Schedule C Form 1040 Fill in Version Profit or Loss from Business Sole Proprietorship

What is the Schedule C Form 1040 Fill in Version Profit Or Loss From Business Sole Proprietorship

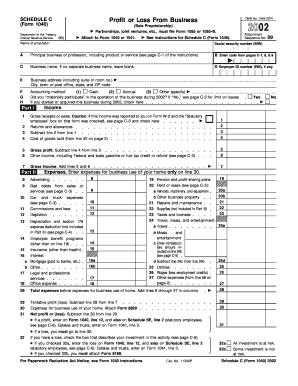

The Schedule C Form 1040 is a crucial document for sole proprietors in the United States. It is used to report income or loss from a business operated as a sole proprietorship. This form provides a detailed account of the business's financial activities, allowing the IRS to assess the taxpayer's earnings and tax obligations. The Schedule C is typically attached to the individual’s Form 1040 when filing annual income taxes. It includes sections for reporting gross receipts, expenses, and the net profit or loss from the business. Understanding this form is essential for accurate tax reporting and compliance.

How to use the Schedule C Form 1040 Fill in Version Profit Or Loss From Business Sole Proprietorship

Using the Schedule C Form 1040 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements, receipts for expenses, and any other relevant records. Next, fill out the form by entering your business name, address, and identifying information. Report your gross receipts in the designated section, followed by detailed listings of your business expenses, such as supplies, utilities, and wages. After calculating your net profit or loss, transfer this amount to your Form 1040. It is advisable to review the completed form for accuracy before submission.

Steps to complete the Schedule C Form 1040 Fill in Version Profit Or Loss From Business Sole Proprietorship

Completing the Schedule C Form 1040 involves a systematic approach:

- Gather Documentation: Collect all income and expense records related to your business.

- Fill in Business Information: Enter your business name, address, and employer identification number, if applicable.

- Report Income: List your total gross receipts from sales or services.

- Detail Expenses: Itemize all business expenses, categorizing them appropriately.

- Calculate Net Profit or Loss: Subtract total expenses from total income to determine your net profit or loss.

- Transfer Results: Input the net profit or loss on your Form 1040.

Key elements of the Schedule C Form 1040 Fill in Version Profit Or Loss From Business Sole Proprietorship

The Schedule C Form 1040 contains several key elements that are essential for accurate reporting:

- Business Information: This section includes the name and address of the business.

- Income Section: Report total gross receipts and any returns or allowances.

- Expenses Section: Detailed categories for various business expenses, such as advertising, car and truck expenses, and depreciation.

- Net Profit or Loss Calculation: The final calculation that determines your taxable income from the business.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule C Form 1040. It is important to follow these guidelines to ensure compliance and avoid potential penalties. The IRS outlines acceptable methods for reporting income and expenses, as well as documentation requirements. Taxpayers should refer to the latest IRS publications and instructions related to Schedule C to stay updated on any changes or specific filing requirements. Adhering to these guidelines helps ensure that the information reported is accurate and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule C Form 1040 align with the annual tax filing deadline for individual taxpayers. Typically, this deadline is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers may also apply for an extension, which grants an additional six months to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest. It is crucial to mark these important dates on your calendar to ensure timely filing.

Quick guide on how to complete schedule c form 1040 fill in version profit or loss from business sole proprietorship

Complete [SKS] easily on any device

Online document management has gained popularity among companies and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely keep it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without interruptions. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to change and eSign [SKS] effortlessly

- Locate [SKS] and then click Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive data with the tools that airSlate SignNow specifically provides for that reason.

- Create your signature using the Sign tool, which takes moments and holds the same legal significance as a standard wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule C Form 1040 Fill in Version Profit Or Loss From Business Sole Proprietorship

Create this form in 5 minutes!

How to create an eSignature for the schedule c form 1040 fill in version profit or loss from business sole proprietorship

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule C Form 1040 Fill in Version Profit Or Loss From Business Sole Proprietorship?

The Schedule C Form 1040 Fill in Version Profit Or Loss From Business Sole Proprietorship is a tax form used by sole proprietors to report income and expenses from their business. This form helps in calculating the net profit or loss, which is then reported on the individual's tax return. Using airSlate SignNow, you can easily fill out and eSign this form, streamlining your tax preparation process.

-

How can airSlate SignNow help me with the Schedule C Form 1040?

airSlate SignNow provides an intuitive platform for filling out the Schedule C Form 1040 Fill in Version Profit Or Loss From Business Sole Proprietorship. With our user-friendly interface, you can quickly input your business information, expenses, and income, ensuring accuracy and compliance. Additionally, you can eSign the document securely, making tax filing hassle-free.

-

Is there a cost associated with using airSlate SignNow for the Schedule C Form 1040?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are designed to be cost-effective, providing you with the tools necessary to fill out the Schedule C Form 1040 Fill in Version Profit Or Loss From Business Sole Proprietorship efficiently. You can choose a plan that fits your budget and access all the features you need for document management.

-

What features does airSlate SignNow offer for filling out tax forms?

airSlate SignNow offers a range of features for filling out tax forms, including templates for the Schedule C Form 1040 Fill in Version Profit Or Loss From Business Sole Proprietorship. You can easily edit, save, and share your forms, as well as utilize eSignature capabilities for quick approvals. Our platform also ensures that your documents are securely stored and accessible anytime.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow can be integrated with various accounting and tax preparation software, enhancing your workflow. This integration allows you to seamlessly transfer data between platforms, making it easier to fill out the Schedule C Form 1040 Fill in Version Profit Or Loss From Business Sole Proprietorship. Check our integration options to find the best fit for your business.

-

What are the benefits of using airSlate SignNow for my Schedule C Form 1040?

Using airSlate SignNow for your Schedule C Form 1040 Fill in Version Profit Or Loss From Business Sole Proprietorship offers numerous benefits, including time savings and increased accuracy. Our platform simplifies the process of filling out tax forms and provides a secure way to eSign documents. Additionally, you can access your forms from anywhere, making tax season less stressful.

-

Is airSlate SignNow secure for handling sensitive tax information?

Absolutely! airSlate SignNow prioritizes the security of your sensitive tax information. We use advanced encryption and security protocols to protect your data while you fill out the Schedule C Form 1040 Fill in Version Profit Or Loss From Business Sole Proprietorship. You can trust that your information is safe with us.

Get more for Schedule C Form 1040 Fill in Version Profit Or Loss From Business Sole Proprietorship

- Pathlabs ufl edupathology laboratories college of medicine university of form

- Kaiser permanente radiology imaging request form

- Application deadline 430 p form

- Uw medicine request for minor proxy mychart access form

- Environmental health safety httpwp research u form

- Opioid induced constipation oic in patients with chronic non cancer pain form

- Fort eustis jble eustis department of public health form

- Lcd parenteral nutrition l38953 centers for medicare ampamp medicaid form

Find out other Schedule C Form 1040 Fill in Version Profit Or Loss From Business Sole Proprietorship

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast