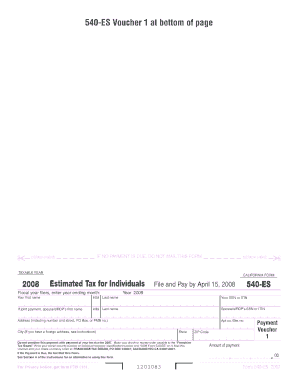

Estimated Tax for Individuals California Form 540 ES

What is the Estimated Tax For Individuals California Form 540 ES

The Estimated Tax For Individuals California Form 540 ES is a tax form used by individuals in California to report and pay estimated state income taxes. This form is particularly important for those who expect to owe tax of one hundred dollars or more when filing their annual tax return. The form allows taxpayers to calculate their estimated tax liability based on their expected income, deductions, and credits for the year.

Using Form 540 ES helps individuals avoid underpayment penalties by ensuring they pay sufficient taxes throughout the year. It is essential for self-employed individuals, freelancers, and those with income not subject to withholding, such as rental income or investment earnings.

How to use the Estimated Tax For Individuals California Form 540 ES

To effectively use the Estimated Tax For Individuals California Form 540 ES, individuals should first gather relevant financial documents, including income statements and prior year tax returns. The form consists of several sections where taxpayers will input their estimated income, deductions, and credits.

Once completed, the form can be submitted in multiple ways, including online, by mail, or in person at designated locations. It is crucial to keep a copy of the submitted form for personal records and future reference.

Steps to complete the Estimated Tax For Individuals California Form 540 ES

Completing the Estimated Tax For Individuals California Form 540 ES involves several key steps:

- Gather financial documents, including W-2s, 1099s, and previous tax returns.

- Determine your expected income for the year, including wages, self-employment income, and any other sources.

- Calculate your deductions and credits to arrive at your taxable income.

- Use the tax tables provided with the form to estimate your tax liability.

- Divide your estimated tax liability by the number of payment periods to determine the amount due for each period.

- Complete the form with the calculated amounts and personal information.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Estimated Tax For Individuals California Form 540 ES. Generally, estimated tax payments are due on the following dates:

- April 15 for the first payment

- June 15 for the second payment

- September 15 for the third payment

- January 15 of the following year for the fourth payment

Taxpayers should ensure that payments are made by these dates to avoid penalties and interest on unpaid taxes.

Key elements of the Estimated Tax For Individuals California Form 540 ES

The key elements of the Estimated Tax For Individuals California Form 540 ES include sections for personal information, estimated income, deductions, and credits. Taxpayers must also indicate their payment schedule and the total amount of estimated tax due for the year. Additionally, the form provides instructions for calculating the estimated tax based on current tax rates and regulations.

Understanding these elements is crucial for accurately completing the form and ensuring compliance with California tax laws.

Who Issues the Form

The Estimated Tax For Individuals California Form 540 ES is issued by the California Franchise Tax Board (FTB). The FTB is responsible for administering California's income tax laws and ensuring that taxpayers comply with their tax obligations. Taxpayers can obtain the form directly from the FTB's website or through authorized tax preparation services.

Quick guide on how to complete estimated tax for individuals california form 540 es

Prepare [SKS] effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed forms, allowing you to locate the correct template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] seamlessly on any device using the airSlate SignNow Android or iOS applications and simplify any document-oriented task today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or blackout sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your updates.

- Choose how you wish to send your form—through email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Estimated Tax For Individuals California Form 540 ES

Create this form in 5 minutes!

How to create an eSignature for the estimated tax for individuals california form 540 es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Estimated Tax For Individuals California Form 540 ES?

The Estimated Tax For Individuals California Form 540 ES is a form used by California residents to report and pay estimated taxes on income that is not subject to withholding. This form helps individuals calculate their estimated tax liability for the year and ensures they stay compliant with state tax regulations.

-

How can airSlate SignNow help with the Estimated Tax For Individuals California Form 540 ES?

airSlate SignNow provides a seamless platform for electronically signing and sending the Estimated Tax For Individuals California Form 540 ES. With our user-friendly interface, you can easily manage your tax documents and ensure they are submitted on time, reducing the stress of tax season.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as eSignature capabilities, document templates, and secure cloud storage, all of which are essential for managing the Estimated Tax For Individuals California Form 540 ES. These features streamline the process, making it easier to prepare and submit your tax forms efficiently.

-

Is airSlate SignNow cost-effective for individuals filing taxes?

Yes, airSlate SignNow is a cost-effective solution for individuals needing to file the Estimated Tax For Individuals California Form 540 ES. Our pricing plans are designed to fit various budgets, ensuring that you can access essential eSigning features without breaking the bank.

-

Can I integrate airSlate SignNow with other tax software?

Absolutely! airSlate SignNow can be integrated with various tax software solutions, allowing you to easily import and export your Estimated Tax For Individuals California Form 540 ES. This integration simplifies the workflow, ensuring that all your tax documents are in one place.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for your Estimated Tax For Individuals California Form 540 ES offers numerous benefits, including enhanced security, ease of use, and time savings. Our platform ensures that your documents are securely signed and stored, giving you peace of mind during tax season.

-

How do I get started with airSlate SignNow for my tax documents?

Getting started with airSlate SignNow is simple! Sign up for an account, and you can begin uploading and managing your Estimated Tax For Individuals California Form 540 ES right away. Our intuitive interface guides you through the process, making it easy to eSign and send your documents.

Get more for Estimated Tax For Individuals California Form 540 ES

Find out other Estimated Tax For Individuals California Form 540 ES

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF