Film Tax CreditApplication2012 2Layout 1 Form

What is the Film Tax Credit Application 2012 2 Layout 1

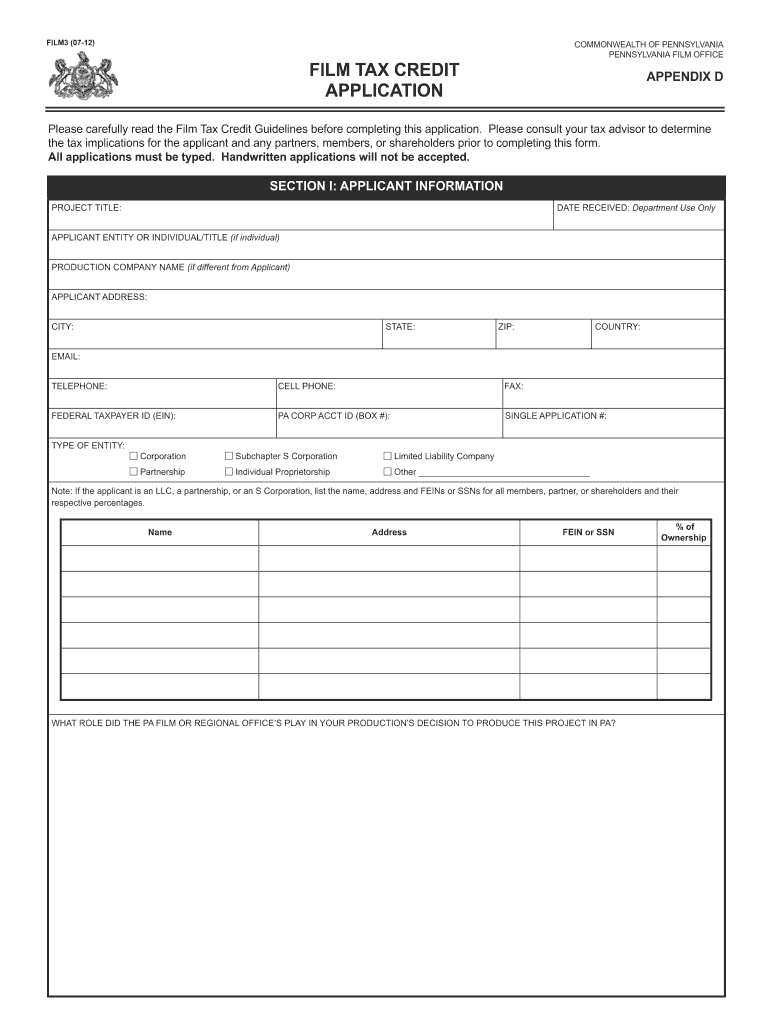

The Film Tax Credit Application 2012 2 Layout 1 is a specific form used by filmmakers and production companies to apply for tax credits offered by various states in the United States. These tax credits are designed to incentivize film and television production within the state, providing financial relief to eligible projects. The application typically requires detailed information about the production, including budget estimates, filming locations, and the expected economic impact on the local community.

Eligibility Criteria

To qualify for the Film Tax Credit Application 2012 2 Layout 1, applicants must meet certain eligibility criteria set by the state. Generally, the production must be a feature film, television series, or other qualifying media. Additionally, the project should demonstrate a minimum spending threshold within the state, which varies by location. Production companies may also need to provide proof of hiring local talent and crew, as well as utilizing local vendors and services.

Steps to Complete the Film Tax Credit Application 2012 2 Layout 1

Completing the Film Tax Credit Application involves several key steps:

- Gather all necessary documentation, including production budgets and schedules.

- Fill out the application form accurately, ensuring all required fields are completed.

- Attach supporting documents, such as proof of local expenditures and employment.

- Review the application for completeness and accuracy before submission.

- Submit the application by the specified deadline, either online or via mail.

Required Documents

When submitting the Film Tax Credit Application 2012 2 Layout 1, applicants must include several essential documents to support their application. These may include:

- A detailed production budget outlining all projected expenses.

- Proof of location permits and agreements.

- Documentation of hiring local talent and crew members.

- Invoices and receipts for services rendered and goods purchased within the state.

