Form 1041 T Fill in Capable Allocation of Estimated Tax Payments to Beneficiaries

What is the Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries

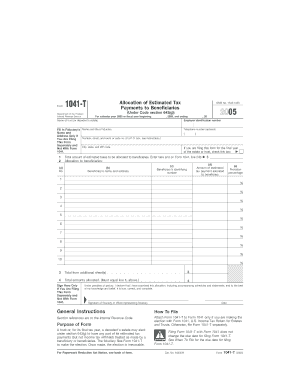

The Form 1041 T is a tax form used by estates and trusts to allocate estimated tax payments to beneficiaries. This form allows fiduciaries to report the distribution of estimated tax payments made on behalf of the estate or trust. It is essential for ensuring that beneficiaries receive the correct amount of tax credit for payments made prior to the distribution of assets. Proper use of this form helps in accurately reflecting the tax liabilities of both the estate and its beneficiaries.

How to use the Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries

To effectively use the Form 1041 T, fiduciaries must gather all relevant financial information pertaining to the estate or trust. This includes details about the estimated tax payments made, the beneficiaries involved, and their respective shares. The form requires specific entries that detail the total estimated tax payments and how these amounts are allocated among the beneficiaries. It is important to ensure that the allocations are made in accordance with the trust or estate agreement to avoid discrepancies.

Steps to complete the Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries

Completing the Form 1041 T involves several key steps:

- Gather all necessary documentation, including prior tax returns and records of estimated tax payments.

- Determine the total estimated tax payments made by the estate or trust.

- Identify the beneficiaries and their respective shares of the estate or trust.

- Fill in the form by entering the total estimated tax payments and the allocation amounts for each beneficiary.

- Review the completed form for accuracy and ensure all calculations are correct.

- Submit the form along with the estate's or trust's tax return.

Key elements of the Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries

Key elements of the Form 1041 T include:

- Identification of the estate or trust: This includes the name, address, and taxpayer identification number.

- Total estimated tax payments: The total amount of estimated tax payments made by the estate or trust during the tax year.

- Beneficiary information: Names, addresses, and taxpayer identification numbers of each beneficiary receiving allocations.

- Allocation amounts: Specific amounts allocated to each beneficiary based on their share of the estate or trust.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Form 1041 T. These guidelines outline the eligibility criteria for using the form, the required information, and the filing process. It is crucial for fiduciaries to adhere to these guidelines to ensure compliance with federal tax laws. The IRS also offers resources and publications that can assist in understanding the form's requirements and any updates that may affect its use.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 T are typically aligned with the tax return deadlines for estates and trusts. Generally, the form must be filed by the fifteenth day of the fourth month following the close of the estate's or trust's tax year. For estates and trusts operating on a calendar year, this means the form is due by April fifteenth. It is important to mark these dates on the calendar to avoid penalties for late filing.

Quick guide on how to complete form 1041 t fill in capable allocation of estimated tax payments to beneficiaries

Complete [SKS] effortlessly on any device

Online document organization has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, alter, and eSign your documents quickly and without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The simplest way to modify and eSign [SKS] without hassle

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searching, or errors that require printing new copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee exceptional communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries

Create this form in 5 minutes!

How to create an eSignature for the form 1041 t fill in capable allocation of estimated tax payments to beneficiaries

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries?

The Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries is a tax form used to allocate estimated tax payments to beneficiaries of an estate or trust. This form helps ensure that beneficiaries receive their fair share of tax payments, simplifying the tax process for estates and trusts.

-

How does airSlate SignNow assist with Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries?

airSlate SignNow provides an easy-to-use platform that allows users to fill out and eSign the Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries efficiently. Our solution streamlines the document management process, making it simple to allocate estimated tax payments accurately.

-

What are the pricing options for using airSlate SignNow for Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of individuals and businesses. Our cost-effective solution ensures that you can manage your Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries without breaking the bank.

-

Can I integrate airSlate SignNow with other software for managing Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow for managing Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries. This integration allows for better data management and improved efficiency in your document processes.

-

What features does airSlate SignNow offer for Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries?

airSlate SignNow includes features such as customizable templates, eSignature capabilities, and secure document storage, all designed to facilitate the completion of Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries. These features help streamline the process and ensure compliance.

-

Is airSlate SignNow secure for handling Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data while handling Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries. You can trust that your sensitive information is safe with us.

-

How can airSlate SignNow improve the efficiency of managing Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries?

By using airSlate SignNow, you can automate the document signing process, reducing the time spent on managing Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries. Our platform simplifies collaboration and ensures that all parties can access and sign documents quickly.

Get more for Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries

- Banner health medical exemption form influenza

- Proof of loss claim statement loyola university chicago form

- Spine history form

- Here is a helpful list of resources for valid health form

- Trinity lutheran church youth group information and trinitycamphill

- Pdf authorization for use or disclosure of health information providence

- Medical information request form

- Pdf hepatic pathology additional information request form

Find out other Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free