Form 943 a Rev December Agricultural Employer's Record of Federal Tax Liability Irs

What is the Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability Irs

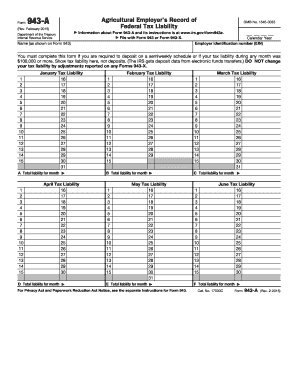

The Form 943 A Rev December is a crucial document for agricultural employers in the United States. This form is specifically designed to record federal tax liabilities related to agricultural wages. It helps employers report the amounts they owe for federal income tax withholding, Social Security, and Medicare taxes on wages paid to their employees. Understanding this form is essential for compliance with IRS regulations, ensuring that agricultural businesses accurately report their tax obligations.

How to use the Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability Irs

Using the Form 943 A Rev December involves several steps to ensure accurate reporting of tax liabilities. Employers should first gather all relevant payroll information, including total wages paid to employees and the corresponding tax amounts. Once the necessary data is collected, employers can fill out the form, ensuring that each section is completed accurately. After completing the form, it must be submitted to the IRS according to the specified deadlines, either electronically or by mail, depending on the employer's preference.

Steps to complete the Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability Irs

Completing the Form 943 A Rev December requires careful attention to detail. Here are the key steps:

- Collect payroll records for the tax year, including total wages and tax withholdings.

- Fill in the employer's information, including name, address, and Employer Identification Number (EIN).

- Report total agricultural wages paid during the year in the designated section.

- Calculate the federal income tax withheld, Social Security tax, and Medicare tax based on the wages reported.

- Double-check all entries for accuracy before submitting the form.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 943 A Rev December is essential for compliance. Typically, agricultural employers must file this form by January 31 of the following year for the previous tax year. If the deadline falls on a weekend or holiday, the due date may be extended to the next business day. Employers should also be aware of any changes in deadlines announced by the IRS, as they can vary from year to year.

Key elements of the Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability Irs

The Form 943 A Rev December contains several key elements that are critical for accurate reporting. These include:

- Employer information section, which requires the name, address, and EIN.

- Wage reporting section, detailing the total agricultural wages paid.

- Tax calculation sections for federal income tax, Social Security, and Medicare taxes.

- Signature section, where the employer certifies the accuracy of the information provided.

Legal use of the Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability Irs

The legal use of the Form 943 A Rev December is governed by IRS regulations. Agricultural employers are required to use this form to report their federal tax liabilities accurately. Failure to file this form or inaccuracies in reporting can lead to penalties and interest charges. It is essential for employers to understand their obligations under federal tax law to avoid legal complications.

Quick guide on how to complete form 943 a rev december agricultural employers record of federal tax liability irs

Easily prepare [SKS] on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the features you need to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The easiest way to modify and electronically sign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools offered to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools provided specifically for this purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just a few seconds and possesses the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign [SKS] while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 943 a rev december agricultural employers record of federal tax liability irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Under which condition is an employer not required to file a quarterly form 941?

Exceptions to this filing requirement are for seasonal employers who don't pay employee wages during one or more quarters, employers of household employees and employers of agricultural employees. Employers of agricultural employees typically file Form 943 instead of Form 941.

-

Who is required to file 943a?

Monthly schedule depositors who accumulate $100,000 or more of tax liability on any day of a calendar month become semiweekly schedule depositors on the next day and remain so for at least the remainder of the year and for the next year, and must also complete and file Form 943-A for the entire year.

-

Why do I need to file 943 instead of 941?

Form 943 is required for agricultural businesses with farmworkers. You'll file this form with the IRS annually. Some businesses may be required to file both a 943 and a 941 or a 944. This form is available to both Automate taxes and forms On or Off options.

-

What kind of payer is 943?

Form 943 is the employer's annual federal tax return for agricultural employees and should be used if wages were paid to a farm worker and were subject to Social Security and Medicare taxes or federal income tax withholding.

-

What is the record of federal tax liability form 943?

What is IRS Form 943? Form 943 is the Employer's Annual Federal Tax Return for Agricultural Employees. It is specifically designed for employers who hire agricultural workers and are required to report and pay federal income tax and FICA (Social Security and Medicare) tax withheld from their employees.

-

What does 943 agricultural employee mean in the IRS?

File Form 943 if you paid wages to one or more farmworkers and the wages were subject to federal income tax withholding or social security and Medicare taxes under the tests discussed next. For more information on farmworkers and wages, see Pub. 51.

-

When to use form 943?

Form 943, Employer's Annual Federal Tax Return for Agricultural Employees, is used to report federal income tax, Social Security and Medicare Tax, as well as any Additional Medicare Tax withheld and paid for the year.

-

What happens if you don't file form 941?

2025 Tax Filing Deadlines and Due Dates If any due date for filing falls on a Saturday, Sunday, or legal holiday, returns may be filed on the next business day. Failure to file IRS Form 941 on time or underreporting your tax liability can result in IRS penalties, which can amount to 5% of the total tax amount due.

Get more for Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability Irs

- Fiscal year fy tribal homeland security grant fema fema form

- Are you ready an in depth guide to citizen preparedness fema gov form

- Fiscal year 07 homeland nt program omeland fema fema form

- Fiscal year fy homeland security grant program hsgp frequently asked questions faqs fema form

- Fiscal year i nteroperable e mergency c fema fema form

- Fy emergency management performance grant empg fema fema

- Emergency management performance grant programfema gov

- Petition to modify spousal maintenance or form

Find out other Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability Irs

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe