essential to pay any estimated taxes owed by the original deadline to avoid penalties. Staying aware of these deadlines helps ensure timely compliance with New York State tax obligations.

Quick guide on how to complete enter the line 15 amount on form it 203 line 32 and mark an x in the itemized box next to line 32 tax ny

Prepare [SKS] seamlessly on any gadget

Web-based document administration has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documentation, allowing you to locate the correct form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without interruptions. Manage [SKS] on any gadget using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the features we offer to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Enter The Line 15 Amount On Form IT 203, Line 32, And Mark An X In The Itemized Box Next To Line 32 Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the enter the line 15 amount on form it 203 line 32 and mark an x in the itemized box next to line 32 tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to enter the Line 15 amount on Form IT 203?

To enter the Line 15 amount on Form IT 203, you need to carefully review your income details and ensure accuracy. After calculating the correct amount, make sure to enter the Line 15 amount on Form IT 203, Line 32, and mark an X in the itemized box next to Line 32 Tax NY for proper filing.

-

How can airSlate SignNow assist with tax document management?

airSlate SignNow streamlines the process of preparing and signing tax documents, including forms like IT 203. By using our platform, you can efficiently enter the Line 15 amount on Form IT 203, Line 32, and mark an X in the itemized box next to Line 32 Tax NY, making tax management hassle-free.

-

What features does airSlate SignNow offer for eSigning tax documents?

Our platform provides a user-friendly interface for eSigning tax documents with features like customizable templates and secure signing workflows. This simplifies the process, ensuring you correctly enter the Line 15 amount on Form IT 203, Line 32, and mark an X in the itemized box next to Line 32 Tax NY without any delays.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. By utilizing our service, you can save time and costs by ensuring you enter the Line 15 amount on Form IT 203, Line 32, and mark an X in the itemized box next to Line 32 Tax NY correctly.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers seamless integration with various software applications. This allows you to manage your tax documents more effectively, including the required step to enter the Line 15 amount on Form IT 203, Line 32, and mark an X in the itemized box next to Line 32 Tax NY.

-

What benefits does eSigning my tax forms offer?

eSigning your tax forms with airSlate SignNow provides convenience and security. You can easily enter the Line 15 amount on Form IT 203, Line 32, and mark an X in the itemized box next to Line 32 Tax NY digitally, ensuring your documents are signed and filed on time.

-

Is it easy to navigate the airSlate SignNow platform?

Yes, our platform is built with user-friendliness in mind, making it easy for anyone to navigate. From entering the Line 15 amount on Form IT 203, Line 32, to marking an X in the itemized box next to Line 32 Tax NY, users will find the process smooth and intuitive.

Get more for Enter The Line 15 Amount On Form IT 203, Line 32, And Mark An X In The Itemized Box Next To Line 32 Tax Ny

- Food application form

- Foreign court subpoena form

- Forms justia comtennesseelocal countyjustia writ of habeas corpus tennessee circuit court

- Pdf bail indemnitor disclosure statement form

- Temporary building permit request application for temporary building permit request in austin texas form

- Up sandyspringsga gov sites defaultcontractor affidavit up sandyspringsga gov form

- Authorizations owner officeramp39s name merchant banking resources form

- Encroachment permit application home westfield in form

Find out other Enter The Line 15 Amount On Form IT 203, Line 32, And Mark An X In The Itemized Box Next To Line 32 Tax Ny

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF