Form 8554 Rev October Fill in Capable Application for Renewal of Enrollment to Practice Before the Internal Revenue Service

What is the Form 8554 Rev October Fill In Capable Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service

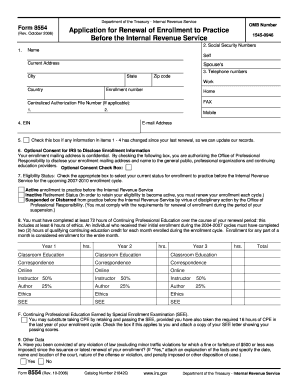

The Form 8554 Rev October is an official document used by tax professionals to renew their enrollment to practice before the Internal Revenue Service (IRS). This form is essential for individuals who provide tax advice or represent clients in front of the IRS. It ensures that practitioners maintain their eligibility and comply with IRS regulations. The form is specifically designed for enrolled agents, allowing them to continue their representation of taxpayers effectively.

How to use the Form 8554 Rev October Fill In Capable Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service

Using the Form 8554 Rev October involves several steps to ensure proper completion and submission. Practitioners must fill in their personal information, including their name, address, and Social Security number. Additionally, they need to provide details regarding their enrollment status and any continuing education credits earned. Once completed, the form must be submitted to the IRS for processing. It is crucial to review the form for accuracy before submission to avoid delays in renewal.

Steps to complete the Form 8554 Rev October Fill In Capable Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service

Completing the Form 8554 Rev October requires careful attention to detail. Follow these steps:

- Gather necessary information, including your Social Security number and prior enrollment details.

- Fill out the personal information section accurately.

- Indicate your continuing education credits and any relevant courses completed.

- Review the form for completeness and correctness.

- Submit the form to the IRS by the specified deadline.

Eligibility Criteria

Eligibility for using the Form 8554 Rev October is primarily for individuals who are already enrolled agents or those seeking to renew their enrollment. Applicants must have completed the required continuing education hours and adhere to the ethical standards set by the IRS. It is important to ensure that all qualifications are met before submitting the renewal application to avoid any issues with the renewal process.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8554 Rev October are critical to maintaining your enrollment status. Generally, the form must be submitted by the end of the enrollment period, which is typically every three years. Specific dates may vary, so it is advisable to check the IRS website or consult with a tax professional for the exact deadlines relevant to your situation. Timely submission is essential to avoid lapses in your ability to practice before the IRS.

Form Submission Methods (Online / Mail / In-Person)

The Form 8554 Rev October can be submitted through various methods. Practitioners have the option to file online, which is often the quickest way to ensure processing. Alternatively, the form can be mailed to the appropriate IRS address or submitted in person at designated IRS offices. Each submission method has its own processing times and requirements, so it is important to choose the one that best suits your needs.

Quick guide on how to complete form 8554 rev october fill in capable application for renewal of enrollment to practice before the internal revenue service

Complete [SKS] with ease on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with everything necessary to create, modify, and eSign your documents promptly without interruptions. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign [SKS] effortlessly

- Locate [SKS] and select Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign [SKS] and ensure clear communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8554 Rev October Fill In Capable Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service

Create this form in 5 minutes!

How to create an eSignature for the form 8554 rev october fill in capable application for renewal of enrollment to practice before the internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8554 Rev October Fill In Capable Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service?

The Form 8554 Rev October Fill In Capable Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service is a crucial document for tax professionals seeking to renew their enrollment. This form ensures that practitioners remain compliant with IRS regulations and can continue to represent clients effectively. Completing this form accurately is essential for maintaining your professional standing.

-

How can airSlate SignNow help with the Form 8554 Rev October Fill In Capable Application?

airSlate SignNow provides an intuitive platform for completing and eSigning the Form 8554 Rev October Fill In Capable Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service. Our solution simplifies the process, allowing users to fill in the form digitally, ensuring accuracy and compliance. With our platform, you can streamline your application process and save valuable time.

-

What are the pricing options for using airSlate SignNow for the Form 8554 Rev October Fill In Capable Application?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various users, including those needing to complete the Form 8554 Rev October Fill In Capable Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service. Our plans are designed to be cost-effective, ensuring you get the best value for your investment. You can choose from monthly or annual subscriptions based on your usage requirements.

-

What features does airSlate SignNow offer for completing the Form 8554 Rev October Fill In Capable Application?

airSlate SignNow includes a range of features that enhance the completion of the Form 8554 Rev October Fill In Capable Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service. These features include customizable templates, secure eSigning, and real-time collaboration tools. Our platform ensures that you can fill out and submit your application efficiently and securely.

-

Is airSlate SignNow secure for submitting the Form 8554 Rev October Fill In Capable Application?

Yes, airSlate SignNow prioritizes security, making it a safe choice for submitting the Form 8554 Rev October Fill In Capable Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service. We utilize advanced encryption and security protocols to protect your sensitive information. You can trust that your data is secure while using our platform.

-

Can I integrate airSlate SignNow with other applications for the Form 8554 Rev October Fill In Capable Application?

Absolutely! airSlate SignNow offers seamless integrations with various applications, enhancing your workflow for the Form 8554 Rev October Fill In Capable Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service. Whether you use CRM systems, document management tools, or other software, our integrations help streamline your processes and improve efficiency.

-

What are the benefits of using airSlate SignNow for the Form 8554 Rev October Fill In Capable Application?

Using airSlate SignNow for the Form 8554 Rev October Fill In Capable Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service offers numerous benefits, including time savings, increased accuracy, and enhanced compliance. Our user-friendly platform allows you to complete and submit your application quickly, reducing the risk of errors. Additionally, our eSigning feature ensures that your documents are legally binding and secure.

Get more for Form 8554 Rev October Fill In Capable Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service

- Attestation of ownership form myrexis inc

- Omb approval no 1870 0503 form

- Instructions to builders for completing certificates of participation form

- Designation of beneficiary alternate benefit program form

- Add on form to register additional equipment only nj gov

- Forms ampamp documentsgirl scouts of southeastern michigan

- Ds 3026 medical history and physical examination worksheet form

- Dog license barry county form

Find out other Form 8554 Rev October Fill In Capable Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word