Filing Deadlines / Important Dates

Filing deadlines for the Film Tax Credit Application 2012 2 Layout 1 can vary by state. It is crucial for applicants to be aware of these dates to ensure timely submission. Typically, applications must be submitted before the start of production or within a specified period after completion. Additionally, some states may have annual deadlines for tax credit allocation, making it important to stay informed about changes and updates in regulations.

Application Process & Approval Time

The application process for the Film Tax Credit Application 2012 2 Layout 1 involves several stages. After submission, the application will be reviewed by the appropriate state agency. The approval time can vary, often taking several weeks to months, depending on the complexity of the project and the volume of applications received. Applicants may be required to provide additional information or clarification during the review process, which can affect the timeline for approval.

Quick guide on how to complete film tax creditapplication2012 2layout 1

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to easily find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Handle [SKS] on any platform using the airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

How to Edit and eSign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight pertinent sections of your documents or redact sensitive details with specialized tools offered by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all information carefully and click the Done button to save your changes.

- Choose your preferred method to submit your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, and errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Film Tax CreditApplication2012 2Layout 1

Create this form in 5 minutes!

How to create an eSignature for the film tax creditapplication2012 2layout 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Film Tax CreditApplication2012 2Layout 1?

The Film Tax CreditApplication2012 2Layout 1 is a specific form used to apply for tax credits related to film production. This application helps filmmakers secure financial incentives that can signNowly reduce production costs. Understanding this form is crucial for maximizing your benefits under the film tax credit program.

-

How can airSlate SignNow assist with the Film Tax CreditApplication2012 2Layout 1?

airSlate SignNow streamlines the process of completing and submitting the Film Tax CreditApplication2012 2Layout 1. With our easy-to-use platform, you can fill out the application, eSign it, and send it securely to the relevant authorities. This saves time and ensures that your application is processed efficiently.

-

What are the pricing options for using airSlate SignNow for the Film Tax CreditApplication2012 2Layout 1?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those focused on the Film Tax CreditApplication2012 2Layout 1. Our plans are designed to be cost-effective, ensuring that you can manage your document signing and submission without breaking the bank. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow provide for the Film Tax CreditApplication2012 2Layout 1?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for the Film Tax CreditApplication2012 2Layout 1. These features enhance your workflow, making it easier to manage your applications and ensuring compliance with all necessary regulations. Additionally, our platform is user-friendly, allowing for quick navigation.

-

What are the benefits of using airSlate SignNow for my Film Tax CreditApplication2012 2Layout 1?

Using airSlate SignNow for your Film Tax CreditApplication2012 2Layout 1 offers numerous benefits, including increased efficiency and reduced turnaround times. Our platform allows you to manage all your documents in one place, ensuring that you never miss a deadline. Furthermore, the ability to eSign documents securely enhances the overall security of your application process.

-

Can I integrate airSlate SignNow with other tools for the Film Tax CreditApplication2012 2Layout 1?

Yes, airSlate SignNow offers integrations with various tools and platforms that can assist in managing your Film Tax CreditApplication2012 2Layout 1. This includes popular project management and accounting software, allowing for seamless data transfer and improved workflow. Integrating these tools can enhance your overall efficiency in handling film tax credit applications.

-

Is airSlate SignNow compliant with regulations for the Film Tax CreditApplication2012 2Layout 1?

Absolutely! airSlate SignNow is designed to comply with all relevant regulations concerning the Film Tax CreditApplication2012 2Layout 1. Our platform ensures that your documents are handled securely and in accordance with legal standards, providing peace of mind as you navigate the application process.

Get more for Film Tax CreditApplication2012 2Layout 1

- 1500010263 kentucky department of revenue form

- Payroll tax forms city of burkesville cityofburkesville

- Form 200 local intangibles tax return rev 7 21 form 200 local intangibles tax return county taxes

- Rf 9 decedent refund claim rev 9 19 form

- K 40svr property tax relief claim for seniors and disabled form

- Kansas department of revenueagricultural exemptio form

- Tourist tax return form brevard tax collector

- Optod lettersandscience netreportpolktaxespolktaxes com home polk county tax collector form

Find out other Film Tax CreditApplication2012 2Layout 1

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online