Form 4137, Social Security and Medicare Tax on Unreported Tip Income

What is the Form 4137, Social Security And Medicare Tax On Unreported Tip Income

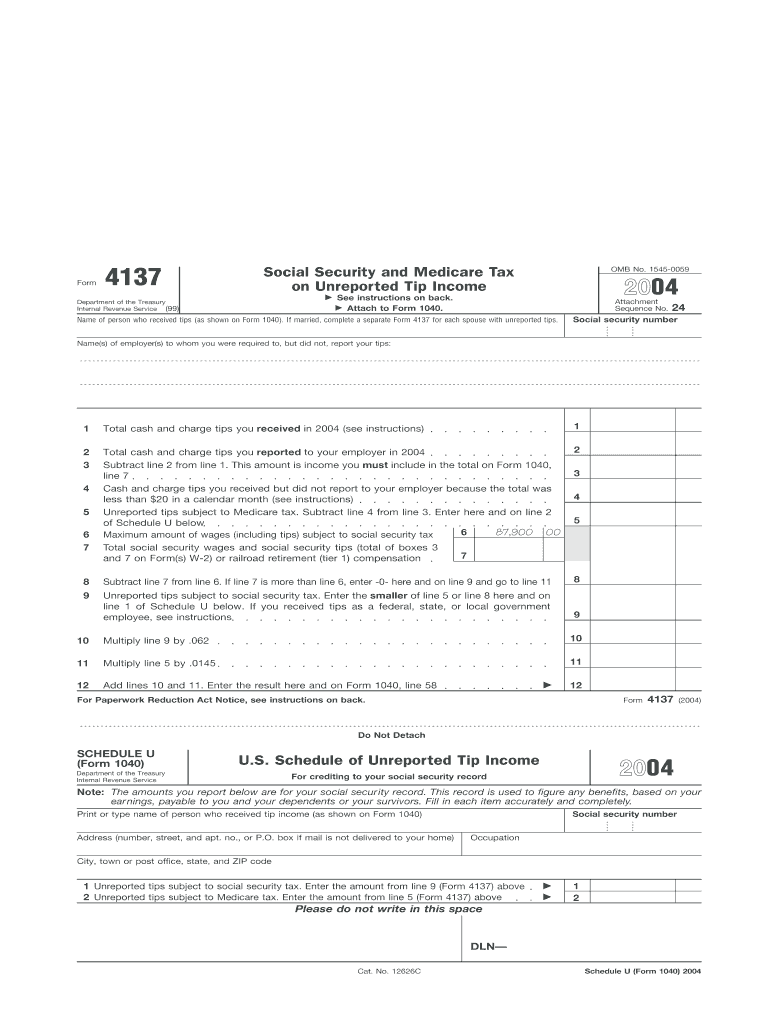

The Form 4137 is used to report Social Security and Medicare tax on unreported tip income for employees who receive tips in the course of their employment. This form is essential for individuals working in industries where tipping is common, such as restaurants and hospitality. By reporting unreported tips, employees ensure compliance with federal tax obligations and contribute to their Social Security and Medicare benefits.

How to use the Form 4137, Social Security And Medicare Tax On Unreported Tip Income

To use Form 4137 effectively, individuals must first gather all relevant information regarding their unreported tip income. This includes the total amount of tips received during the year that were not reported to their employer. The form requires the taxpayer to calculate the appropriate amount of Social Security and Medicare tax owed based on this unreported income. Once completed, the form should be submitted along with the individual's tax return to the Internal Revenue Service (IRS).

Steps to complete the Form 4137, Social Security And Medicare Tax On Unreported Tip Income

Completing Form 4137 involves several key steps:

- Gather documentation of all unreported tips received throughout the year.

- Calculate the total unreported tips and enter this amount on the form.

- Determine the applicable Social Security and Medicare tax rates to calculate the total tax owed.

- Fill out the form accurately, ensuring all information is correct.

- Attach the completed Form 4137 to your tax return when filing.

Key elements of the Form 4137, Social Security And Medicare Tax On Unreported Tip Income

Key elements of Form 4137 include the reporting of total unreported tips, the calculation of Social Security and Medicare taxes, and the identification of the taxpayer's information. The form requires specific details such as the taxpayer's name, Social Security number, and the total amount of tips received. It is crucial to ensure all calculations are accurate to avoid any issues with the IRS.

Filing Deadlines / Important Dates

Form 4137 must be filed as part of the annual tax return, which is typically due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of these deadlines to avoid late filing penalties. Additionally, if an extension is filed for the tax return, the same extension applies to Form 4137.

Penalties for Non-Compliance

Failure to report unreported tip income using Form 4137 can result in significant penalties. The IRS may impose fines for underreporting income, which can include interest on unpaid taxes and additional penalties for late filing. It is essential for employees in tip-receiving positions to accurately report their income to avoid these repercussions and ensure compliance with federal tax laws.

Quick guide on how to complete form 4137 social security and medicare tax on unreported tip income

Effortlessly complete [SKS] on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and select Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which is quick and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your alterations.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 4137, Social Security And Medicare Tax On Unreported Tip Income

Create this form in 5 minutes!

How to create an eSignature for the form 4137 social security and medicare tax on unreported tip income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 4137, Social Security And Medicare Tax On Unreported Tip Income?

Form 4137, Social Security And Medicare Tax On Unreported Tip Income, is used by employees to report tips that were not included in their income. This form ensures that employees pay the necessary Social Security and Medicare taxes on income earned from tips. Proper use of this form can help avoid potential tax penalties and ensure compliance.

-

How can airSlate SignNow assist with Form 4137 submissions?

With airSlate SignNow, you can easily create, send, and eSign Form 4137, Social Security And Medicare Tax On Unreported Tip Income online. The platform streamlines the submission process, making it more efficient and error-free. Our user-friendly interface ensures that you can complete this important tax form quickly and effectively.

-

What features does airSlate SignNow offer for tax document management?

AirSlate SignNow offers features such as customizable templates, secure eSigning, and seamless document storage for forms like Form 4137, Social Security And Medicare Tax On Unreported Tip Income. These tools help you manage your tax documents efficiently and ensure that you never miss a deadline. Collaboration features also allow multiple parties to review and sign documents simultaneously.

-

Is airSlate SignNow cost-effective for small businesses handling Form 4137?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing paperwork like Form 4137, Social Security And Medicare Tax On Unreported Tip Income. Our pricing plans are tailored to fit the budgets of businesses of all sizes while offering powerful features that enhance productivity. Investing in this solution can lead to signNow time and cost savings.

-

What integrations does airSlate SignNow support for tax documents?

AirSlate SignNow integrates seamlessly with popular accounting and tax software, allowing for smooth workflows when handling Form 4137, Social Security And Medicare Tax On Unreported Tip Income. Integration with platforms like QuickBooks and Xero enables you to sync your tax data effortlessly. This ensures you can manage all aspects of your business finance in one place.

-

How secure is my information when using airSlate SignNow for Form 4137?

When using airSlate SignNow for Form 4137, Social Security And Medicare Tax On Unreported Tip Income, your information is safeguarded with industry-standard encryption and security protocols. We prioritize data protection and compliance to ensure that sensitive tax information remains private. You can focus on completing your documents without worrying about privacy concerns.

-

Can I access my Form 4137 documents from multiple devices using airSlate SignNow?

Yes, airSlate SignNow allows you to access your documents, including Form 4137, Social Security And Medicare Tax On Unreported Tip Income, from various devices. Our cloud-based solution ensures that your documents are available anytime, anywhere. This flexibility is particularly beneficial for professionals who are often on the move.

Get more for Form 4137, Social Security And Medicare Tax On Unreported Tip Income

- Lio ns club cha rt er a p p l i c a t i o n w o r k s h eet form

- Vehicle inspection form templates business templates

- Confidential healthdeclaration thisdocumentistobef form

- All sag documents sag aftra form

- Naacp candidates consent form i consent to serve

- Pdf version here lekki concession company form

- Qdoba donation request 400945045 form

- Residence permit application on the basis of other employment form

Find out other Form 4137, Social Security And Medicare Tax On Unreported Tip Income

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors