Form 1041 T Fill in Capable Allocation of Estimated Tax Payments to Beneficiaries

What is the Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries

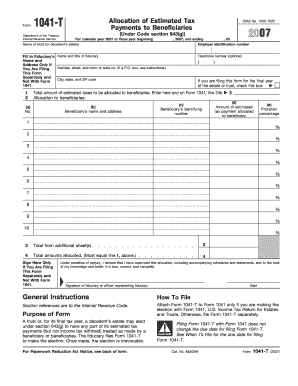

The Form 1041 T is a tax document used by estates and trusts to allocate estimated tax payments to beneficiaries. This form allows fiduciaries to specify how much of the estimated tax payments made by the estate or trust should be attributed to each beneficiary. It is essential for ensuring that beneficiaries receive proper credit for their share of the tax payments when they file their individual tax returns. Understanding the purpose of this form is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries

Using the Form 1041 T involves several steps to ensure accurate completion. First, gather all necessary financial information regarding the estate or trust, including total estimated tax payments made. Next, determine the allocation amounts for each beneficiary based on their share of the income or distributions from the estate or trust. After filling in the relevant sections of the form, it is important to review the entries for accuracy. Finally, submit the completed form along with the estate's or trust's tax return to the IRS.

Steps to complete the Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries

Completing the Form 1041 T requires careful attention to detail. Follow these steps:

- Obtain the latest version of Form 1041 T from the IRS website or through tax preparation software.

- Fill in the name and identifying information of the estate or trust at the top of the form.

- List the beneficiaries and their respective shares of the estate or trust income.

- Calculate the total estimated tax payments made and allocate the appropriate amounts to each beneficiary.

- Double-check all calculations and ensure that the form is signed by the fiduciary.

- File the form with the estate's or trust's tax return by the deadline.

Key elements of the Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries

Key elements of the Form 1041 T include the following:

- Beneficiary Information: Names, addresses, and identification numbers of all beneficiaries.

- Allocation Amounts: Specific amounts of estimated tax payments allocated to each beneficiary.

- Fiduciary Signature: The form must be signed by the fiduciary managing the estate or trust.

- Tax Year: The tax year for which the estimated payments are being allocated.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 1041 T. It is important to refer to these guidelines to ensure compliance. The IRS outlines the necessary information required on the form, including how to calculate the estimated tax payments and allocate them among beneficiaries. Adhering to these guidelines helps prevent errors and potential penalties associated with incorrect filings.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 T align with the tax return deadlines for estates and trusts. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this typically means April 15. It is crucial to be aware of these deadlines to avoid late filing penalties and ensure that beneficiaries receive their allocated tax credits in a timely manner.

Quick guide on how to complete form 1041 t fill in capable allocation of estimated tax payments to beneficiaries 6110028

Complete [SKS] seamlessly on any device

Digital document management has become favored by companies and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without complications. Manage [SKS] on any device through the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your edits.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious document searches, or mistakes that require the printing of new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device you select. Edit and eSign [SKS] and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries

Create this form in 5 minutes!

How to create an eSignature for the form 1041 t fill in capable allocation of estimated tax payments to beneficiaries 6110028

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries?

The Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries is a tax form used to allocate estimated tax payments to beneficiaries of an estate or trust. This form helps ensure that beneficiaries receive their fair share of tax payments, simplifying the tax process for estates and trusts.

-

How does airSlate SignNow assist with the Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries?

airSlate SignNow provides an easy-to-use platform for completing and eSigning the Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries. Our solution streamlines the process, allowing users to fill in the form accurately and efficiently, ensuring compliance with tax regulations.

-

What are the pricing options for using airSlate SignNow for Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while gaining access to features that simplify the Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries.

-

What features does airSlate SignNow offer for managing Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all designed to enhance the management of the Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries. These tools help ensure that your documents are processed quickly and securely.

-

Can I integrate airSlate SignNow with other software for Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries?

Yes, airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries. This ensures that you can manage your documents seamlessly across different platforms.

-

What are the benefits of using airSlate SignNow for Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries?

Using airSlate SignNow for the Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the process, allowing you to focus on what matters most.

-

Is airSlate SignNow secure for handling sensitive information related to Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all documents, including the Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries, are protected with advanced encryption and secure access controls. Your sensitive information is safe with us.

Get more for Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries

Find out other Form 1041 T Fill In Capable Allocation Of Estimated Tax Payments To Beneficiaries

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy