CT 2658 Report of Estimated Tax for New York State Department of Taxation and Finance Page 1 of Corporate Partners for Payments Form

Understanding the CT 2658 Report Of Estimated Tax

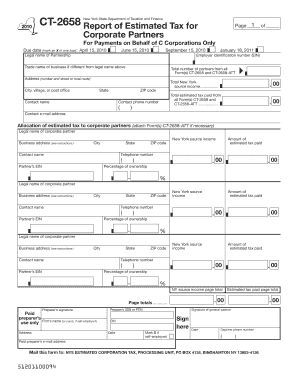

The CT 2658 Report Of Estimated Tax is a crucial document issued by the New York State Department of Taxation and Finance. This form is specifically designed for corporate partners to report estimated tax payments on behalf of C corporations. It is essential for ensuring compliance with state tax regulations. The form requires the taxpayer to indicate the due date by marking an X in one of the designated boxes for April 15, June 15, or September 15. Understanding the purpose of this form helps corporate partners manage their tax obligations effectively.

Steps to Complete the CT 2658 Report Of Estimated Tax

Completing the CT 2658 Report requires careful attention to detail. Start by gathering all necessary financial information related to the C corporation. This includes income projections, previous tax payments, and any applicable deductions. Next, fill out the form by entering the estimated tax amount due. Be sure to mark the appropriate due date by placing an X in the corresponding box. Double-check all entries for accuracy before submission. Ensuring that the form is filled out correctly minimizes the risk of penalties and ensures timely processing.

Obtaining the CT 2658 Report Of Estimated Tax

The CT 2658 Report can be obtained directly from the New York State Department of Taxation and Finance website or through authorized tax professionals. It is available in both digital and paper formats, allowing for flexibility in how corporate partners choose to complete and submit the form. Accessing the form online is often the quickest method, as it allows for immediate download and completion.

Filing Deadlines for the CT 2658 Report Of Estimated Tax

Timely filing of the CT 2658 Report is vital to avoid penalties. The due dates for estimated tax payments are April 15, June 15, and September 15. Corporate partners should mark their calendars to ensure that payments are made on time. Missing these deadlines can result in interest and penalties, impacting the overall financial health of the corporation.

Key Elements of the CT 2658 Report Of Estimated Tax

Several key elements must be included when completing the CT 2658 Report. These include the name and address of the C corporation, the estimated tax payment amount, and the chosen due date. Additionally, it is important to provide accurate financial information to reflect the corporation's tax obligations accurately. Each element plays a critical role in ensuring compliance with state tax laws.

Legal Use of the CT 2658 Report Of Estimated Tax

The CT 2658 Report serves a legal purpose in the context of corporate taxation in New York State. By submitting this form, corporate partners fulfill their obligations under state tax law, ensuring that estimated tax payments are made on behalf of C corporations. Proper use of this form helps maintain good standing with the New York State Department of Taxation and Finance and avoids potential legal issues related to tax compliance.

Quick guide on how to complete ct 2658 report of estimated tax for new york state department of taxation and finance page 1 of corporate partners for payments

Conveniently Prepare [SKS] on Any Device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Handle [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and eSign [SKS] Effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, the annoyance of tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and eSign [SKS] to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to CT 2658 Report Of Estimated Tax For New York State Department Of Taxation And Finance Page 1 Of Corporate Partners For Payments

Create this form in 5 minutes!

How to create an eSignature for the ct 2658 report of estimated tax for new york state department of taxation and finance page 1 of corporate partners for payments

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CT 2658 Report Of Estimated Tax For New York State Department Of Taxation And Finance Page 1 Of Corporate Partners?

The CT 2658 Report Of Estimated Tax For New York State Department Of Taxation And Finance Page 1 Of Corporate Partners is a form used by C Corporations in New York to report estimated tax payments. This form is essential for ensuring compliance with state tax regulations and helps businesses manage their tax obligations effectively.

-

What are the due dates for the CT 2658 Report Of Estimated Tax?

The due dates for the CT 2658 Report Of Estimated Tax For New York State Department Of Taxation And Finance Page 1 Of Corporate Partners are April 15, June 15, and September 15. It is crucial to mark an X in one box corresponding to the chosen due date to avoid penalties and ensure timely payments.

-

How can airSlate SignNow help with the CT 2658 Report?

airSlate SignNow provides an easy-to-use platform for businesses to eSign and send the CT 2658 Report Of Estimated Tax For New York State Department Of Taxation And Finance Page 1 Of Corporate Partners. This streamlines the process, making it more efficient and reducing the risk of errors in submission.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The cost is competitive and provides a cost-effective solution for managing documents like the CT 2658 Report Of Estimated Tax For New York State Department Of Taxation And Finance Page 1 Of Corporate Partners.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSigning, document templates, and secure cloud storage. These features enhance the management of important documents like the CT 2658 Report Of Estimated Tax For New York State Department Of Taxation And Finance Page 1 Of Corporate Partners, ensuring they are easily accessible and securely stored.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers integrations with various software applications, enhancing its functionality. This allows users to seamlessly manage the CT 2658 Report Of Estimated Tax For New York State Department Of Taxation And Finance Page 1 Of Corporate Partners alongside their existing tools.

-

What are the benefits of using airSlate SignNow for tax reporting?

Using airSlate SignNow for tax reporting, including the CT 2658 Report Of Estimated Tax For New York State Department Of Taxation And Finance Page 1 Of Corporate Partners, provides numerous benefits. These include increased efficiency, reduced paperwork, and enhanced compliance with tax regulations.

Get more for CT 2658 Report Of Estimated Tax For New York State Department Of Taxation And Finance Page 1 Of Corporate Partners For Payments

- Obtain colorado juvenile form

- Order for informal probate of will and informal courts state co

- Order re motion to relocate bminorb bchildrenb courts state co form

- Courts state co 6968180 form

- Jdf 1407 colorado form

- Instructions for obtaining a restraining order courts state co form

- District court denver juvenile court county colorado court address na na in re the marriage of petitioner v courts state co form

- Upon the courts state co form

Find out other CT 2658 Report Of Estimated Tax For New York State Department Of Taxation And Finance Page 1 Of Corporate Partners For Payments

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile