Schedule V Wisconsin Department of Revenue Save Wisconsin Additions to Federal Income Print Clear File with Wisconsin Form 4 or

Understanding Schedule V for Wisconsin Department of Revenue

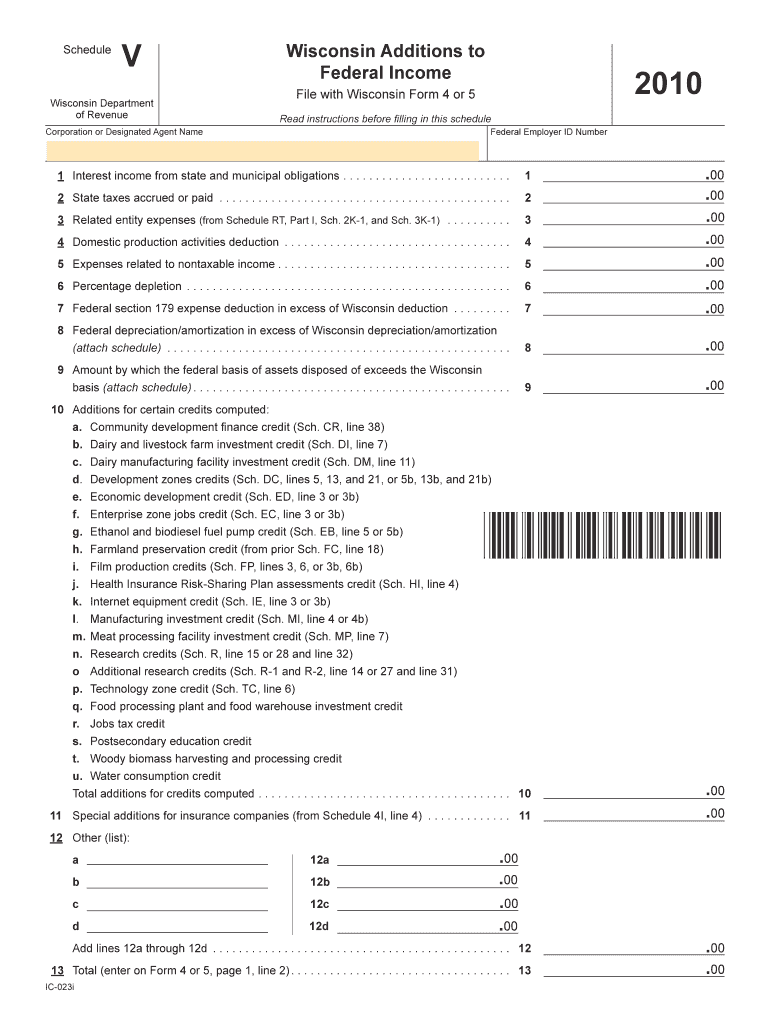

The Schedule V is a specific form used by the Wisconsin Department of Revenue to report additions to federal income. This form is essential for corporations and designated agents to accurately reflect their financial activities as they relate to state tax obligations. It is crucial for ensuring compliance with state tax laws and for calculating the correct amount of state tax owed.

How to Use Schedule V

To effectively use Schedule V, you must first gather all necessary financial documents related to your federal income. This includes any relevant federal tax returns and supporting documentation. Once you have these documents, you can begin filling out Schedule V by entering the appropriate additions to your federal income as instructed. It is important to read the instructions carefully before proceeding to ensure accuracy.

Steps to Complete Schedule V

Completing Schedule V involves several steps:

- Obtain the Schedule V form, which can be printed from the Wisconsin Department of Revenue website.

- Review the instructions provided with the form to understand what information is required.

- Fill in the corporation or designated agent name and federal employer identification number at the top of the form.

- Enter the additions to federal income in the designated sections, ensuring all figures are accurate and supported by documentation.

- Double-check your entries for any errors before submitting the form.

