Form 1120NF, Nebraska Financial Institution Tax Return Revenue Ne

What is the Form 1120NF, Nebraska Financial Institution Tax Return Revenue Ne

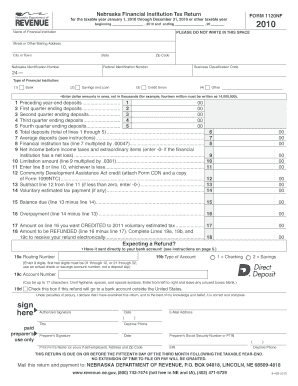

The Form 1120NF is a tax return specifically designed for financial institutions operating in Nebraska. This form is used to report the income, deductions, and tax liability of financial entities, such as banks and credit unions, that are subject to the Nebraska Financial Institution Tax. It ensures compliance with state tax regulations and provides the Nebraska Department of Revenue with essential financial information.

How to use the Form 1120NF, Nebraska Financial Institution Tax Return Revenue Ne

Using the Form 1120NF involves several steps to ensure accurate reporting of financial data. First, gather all necessary financial documents, including income statements and balance sheets. Next, complete the form by entering relevant financial figures, such as gross income and allowable deductions. Finally, review the completed form for accuracy before submission to ensure compliance with state tax laws.

Steps to complete the Form 1120NF, Nebraska Financial Institution Tax Return Revenue Ne

Completing the Form 1120NF requires attention to detail. Follow these steps:

- Obtain the latest version of the Form 1120NF from the Nebraska Department of Revenue.

- Fill in the identification section with your institution's name, address, and tax identification number.

- Report total income and any applicable deductions in the designated sections.

- Calculate the tax liability based on the provided instructions.

- Sign and date the form to certify its accuracy before submission.

Filing Deadlines / Important Dates

It is crucial to adhere to filing deadlines for the Form 1120NF to avoid penalties. Typically, the form must be submitted by the fifteenth day of the fourth month following the end of the tax year. For institutions operating on a calendar year basis, this means the deadline is April 15. Always verify specific dates for the current tax year, as they may vary.

Required Documents

To successfully complete the Form 1120NF, several documents are necessary. These include:

- Financial statements, including income statements and balance sheets.

- Records of all income sources and deductions.

- Previous tax returns, if applicable, for reference.

- Any additional documentation required by the Nebraska Department of Revenue.

Penalties for Non-Compliance

Failure to file the Form 1120NF on time or inaccuracies in the submitted information can result in penalties. These may include fines based on the amount of tax owed or additional interest charges on late payments. It is essential to ensure timely and accurate submission to avoid these financial repercussions.

Quick guide on how to complete form 1120nf nebraska financial institution tax return revenue ne

Finalize [SKS] effortlessly on any device

Online document handling has gained traction with businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly without waiting. Handle [SKS] on any device using airSlate SignNow Android or iOS apps and simplify any document-related task today.

The easiest way to edit and eSign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or mask sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that require reprinting. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1120nf nebraska financial institution tax return revenue ne

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1120NF, Nebraska Financial Institution Tax Return Revenue Ne?

Form 1120NF, Nebraska Financial Institution Tax Return Revenue Ne, is a tax form specifically designed for financial institutions operating in Nebraska. This form is used to report income, deductions, and tax liability to the state. Understanding this form is crucial for compliance and accurate tax reporting.

-

How can airSlate SignNow help with filing Form 1120NF?

airSlate SignNow streamlines the process of preparing and submitting Form 1120NF, Nebraska Financial Institution Tax Return Revenue Ne, by providing easy-to-use templates and eSignature capabilities. This ensures that your documents are completed accurately and submitted on time. Our platform simplifies the entire workflow, making tax season less stressful.

-

What are the pricing options for using airSlate SignNow for Form 1120NF?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose from monthly or annual subscriptions, which provide access to features that simplify the completion of Form 1120NF, Nebraska Financial Institution Tax Return Revenue Ne. Our cost-effective solution ensures you get the best value for your document management needs.

-

What features does airSlate SignNow offer for Form 1120NF?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all tailored to assist with Form 1120NF, Nebraska Financial Institution Tax Return Revenue Ne. These features enhance efficiency and ensure that your tax documents are handled securely and professionally.

-

Is airSlate SignNow compliant with Nebraska tax regulations?

Yes, airSlate SignNow is designed to comply with Nebraska tax regulations, including those related to Form 1120NF, Nebraska Financial Institution Tax Return Revenue Ne. Our platform is regularly updated to reflect any changes in tax laws, ensuring that your submissions are compliant and accurate.

-

Can I integrate airSlate SignNow with other accounting software for Form 1120NF?

Absolutely! airSlate SignNow offers integrations with various accounting software, making it easier to manage your financial documents, including Form 1120NF, Nebraska Financial Institution Tax Return Revenue Ne. This integration helps streamline your workflow and ensures that all your financial data is synchronized.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like Form 1120NF, Nebraska Financial Institution Tax Return Revenue Ne, provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform allows for quick document preparation and eSigning, which saves time and minimizes the risk of mistakes during tax filing.

Get more for Form 1120NF, Nebraska Financial Institution Tax Return Revenue Ne

Find out other Form 1120NF, Nebraska Financial Institution Tax Return Revenue Ne

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation