Ira Investment through Goldstar Trust Company Ira Form

Understanding the IRA Investment Through Goldstar Trust Company IRA

The IRA investment through Goldstar Trust Company IRA allows individuals to diversify their retirement portfolios by investing in alternative assets such as precious metals, real estate, and more. This type of investment is particularly appealing for those looking to hedge against market volatility and inflation. Goldstar Trust Company acts as a custodian, ensuring compliance with IRS regulations while providing account holders with the flexibility to manage their investments effectively.

How to Utilize the IRA Investment Through Goldstar Trust Company IRA

To utilize an IRA investment through Goldstar Trust Company, individuals must first establish an account with the company. This involves completing the necessary paperwork and providing identification. Once the account is set up, investors can fund their IRA through contributions or rollovers from existing retirement accounts. After funding, investors can select their desired assets to include in their portfolio, ensuring they adhere to IRS guidelines regarding permissible investments.

Steps to Complete the IRA Investment Through Goldstar Trust Company IRA

Completing an IRA investment through Goldstar Trust Company involves several key steps:

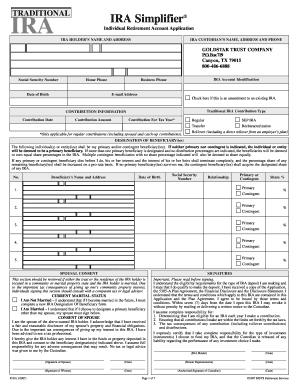

- Open an IRA account with Goldstar Trust Company by submitting the required application forms.

- Fund your IRA through direct contributions or by rolling over funds from another retirement account.

- Select the types of investments you wish to include, such as gold, silver, or real estate.

- Complete any additional documentation required for your chosen investments.

- Submit all necessary forms to Goldstar Trust Company for processing.

Legal Considerations for the IRA Investment Through Goldstar Trust Company IRA

Investing through an IRA with Goldstar Trust Company must comply with IRS regulations. This includes adhering to contribution limits, understanding prohibited transactions, and ensuring that all investments are eligible under IRS guidelines. It is crucial for investors to familiarize themselves with these legal requirements to avoid penalties and ensure the tax-advantaged status of their IRA remains intact.

Required Documents for IRA Investment Through Goldstar Trust Company IRA

When setting up an IRA investment through Goldstar Trust Company, several documents are typically required:

- Completed IRA application form.

- Identification documents, such as a driver’s license or passport.

- Proof of income or financial statements for contribution verification.

- Any additional forms specific to the investments being made.

IRS Guidelines for IRA Investments

The IRS provides specific guidelines that govern IRA investments, including what types of assets can be held within an IRA and the tax implications of various transactions. Investors should consult IRS publications or a tax professional to understand these guidelines fully. Key points include contribution limits, distribution rules, and the tax treatment of gains from investments held within the IRA.

Quick guide on how to complete ira investment through goldstar trust company ira

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources you require to create, alter, and eSign your documents quickly and without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign [SKS] without any hassle

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and eSign [SKS] while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Ira Investment Through Goldstar Trust Company Ira

Create this form in 5 minutes!

How to create an eSignature for the ira investment through goldstar trust company ira

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRA investment through Goldstar Trust Company IRA?

An IRA investment through Goldstar Trust Company IRA allows individuals to invest in alternative assets like real estate, precious metals, and more within their retirement accounts. This type of investment can provide diversification and potential tax advantages, making it an attractive option for retirement planning.

-

How does airSlate SignNow facilitate IRA investments through Goldstar Trust Company IRA?

airSlate SignNow streamlines the documentation process for IRA investments through Goldstar Trust Company IRA by providing an easy-to-use platform for eSigning and sending necessary documents. This ensures that all paperwork is handled efficiently, allowing investors to focus on their investment strategies.

-

What are the fees associated with IRA investments through Goldstar Trust Company IRA?

The fees for IRA investments through Goldstar Trust Company IRA can vary based on the type of investment and account management services. It's important to review the fee structure provided by Goldstar Trust Company to understand any costs associated with setting up and maintaining your IRA investment.

-

What are the benefits of using Goldstar Trust Company for IRA investments?

Using Goldstar Trust Company for IRA investments offers several benefits, including access to a wide range of alternative investment options and expert guidance on managing your IRA. Additionally, their services can help simplify the investment process, making it easier to achieve your retirement goals.

-

Can I integrate airSlate SignNow with my existing financial tools for IRA investments?

Yes, airSlate SignNow can be integrated with various financial tools and platforms to enhance your IRA investment experience through Goldstar Trust Company IRA. This integration allows for seamless document management and eSigning, ensuring that all your investment-related paperwork is organized and accessible.

-

What types of assets can I invest in through Goldstar Trust Company IRA?

With Goldstar Trust Company IRA, you can invest in a variety of assets, including real estate, precious metals, private equity, and more. This flexibility allows you to diversify your portfolio and tailor your IRA investment strategy to meet your individual financial goals.

-

How secure is my information when using airSlate SignNow for IRA investments?

airSlate SignNow prioritizes the security of your information when handling IRA investments through Goldstar Trust Company IRA. The platform employs advanced encryption and security protocols to ensure that all documents and personal data are protected throughout the eSigning process.

Get more for Ira Investment Through Goldstar Trust Company Ira

- Instructions in order for the court to assign your case to the proper court location this venue declaration is required form

- Docest comrfp title court security modificationrfp title court security modification docest form

- Mediation data sheet form

- Advance health care directive formpage 1 of 7print

- Sc 6021 form

- California revocation of premarital or prenuptial agreement form

- Select one marital uniform parentage agreement

- Escrow no form

Find out other Ira Investment Through Goldstar Trust Company Ira

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now