Key Elements of Schedule V

Key elements of Schedule V include the identification of the corporation or designated agent, the federal employer identification number, and the specific additions to federal income. Each section of the form is designed to capture detailed financial information that is necessary for the Wisconsin Department of Revenue to assess tax liabilities accurately. Understanding these elements is vital for proper completion of the form.

Filing Deadlines for Schedule V

Filing deadlines for Schedule V align with the overall tax filing deadlines set by the Wisconsin Department of Revenue. Typically, corporations must file their tax returns by the 15th day of the 4th month following the end of their fiscal year. It is important to stay informed about any changes to these deadlines to avoid penalties.

Required Documents for Schedule V

To complete Schedule V, you will need several documents, including:

- Your federal tax return, which serves as the basis for reporting additions.

- Any supporting documentation related to the additions being reported, such as financial statements or receipts.

- Previous tax filings, if applicable, to ensure consistency and accuracy in reporting.

Form Submission Methods

Schedule V can be submitted to the Wisconsin Department of Revenue through various methods. You may choose to file the form online, via mail, or in person. Each method has its own requirements and processing times, so it is advisable to select the method that best suits your needs and ensures timely submission.

Quick guide on how to complete schedule v wisconsin department of revenue save wisconsin additions to federal income print clear file with wisconsin form 4 or

Effortlessly prepare [SKS] on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the right format and safely preserve it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to adjust and electronically sign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Adjust and electronically sign [SKS] and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule V Wisconsin Department Of Revenue Save Wisconsin Additions To Federal Income Print Clear File With Wisconsin Form 4 Or

Create this form in 5 minutes!

How to create an eSignature for the schedule v wisconsin department of revenue save wisconsin additions to federal income print clear file with wisconsin form 4 or

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule V Wisconsin Department Of Revenue?

Schedule V Wisconsin Department Of Revenue is a form used to report additions to federal income for Wisconsin tax purposes. It is essential for corporations or designated agents to accurately complete this schedule to ensure compliance with state tax regulations. Make sure to read the instructions before filling in this schedule to avoid any errors.

-

How can I save Wisconsin additions to federal income?

To save Wisconsin additions to federal income, you need to complete Schedule V Wisconsin Department Of Revenue. This involves filling out the necessary information on Wisconsin Form 4 or 5. Ensure that you print, clear, and file the form correctly to maintain compliance with state tax laws.

-

What are the benefits of using airSlate SignNow for filing Schedule V?

Using airSlate SignNow simplifies the process of filing Schedule V Wisconsin Department Of Revenue. Our platform allows you to eSign documents securely and efficiently, ensuring that your submissions are timely and accurate. This cost-effective solution saves you time and reduces the risk of errors in your tax filings.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. The cost is competitive and provides access to features that streamline the process of completing forms like Schedule V Wisconsin Department Of Revenue. You can choose a plan that best fits your requirements.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This integration allows you to manage your documents and forms, including Schedule V Wisconsin Department Of Revenue, more efficiently. Check our integrations page for a list of compatible applications.

-

What should I do if I make a mistake on Schedule V?

If you make a mistake on Schedule V Wisconsin Department Of Revenue, it's important to correct it as soon as possible. You can amend your submission by following the guidelines provided in the instructions for Wisconsin Form 4 or 5. Ensure that you keep a record of any changes made for your records.

-

How do I ensure my Schedule V is filed correctly?

To ensure your Schedule V Wisconsin Department Of Revenue is filed correctly, carefully read the instructions before filling in the form. Utilize airSlate SignNow's features to eSign and review your documents for accuracy. Double-check all entries to minimize the risk of errors before submission.

Get more for Schedule V Wisconsin Department Of Revenue Save Wisconsin Additions To Federal Income Print Clear File With Wisconsin Form 4 Or

Find out other Schedule V Wisconsin Department Of Revenue Save Wisconsin Additions To Federal Income Print Clear File With Wisconsin Form 4 Or

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself