Schedule V Wisconsin Additions to Federal Income PDF Fillable Format Sch V

What is the Schedule V Wisconsin Additions To Federal Income pdf Fillable Format Sch V

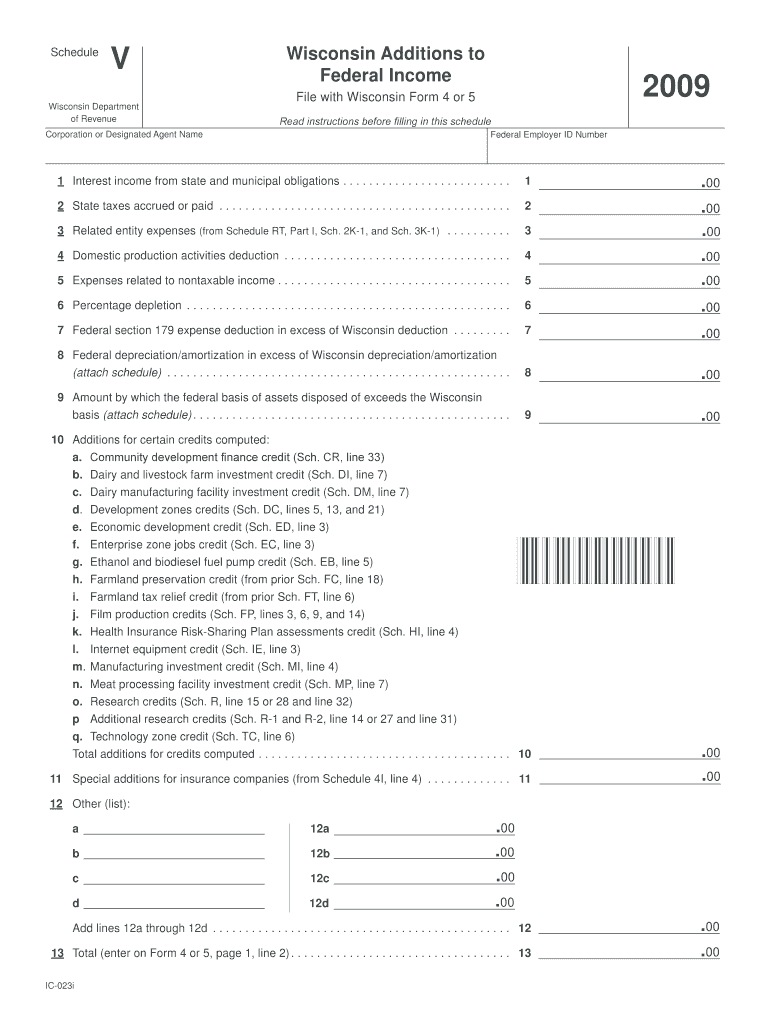

The Schedule V Wisconsin Additions To Federal Income is a tax form used by residents of Wisconsin to report specific additions to their federal income. This form is essential for ensuring that taxpayers accurately reflect any income that may not be included in their federal tax return but is subject to state taxation. The Schedule V is designed to facilitate the process of reporting these additions in a clear and organized manner. Utilizing a fillable PDF format allows users to enter their information digitally, making it easier to complete and submit the form.

How to use the Schedule V Wisconsin Additions To Federal Income pdf Fillable Format Sch V

Using the Schedule V in fillable PDF format is straightforward. First, download the form from an official source. Open the PDF in a compatible reader that supports fillable forms. Begin by entering your personal information, including your name and Social Security number. Next, fill in the relevant sections detailing the additions to your federal income. Ensure that all entries are accurate and complete to avoid issues during processing. Once finished, save the document and follow the submission instructions provided by the Wisconsin Department of Revenue.

Steps to complete the Schedule V Wisconsin Additions To Federal Income pdf Fillable Format Sch V

Completing the Schedule V involves several key steps:

- Download the fillable PDF from an official source.

- Open the document in a PDF reader that supports form filling.

- Enter your personal information at the top of the form.

- Identify and list all applicable additions to your federal income in the designated sections.

- Review the form for accuracy and completeness.

- Save the completed form on your device.

- Submit the form according to the guidelines provided by the state.

Key elements of the Schedule V Wisconsin Additions To Federal Income pdf Fillable Format Sch V

The Schedule V includes several key elements that are crucial for accurate reporting. These elements typically consist of sections for personal identification, a detailed list of income additions, and instructions for each line item. Understanding these components is vital for ensuring that all necessary information is included. Additionally, the fillable format enhances usability by allowing users to input data directly into the form, streamlining the process of tax preparation.

Legal use of the Schedule V Wisconsin Additions To Federal Income pdf Fillable Format Sch V

The Schedule V is legally recognized by the Wisconsin Department of Revenue for the purpose of reporting income additions. Taxpayers must use this form to comply with state tax laws, ensuring that all applicable income is reported accurately. Failure to use the Schedule V when required could result in penalties or discrepancies in tax filings. It is important for taxpayers to understand their obligations and utilize the form correctly to maintain compliance with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule V align with the general tax filing deadlines set by the IRS and the Wisconsin Department of Revenue. Typically, individual income tax returns are due on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential for taxpayers to stay informed about any changes to these dates to ensure timely submission of the Schedule V and avoid potential penalties.

Quick guide on how to complete schedule v wisconsin additions to federal income pdf fillable format sch v

Easily prepare [SKS] on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and eSign your documents without delays. Manage [SKS] on any system with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and eSign [SKS] and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule v wisconsin additions to federal income pdf fillable format sch v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What makes you exempt from Wisconsin withholding?

You may claim exemption from withholding of Wisconsin income tax if you had no liability for income tax last year, and you expect to incur no liability for income tax this year. To claim complete exemption from withholding use Wisconsin Form WT-4, Employee's Wisconsin Withholding Exemption Certificate.

-

What is a Schedule 4W in Wisconsin?

Supported Forms FormDescriptionCRP Schedule 4W Subtractions from Federal Income P Schedule 4Y Subtraction Modification for Dividends P Schedule 5K-1 Tax-Option (S) Corporation Shareholder's Share of Income, Deductions, Credits, etc. Schedule 2440W Disability Income Exclusion 77 more rows • Dec 5, 2024

-

What is a Schedule 4V in Wisconsin?

Purpose of Schedule 4V Corporations complete Schedule 4V to report addition modifications that are needed to account for differences be- tween taxable income under Wisconsin law and under federal law. The corporation files Schedule 4V with its Wis- consin Form 4.

-

What is the federal tax income?

2025 Federal Tax Brackets RateSingleMarried Filing Separately 10% $0 – $11,925 $0 – $11,925 12% $11,925 – $48,475 $11,925 – $48,475 22% $48,475 – $103,350 $48,475 – $103,350 24% $103,350 – $197,300 $103,350 – $197,3003 more rows • Nov 22, 2024

-

How much money can you make before you have to file taxes in Wisconsin?

What are Wisconsin's other filing requirements? You were a nonresident or part-year resident of Wisconsin for 2023 and your gross income was $2,000 or more. If you were married, you must file a return on Form 1NPR if the combined gross income of you and your spouse was $2,000 or more.

-

How much does an LLC get taxed in Wisconsin?

Wisconsin has a personal income tax that ranges from 3.54% to 7.56%, depending on the filer's marital status and total annual income. If your Wisconsin LLC has chosen C-corp status, you will be responsible for either filing a Wisconsin corporate franchise tax or a net income tax, which are both taxed at 7.9%.

Get more for Schedule V Wisconsin Additions To Federal Income pdf Fillable Format Sch V

- Saddleback sermon notes pdf form

- Flood forecasting division form

- Export behance portfolio to pdf form

- Darden employee handbook form

- Oxford dictionary english to urdu download pdf form

- Delhi police shanti sewa form

- Riverside county restraining order form

- South african divorce papers pdf download form

Find out other Schedule V Wisconsin Additions To Federal Income pdf Fillable Format Sch V

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free