Illinois Department of Revenue Schedule M Other Additions and Subtractions for Individuals Attach to Your Form IL 1040 IL

What is the Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals Attach To Your Form IL 1040 IL

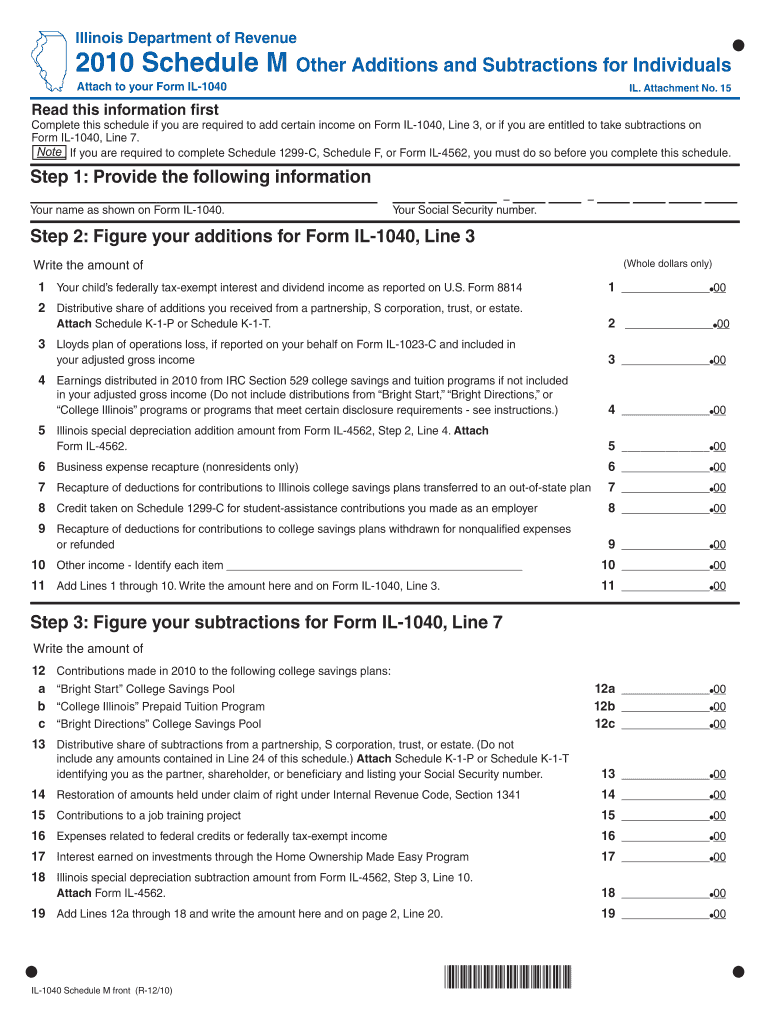

The Illinois Department Of Revenue Schedule M is a supplementary form that individuals must attach to their Form IL-1040 when filing their state income tax returns. This form is designed to report various additions and subtractions that affect an individual's taxable income. Additions may include items such as certain types of income that are not subject to federal tax but are taxable at the state level. Subtractions can include deductions for specific expenses or income exclusions that reduce the overall tax liability. Understanding the purpose and function of Schedule M is essential for accurate tax reporting and compliance with Illinois tax laws.

Steps to complete the Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals Attach To Your Form IL 1040 IL

Completing the Illinois Department Of Revenue Schedule M involves several key steps:

- Gather necessary documents, including your federal tax return and any relevant financial statements.

- Identify the specific additions and subtractions applicable to your situation. Review the instructions provided with Schedule M for guidance on what qualifies.

- Fill out the form by entering the amounts for each addition and subtraction in the appropriate sections. Ensure that all figures are accurate and correspond to your financial records.

- Attach Schedule M to your completed Form IL-1040. Double-check that all forms are signed and dated before submission.

- Submit your tax return by the filing deadline, either electronically or by mail, ensuring that all required documents are included.

Key elements of the Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals Attach To Your Form IL 1040 IL

Key elements of Schedule M include:

- Additions: These may consist of income types such as state tax refunds or certain retirement distributions that are taxable in Illinois.

- Subtractions: Common subtractions include contributions to qualified retirement plans or certain types of disability income.

- Instructions: The form comes with detailed instructions that outline how to report each addition and subtraction, ensuring clarity for taxpayers.

- Signature Requirement: A completed Schedule M must be signed and dated by the taxpayer to validate the submission.

How to obtain the Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals Attach To Your Form IL 1040 IL

The Illinois Department Of Revenue Schedule M can be obtained through several methods:

- Visit the official Illinois Department of Revenue website, where you can download the form directly in PDF format.

- Request a physical copy by contacting the Illinois Department of Revenue directly, either through phone or mail.

- Access the form through tax preparation software that is compatible with Illinois tax forms, which often includes Schedule M as part of their package.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines related to the Illinois Department Of Revenue Schedule M. Typically, individual income tax returns, including Form IL-1040 and attached Schedule M, are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions they may file, which can provide additional time to submit their returns, but not to pay any taxes owed.

Legal use of the Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals Attach To Your Form IL 1040 IL

The legal use of Schedule M is essential for compliance with Illinois tax regulations. Taxpayers are required to accurately report their additions and subtractions to ensure they are taxed correctly. Failure to complete this form properly can result in penalties, interest on unpaid taxes, or audits by the Illinois Department of Revenue. It is important to retain copies of Schedule M and any supporting documentation for at least three years after filing, as this may be necessary for verification purposes in case of an audit.

Quick guide on how to complete illinois department of revenue schedule m other additions and subtractions for individuals attach to your form il 1040 il

Complete [SKS] effortlessly on any device

Online document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents swiftly without interruptions. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to adjust and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Stop worrying about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] and ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals Attach To Your Form IL 1040 IL

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule m other additions and subtractions for individuals attach to your form il 1040 il

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals?

The Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals is a form that allows taxpayers to report specific additions and subtractions to their income when filing Form IL 1040 IL. This form helps ensure accurate tax calculations and compliance with state tax regulations.

-

How do I attach the Schedule M to my Form IL 1040 IL?

To attach the Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals to your Form IL 1040 IL, simply include it as a supplementary document when submitting your tax return. Ensure that all relevant information is filled out correctly to avoid delays in processing.

-

What are the benefits of using airSlate SignNow for tax document signing?

Using airSlate SignNow for tax document signing streamlines the process, allowing you to eSign the Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals quickly and securely. This solution is user-friendly and cost-effective, making it easier to manage your tax documents.

-

Is there a cost associated with using airSlate SignNow for signing tax documents?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. The cost is competitive and provides access to features that simplify the signing process for documents like the Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your workflow. This allows you to easily manage and eSign documents such as the Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals within your preferred applications.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and real-time tracking of document status. These features are particularly beneficial when handling important tax documents like the Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals.

-

How secure is airSlate SignNow for signing sensitive tax documents?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance measures to protect your sensitive information, ensuring that documents like the Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals are signed and stored securely.

Get more for Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals Attach To Your Form IL 1040 IL

- Attendance allowance claim form gov uk

- Taken within application for visa form

- Philippines fake id templates philippines fake id templates filmigo video maker is a powerful video editing tool to make form

- Paper checker instant plagiarism checker tool citation machine form

- The universal life church get ordained for online form

- Health care commission registration form

- Republic of the philippines social security system form

- Small estate affidavit illinois secretary of state form

Find out other Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals Attach To Your Form IL 1040 IL

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe