CT 4 Form

What is the CT 4

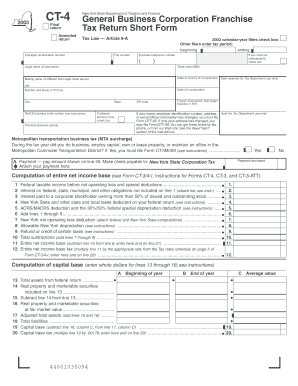

The CT 4 is a specific form used in the United States for reporting certain tax-related information. This form is primarily utilized by businesses and organizations to disclose income, expenses, and other financial details to the relevant tax authorities. Understanding the CT 4 is crucial for compliance with federal and state regulations, ensuring that entities accurately report their financial activities.

How to use the CT 4

Using the CT 4 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form with precise information, ensuring that all entries align with the supporting documentation. After completing the form, review it thoroughly for any errors before submission. This careful approach helps avoid potential penalties and ensures compliance with tax regulations.

Steps to complete the CT 4

Completing the CT 4 requires a systematic approach. Start by entering your business information, including name, address, and tax identification number. Next, detail your income sources, followed by expenses, which should be categorized appropriately. Ensure that you calculate totals accurately. Finally, sign and date the form, confirming that the information provided is true and complete. This structured process helps maintain clarity and accuracy in your tax reporting.

Legal use of the CT 4

The CT 4 must be used in accordance with federal and state laws governing tax reporting. It is essential to ensure that all information submitted is accurate and truthful to avoid legal repercussions. Misrepresentation or failure to file can lead to penalties, fines, or audits. Familiarizing yourself with the legal requirements surrounding the CT 4 is vital for maintaining compliance and protecting your business interests.

Filing Deadlines / Important Dates

Filing deadlines for the CT 4 can vary based on the specific tax year and the nature of the business. Typically, forms are due on or before the tax filing deadline, which may be April 15 for individual entities or other dates for corporations and partnerships. It is important to stay informed about these deadlines to avoid late fees and ensure timely compliance with tax obligations.

Required Documents

To complete the CT 4, certain documents are necessary. These include financial statements, receipts for expenses, and any other relevant financial records that support the information reported on the form. Having these documents readily available simplifies the completion process and ensures that all reported figures are accurate and substantiated.

Who Issues the Form

The CT 4 is issued by the appropriate tax authority, which may vary depending on the jurisdiction of the business. Typically, this form is provided by state revenue departments or the Internal Revenue Service (IRS). Understanding the issuing authority is important for ensuring that the correct version of the form is used and that all filing requirements are met.

Quick guide on how to complete ct 4

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to alter and electronically sign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight key sections of the documents or obscure sensitive details using tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiresome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign [SKS] while ensuring seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to CT 4

Create this form in 5 minutes!

How to create an eSignature for the ct 4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CT 4 and how does it relate to airSlate SignNow?

CT 4 is a powerful feature within airSlate SignNow that enhances document management and eSigning capabilities. It allows users to streamline their workflows, ensuring that documents are signed quickly and efficiently. By utilizing CT 4, businesses can improve their overall productivity and reduce turnaround times.

-

How much does airSlate SignNow with CT 4 cost?

The pricing for airSlate SignNow with CT 4 varies based on the plan you choose. We offer flexible pricing options to accommodate businesses of all sizes. For detailed pricing information, you can visit our website or contact our sales team for a personalized quote.

-

What are the key features of CT 4 in airSlate SignNow?

CT 4 includes features such as advanced document editing, customizable templates, and real-time tracking of document status. These features are designed to enhance user experience and ensure that all signing processes are seamless. With CT 4, you can also integrate with various third-party applications for added functionality.

-

Can I integrate CT 4 with other software tools?

Yes, airSlate SignNow with CT 4 offers robust integration capabilities with popular software tools like Salesforce, Google Drive, and Microsoft Office. This allows you to create a cohesive workflow that enhances your business processes. Integrating CT 4 with your existing tools can signNowly improve efficiency and collaboration.

-

What benefits does CT 4 provide for businesses?

CT 4 provides numerous benefits, including increased efficiency, reduced paper usage, and improved compliance with legal standards. By adopting airSlate SignNow with CT 4, businesses can save time and resources while ensuring that their document processes are secure and reliable. This ultimately leads to better customer satisfaction and streamlined operations.

-

Is there a free trial available for airSlate SignNow with CT 4?

Yes, we offer a free trial for airSlate SignNow with CT 4, allowing you to explore its features and benefits without any commitment. This trial period gives you the opportunity to see how CT 4 can transform your document management processes. Sign up on our website to start your free trial today.

-

How secure is airSlate SignNow with CT 4?

Security is a top priority for airSlate SignNow with CT 4. We implement industry-leading security measures, including encryption and secure access controls, to protect your documents and data. With CT 4, you can trust that your sensitive information is safe and compliant with regulations.

Get more for CT 4

- Atlas islamic monthly pension plan an atlas funds form

- Return this form by fax 02 9850 0813

- Sample demand letter to car dealership form

- Form 8 certificate of suitability

- Jgng form

- Www generalvetproducts com auattachments1388aar breeder litter registration ampamp change of ownership procedure form

- Richard bower superior court of california county of form

- Chapman valley horse riding risk warning and waiver form

Find out other CT 4

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure